Ripple CTO David “JoelKatz” Schwartz has responded to several questions on social media about his involvement with Evan “all the money” Schwartz. The user “DegenXRPHolder” wondered if the two had a relationship. Schwartz pointed out that just because they have the same last name, they are not related. However, he acknowledged that there is another Evan connected to Interledger who is a member of his family.

The discussion then shifted to the current functioning of Interledger. Schwartz stated that the protocol may have been too advanced for its time. He added that being too soon can sometimes be as bad as being too late. In his view, the team made some strategic mistakes, though he noted they weren’t significant enough to impact the project’s long-term potential seriously.

I think interledger was way too far ahead of its time. Being too early can be as bad as being too late. They also, IMO, made some strategic errors, but I'm not sure that would have made much difference.

— David 'JoelKatz' Schwartz (@JoelKatz) June 8, 2025

Schwartz Reflects on Interledger’s Early Challenges and Future Potential

The user asked if Interledger met its original objectives, and Schwartz gave an honest reply. He noted that the protocol was still not operating at its full strength. In his opinion, the initial aims may have been beyond what could have been realized.

Schwartz’s observation about the harsh beginning for Interledger aligns with the lively discussions surrounding the creation of blockchain technology at the right time. He noted that early adoption can slow down the success of a project. Timing issues have been a major problem for many projects, including Interledger.

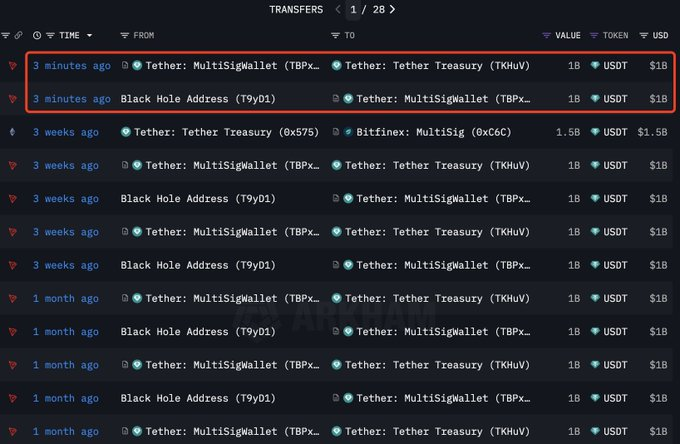

Tether’s $1B Minting Stirs Debate on Bitcoin’s Price Influence

Nevertheless, Lookonchain found that Tether minted another $1 billion worth of USDT on the Tron blockchain. This follows Tether’s minting of $2 billion worth of USDT on May 21. Soon after Tether minted billions in stablecoins, Bitcoin’s price jumped to more than $111,000. These comments sparked new discussions about how the issuance of stablecoins can impact the price of Bitcoin.

The surge in Tether minting has renewed debate among analysts about how such actions may influence broader crypto markets. While some argue it supports price growth in assets like Bitcoin, others remain skeptical of its long-term effects.

Related: Paolo Ardoino Details Tether’s ‘Perfect’ Bitcoin Strategy, $2 Billion Mining Push

Schwartz describes the struggles faced during the early development of Interledger and how they apply to the blockchain industry as a whole. On the other hand, Tether’s decisions demonstrate the significant impact of stablecoins on trends in the cryptocurrency market. Both events point to ongoing changes in cryptocurrency that could play a role in determining its future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com