Circle has introduced a privacy-focused version of its USDC stablecoin on Aleo, highlighting a broader push by privacy-oriented blockchains to gain access to regulated, dollar-backed assets as demand for onchain privacy tools grows.

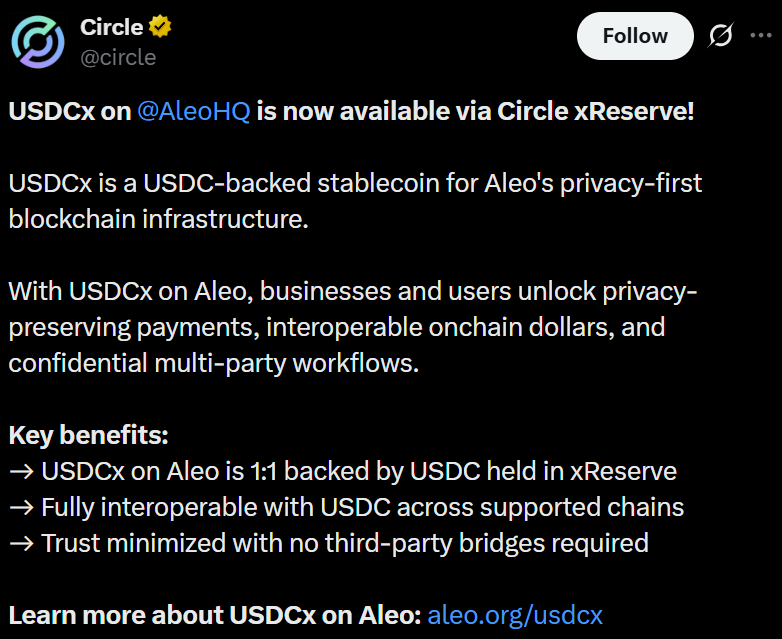

Circle and Aleo announced Tuesday that USDCx on Aleo is now available via Circle’s xReserve, a reserve-backed issuance model that allows USDC (USDC) to be represented on additional blockchains without relying on third-party bridges.

USDCx on Aleo is fully backed by USDC held in xReserve and is interoperable with USDC across other supported networks, including Ethereum and several major layer-1 and layer-2 blockchains where USDC is natively issued.

USDC is Circle’s dollar-backed stablecoin issued directly on supported blockchains, while USDCx is minted on Aleo through xReserve and operates within Aleo’s privacy-focused architecture.

Aleo uses zero-knowledge technology to enable applications where transaction details, such as the sender, receiver and amount can remain confidential while still being verifiable onchain.

As Cointelegraph reported, the Circle-Aleo privacy project was unveiled in December, targeting banking and enterprise customers.

Related: Bank lobby is ‘panicking’ about yield-bearing stablecoins

Privacy gains traction as crypto markets struggle

While privacy-focused digital asset projects have existed for years, the sector has regained traction since 2025 as market conditions have shifted. Cryptocurrencies such as Zcash (ZEC) and Monero (XMR) have outperformed parts of the broader market during periods of heightened volatility.

Zcash, in particular, saw renewed interest in the fourth quarter, with its price rising several-fold over a two-month period. The rally coincided with a notable increase in the use of shielded addresses, which obscure transaction details such as sender, receiver and transferred amount.

Network data showed a rise in shielded transaction activity during the same period, suggesting growing demand for enhanced onchain privacy.

Research from Grayscale suggested that the renewed interest in privacy coins was partly driven by more defensive positioning within crypto markets, as investors sought assets perceived to offer insulation from surveillance, compliance-related risks and growing transparency across public blockchains.

Other analysts pointed to a tightening regulatory backdrop, particularly around global anti-money laundering standards set by the Financial Action Task Force (FATF). As enforcement of travel rules and transaction monitoring intensifies, privacy-focused tokens have drawn attention as alternatives for users seeking greater confidentiality.

Related: What’s behind the surge in privacy tokens as the rest of the market weakens?

cryptopolitan.com

cryptopolitan.com

coinfomania.com

coinfomania.com

u.today

u.today