The battle over BIP-110 and the related BIP-444 represents a fundamental schism in the Bitcoin community over whether the network should remain a neutral data protocol or become a curated financial ledger.

Philosophical: Neutrality vs. Curation

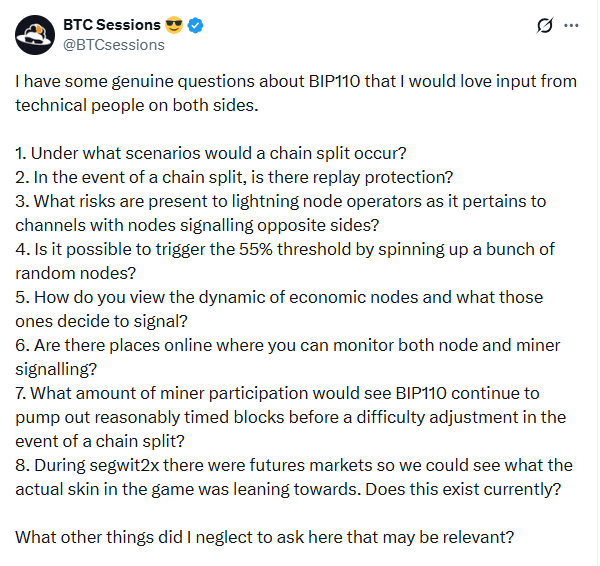

An ideological clash is erupting over Bitcoin Improvement Proposal 110 (BIP-110)—often discussed alongside the broader BIP-444 framework—a temporary soft fork intended to purge “junk data” from the blockchain. Supporters call it a necessary cleanup; critics see it as a dangerous precedent.

Introduced in late 2025 by pseudonymous developer Dathon Ohm and backed by figures like Luke Dashjr, BIP-110 targets non-monetary data—primarily Ordinals inscriptions—that consume block space. Advocates argue this move frees capacity for financial transactions, lowering costs for everyday users.

Opponents counter that it undermines Bitcoin’s neutrality, threatening its credibility as a permissionless store of value. They note that Ordinals and Runes have generated over $500 million in miner fees, strengthening the network’s security budget.

Industry voices warn that the debate is less about technical congestion than Bitcoin’s identity. The risk to permissionless access is a primary concern, as allowing developers to decide which transactions are “valid” introduces subjective gatekeeping into a system designed for mathematical certainty. This creates a censorship precedent where filtering JPEGs today could justify banning other use cases tomorrow.

Furthermore, many experts argue that scalability challenges should be solved with engineering rather than moderation. They suggest that better technology, such as Layer 2 solutions, is the proper answer to network demand rather than content policing. At the consensus layer, all transactions are fundamentally data, and drawing ideological lines between payments and storage erodes the neutrality that makes the network valuable.

The Fee Revenue Irony

Beyond the philosophical debate lies a stark economic reality. Samuel Patt, co-founder of OP_NET, highlights a “great irony” in the proposal: While supporters claim to protect Bitcoin’s future, they may be starving it of the revenue needed for long-term survival. With the block reward currently at 3.125 BTC and scheduled to halve again in 2028, miners are increasingly dependent on transaction fees to maintain the network’s security.

Patt argues that any attempt to artificially reduce demand for block space is effectively economic self-harm. As the subsidy trends toward zero by 2140, the security of the entire network will rely entirely on a robust fee market.

“Anyone who says they’re a Bitcoin maximalist while simultaneously trying to reduce demand for block space is holding two contradictory positions. Bitcoin needs transactions. It needs people competing for block space. It needs robust fee markets,” Patt said. “That’s not a bug—it’s how Satoshi designed the system to remain secure long after the subsidy disappears.”

Instead, he suggests that true utility—such as decentralized finance ( DeFi) and stablecoin infrastructure—should compete for block space naturally through the market rather than through protocol-level exclusion.

Creating an Attack Surface

Perhaps the most alarming critique involves the technical stability of the network itself. Nima Beni, founder of Bitlease, warns that content-triggered filtering does not reduce the attack surface—it creates one. By establishing that certain types of data can trigger a mandatory protocol response or a soft fork, the network provides a literal “attack manual” for bad actors.

Beni points out that the economics are brutally asymmetric: Inscribing problematic content costs pennies, yet if that data forces a chain reorganization or a split, it creates massive coordination requirements across nodes and miners.

“Content-based filtering introduces subjective decision points that can be deliberately manipulated. Once you establish that specific content types force protocol responses, you’ve published attack instructions,” Beni said. “Anyone wanting to destabilize Bitcoin’s consensus knows exactly how.”

The Bitlease founder argues that Bitcoin’s censorship resistance is not just a political stance; it is the security foundation that makes algorithmic consensus trustworthy. By moving away from content-agnostic validation, the network risks inviting the very destabilization it seeks to avoid.

Meanwhile, the draft of BIP-444 reportedly goes beyond technical language, warning that rejecting the fork “may subject you to legal or moral consequences.” This clause has raised eyebrows across the community, as it suggests that opposition to the proposal could carry not only reputational costs but potential liability—an unusual and controversial framing in Bitcoin governance debates.

Remarking on this, Iva Wisher, CEO at MIDL, said, “The moment you start threatening legal consequences for not adopting a fork, you’ve fundamentally misunderstood how this system works. Protocol changes should be driven by technical merit and community consensus, not coercion.”

Beni also weighed in by equating the clause to “coercive governance” and reiterated that Bitcoin’s value is “credible neutrality.” He added that proposals containing liability clauses admit insufficient technical merit. “If the proposal cannot earn adoption through legitimate channels, legal language doesn’t strengthen the case,” he said. “It exposes fatal weakness.”

FAQ ❓

- What is BIP‑110? BIP‑110 is a proposed soft fork to limit non‑monetary “junk data” like Ordinals from consuming Bitcoin block space.

- Why is BIP‑444 controversial? BIP‑444 echoes BIP‑110’s goals but adds a clause warning that rejecting the fork “may subject you to legal or moral consequences.”

- How does this affect miners and fees? Critics argue that restricting block space reduces fee revenue, which is vital for Bitcoin’s long‑term security as block rewards decline.

- Why does this matter globally? The proposals raise questions about Bitcoin’s neutrality, censorship resistance, and governance, issues central to its role as a permissionless global network.

cryptobriefing.com

cryptobriefing.com

coindesk.com

coindesk.com