A newly created multi-signature wallet linked to Trump’s World Liberty Financial has purchased 200 million $WLFI tokens after withdrawing $10 million $USDC from Binance.

The transaction which took place on early Feb. 18 was reported by on-chain analytics platform On-Chain Lens. The purchase adds to the ongoing activity around $WLFI, a controversial crypto project with strong political ties to the Trump family.

6 hours ago, A newly created MultiSig wallet by #Trump's World Liberty Finance (@worldlibertyfi) has withdrawn $10M $USDC from #Binance and bought 200M $WLFi.

— Onchain Lens (@OnchainLens) February 17, 2025

Address: 0xe54a7f3714c8d104783b207799d6d9985cd68539

Data @nansen_ai pic.twitter.com/Y4CDMe99b5

According to BitMart Research’s latest report, $WLFI has raised $455 million through token sales as of February 9, 2025. The project raised $319 million from the first public sale of 21.3 billion $WLFI tokens at a price of $0.015 each, and another $136 million from a second round of sales at a price of $0.05 per token.

Despite presenting itself as a DeFi lending platform, $WLFI has not yet introduced any DeFi services, hence there is no clear utility for its tokens. The project’s goal seems to be centered on building up its $327 million worth of on-chain and centralized exchange assets instead.

$WLFI’s intimate ties to the Trump family have brought attention to its asset selection. Market observers see the token, like other Trump-affiliated tokens, as a component of a larger plan to profit from Trump’s political power. Notably, the Trump family controls 75% of the token sales revenue.

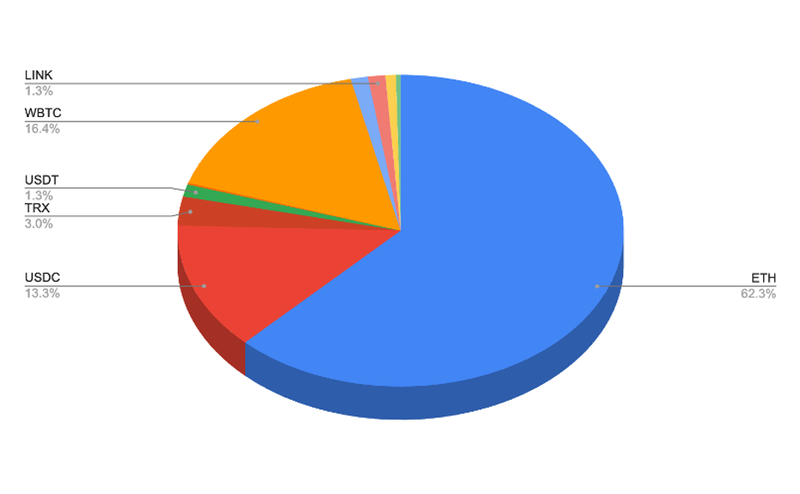

Justin Sun, the founder of TRON ($TRX), has also developed strong ties with the project and is now $WLFI’s largest institutional investor, having contributed $75 million. The project has allocated $63.41 million to Sun-related assets like $TRX and Wrapped Bitcoin (WBTC).

According to the report, $WLFI had $47.49 million in stablecoins (prior to the purchase) and has moved $307.4 million into Coinbase Prime for safekeeping. In addition to boosting its exposure to Real-World Assets and DeFi protocols, the project’s investment strategy makes it apparent that it’s focused on growing its core asset holdings, especially Bitcoin (BTC) and Ethereum (ETH).

theblock.co + 1 more

theblock.co + 1 more

financemagnates.com

financemagnates.com