- Chainlink leads DeFi development with the highest momentum score, staying dominant in smart contract infrastructure.

- Despite strong development activity, Chainlink’s price drops and trading activity declines by over 22%.

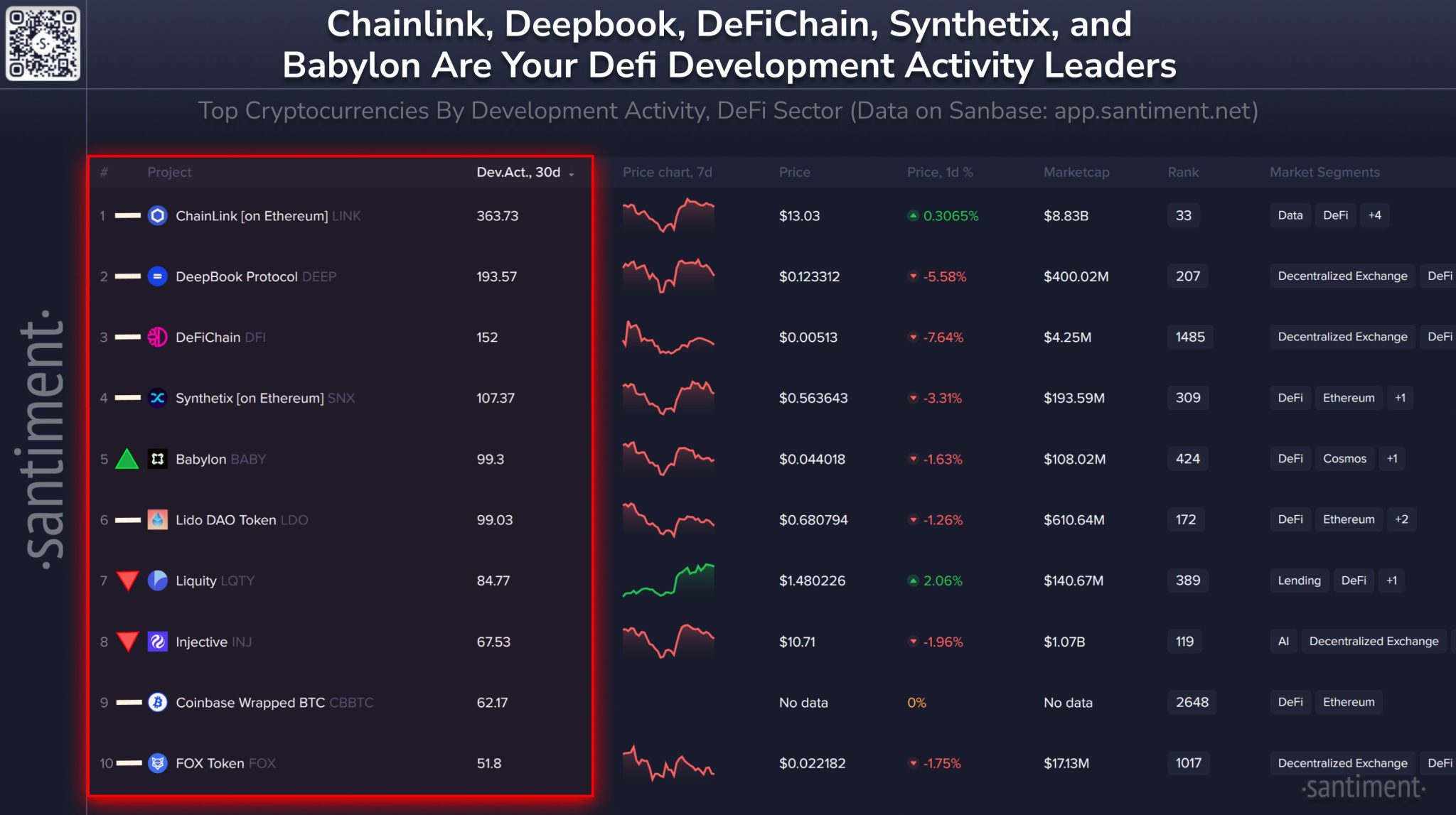

In its latest rankings, blockchain analytics platform Santiment has ranked Chainlink (LINK) as the top DeFi project based on development momentum, achieving a whopping development activity score of 363.73. This ranking indicates Chainlink’s utmost focus on growth and innovation within the decentralized finance segment.

Santiment’s data, tracking GitHub commits and code contributions, shows Chainlink has maintained its position as the most actively developed DeFi project over the past 30 days. The network’s central capability of underpinning smart contracts with reliable data feeds has cemented its role as a core infrastructure within the DeFi ecosystem.

Rising Stars in DeFi Development

DeepBook Protocol (DEEP) closely follows Chainlink in development activity, occupying second place with a score of 193.57. DeepBook is focused on decentralized exchange protocols and liquidity provision, gaining attention within the DeFi community for its innovations. As a emergent player within the markets, DeepBook continues to make crucial steps and become a core component of DeFi’s development.

DeFiChain (DFI) stands at third with 152 points. Known for its dedication to decentralized finance within the Bitcoin ecosystem, DeFiChain is expanding DeFi’s reach beyond Ethereum, opening new avenues in the sector. Synthetix (SNX) ranks fourth with a development activity score of 107.37, with significant contributions to the DeFi space, especially through the creation of synthetic assets on the Ethereum blockchain. Babylon (BABY) completes the top five, scoring 99.3, focusing on improving decentralized exchange features.

Other projects such as Lido DAO (LDO), Liquity (LQT), and Injective (INJ) also substantially contribute to DeFi. Such projects have been instrumental players in building many decentralized finance sectors such as staking and decentralized derivatives.

Chainlink’s Expanding Role Beyond Development

As Chainlink development activity continues to lead the pack, though, the project is expanding its scope even further from code contributions. In a previous article, CNF revealed that Chainlink partnered with Mastercard to make cryptocurrency within reach.

This initiative aims to allow 3 billion Mastercard cardholders direct on-chain access to crypto. Chainlink will supply its decentralized oracle network to facilitate secure interoperability between Mastercard’s payments platform and crypto space.

Despite its notable development activity, LINK has seen a decline in its price. Over the last 24 hours, its price has reduced by nearly 3%, changing hands at $13.04. This decline is accompanied by a drop in trade activity, decreasing by more than 22%, which brings the daily trade value to $284.45 million.