Chainlink’s blockchain protocol facilitated a simulated exchange between Hong Kong’s prototype central bank digital currency (CBDC) and an Australian dollar stablecoin in Phase 2 of the e-HKD+ Pilot Programme.

Chainlink Enables Direct e-HKD to Australian Stablecoin Exchange in Test

The Hong Kong Monetary Authority (HKMA) initiative involves Visa, ANZ, Fidelity International, and ChinaAMC Hong Kong testing cross-border transactions using tokenized assets. The experiment demonstrated how Australia-based investors could acquire Hong Kong money market fund (MMF) units using either the e-HKD or tokenized bank deposits.

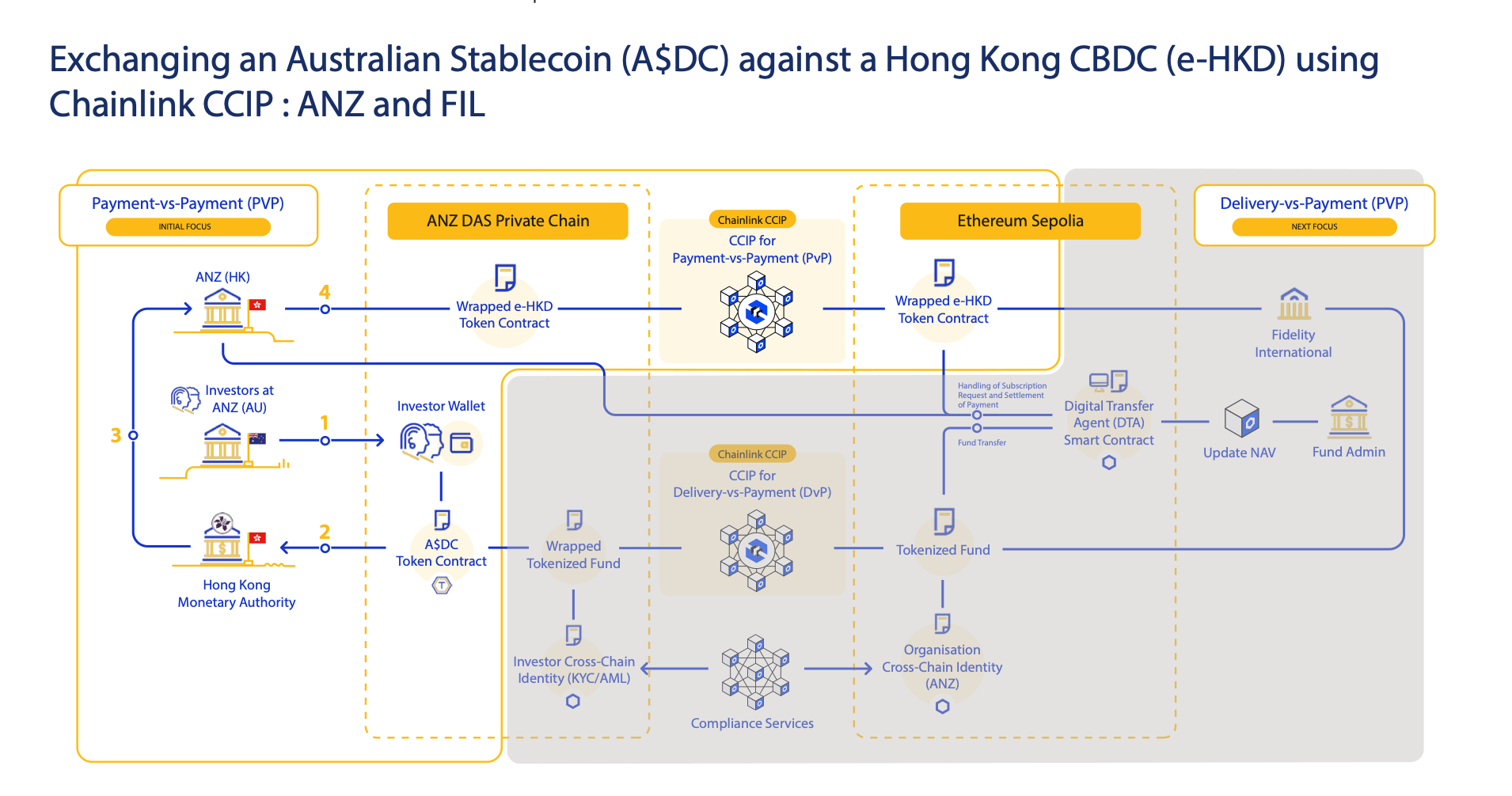

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) connected ANZ’s private blockchain (DASchain) and the public Ethereum Sepolia testnet to execute the exchange. This allowed atomic settlement—simultaneous transfer of the Australian stablecoin (A$DC) and e-HKD—reducing counterparty risk by ensuring both sides of the transaction finalized near-instantly.

Pilot participants evaluated Ethereum‘s ERC-20 and ERC-3643 token standards for compatibility. The e-HKD used the widely adopted ERC-20 standard, while tokenized deposits employed ERC-3643, which embeds regulatory compliance features like identity verification.

The test highlighted interoperability challenges between public and permissioned blockchains. Financial institutions typically use private chains for controlled operations but require public chains for broader asset distribution. CCIP’s messaging protocol enabled cross-chain data transfer without asset bridging.

Next-stage testing will assess end-to-end transactions, including MMF unit purchases. Outcomes aim to inform global standards for CBDCs, tokenized deposits, and settlement infrastructure. Results from further phases of the testing are expected later in 2025.

news.bitcoin.com

news.bitcoin.com