Bitcoin is trading under sustained pressure after losing key higher-timeframe support levels, with the price structure showing a clear transition from distribution to a developing downtrend. Momentum remains weak, and recent rebounds appear corrective rather than impulsive, keeping downside risk elevated in the near term.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, the asset continues to respect a descending channel while trading below major moving averages, confirming bearish market structure. The rejection from the mid-range resistance zone and subsequent sharp sell-off toward the low-$60K region reinforces that sellers still control trend direction.

Momentum indicators remain subdued, with RSI holding far below neutral and failing to produce strong bullish divergence. Unless the price can reclaim the $75K–$80K resistance cluster and close above the channel midpoint, the broader bias stays tilted toward continuation lower or prolonged consolidation near the $60K support level.

BTC/USDT 4-Hour Chart

The 4-hour chart shows a steep impulsive drop followed by choppy sideways movement, typical of a bear-flag or accumulation attempt after liquidation. Lower highs continue to form beneath descending dynamic resistance, signaling that buyers have not yet regained short-term control.

Key support sits around the recent wick low near the $60K area, while immediate resistance is clustered between roughly $73K and $76K. A breakout above this range would be the first technical signal of a momentum shift, whereas a breakdown below the mentioned support zone could accelerate another leg downward and lead to another round of massive liquidations.

Sentiment Analysis

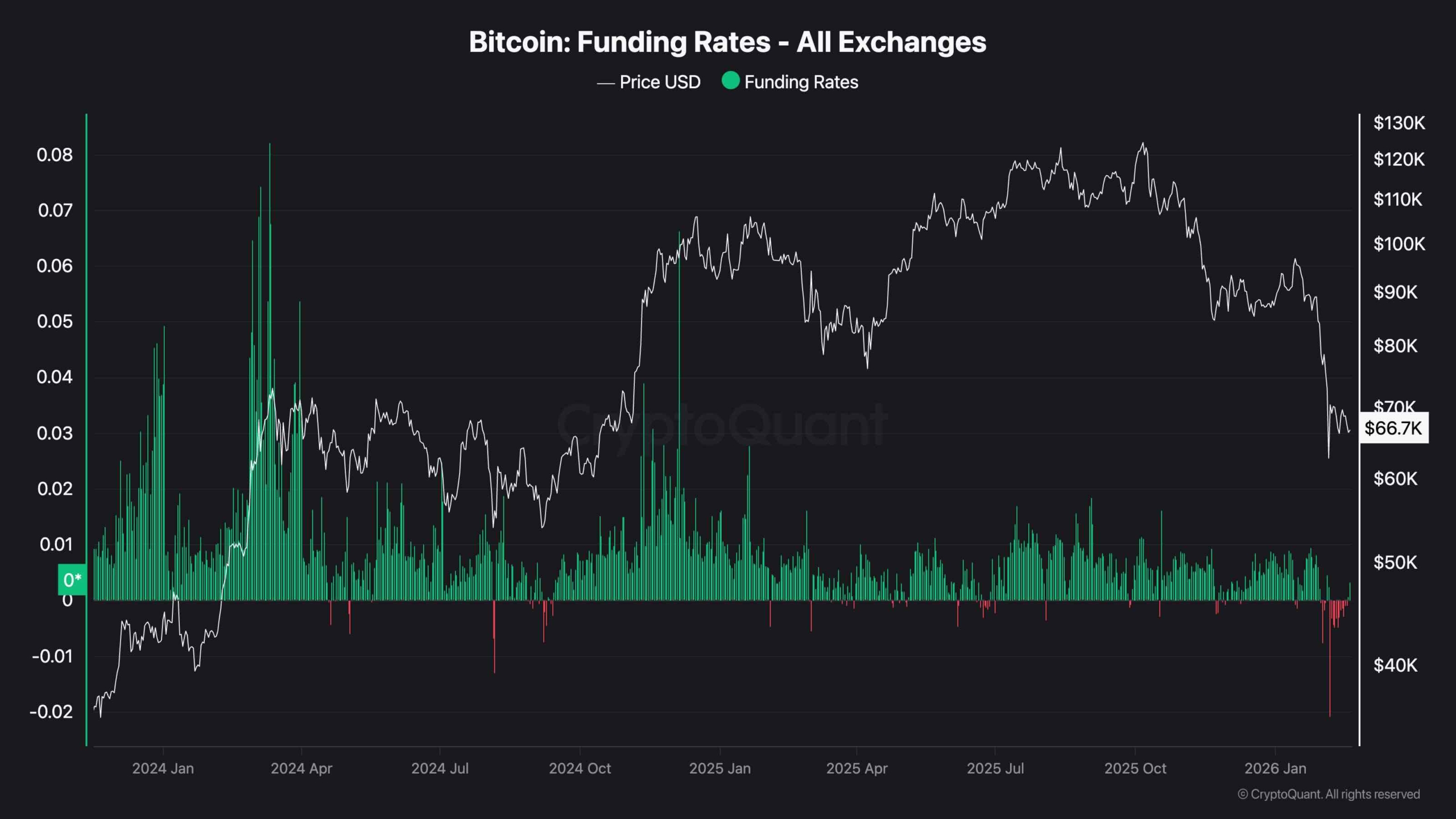

Funding rate data shows sentiment cooling significantly compared to earlier overheated conditions, with the recent deeply negative prints suggesting reduced long-side leverage. This type of reset is constructive over the medium term but does not, by itself, confirm an immediate bullish reversal.

Overall market psychology appears cautious rather than euphoric, which often precedes range formation before the next major move. For sentiment to flip decisively bullish, price strength must return alongside rising but controlled funding and improving momentum across timeframes.

beincrypto.com

beincrypto.com

u.today

u.today

coinedition.com

coinedition.com