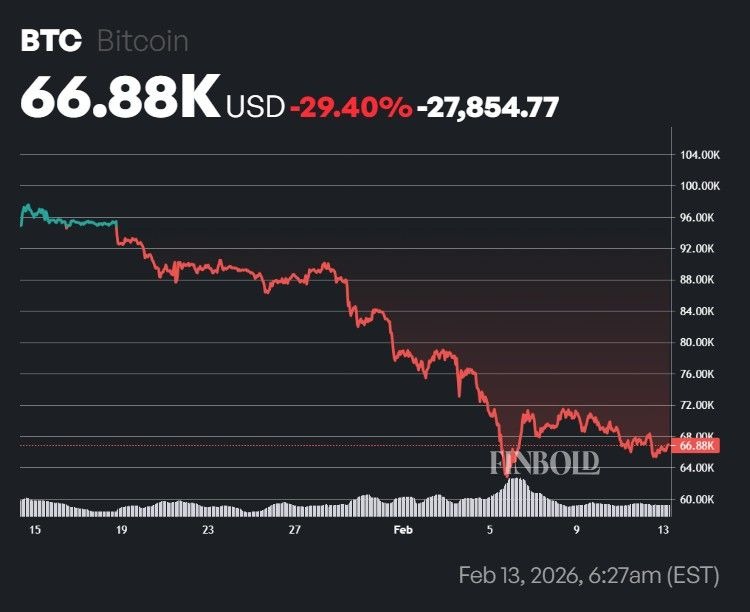

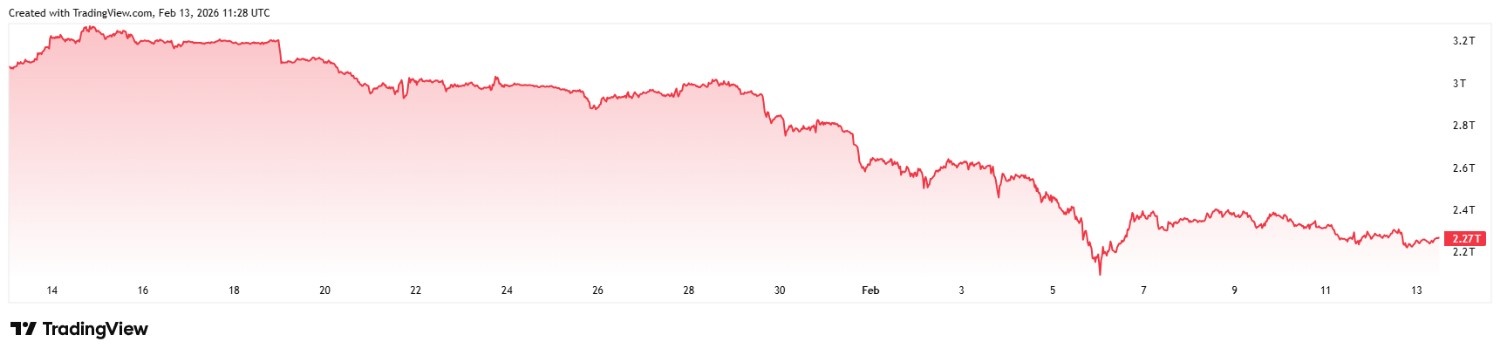

The cryptocurrency market turbulence that started in earnest in late January sent Bitcoin ($BTC) into a descending channel it has, with its February 13 press time price of $66,887, so far been unable to escape.

Following the latest $BTC moves, a popular on-chain expert, Ali Martinez, explained in a Friday post on X that the digital asset is now range-bound within the channel, but also identified two key levels investors should watch.

Specifically, at $66,887, Bitcoin is between a support at $64,000 and a resistance at $67,000. Should the world’s premier cryptocurrency touch either of these levels and then rebound toward the press time price, it would confirm the digital asset will remain on its downward path.

Simultaneously, the performance of the asset group showcased the relative strength of its resistance levels, considering that some of the most extreme drops in the total market capitalization – and in Bitcoin’s own price – on February 4 and 5, and February 12 were met with swift upward corrections.

Will 2026 really be a Bitcoin bear market?

A significant reason why investors should watch Bitcoin’s current support and resistance levels is that, despite the prevailing fearful sentiment among traders, multiple notable institutions have noted that the entirety of the bear case of early 2026 is, in fact, weak.

Specifically, while many veteran traders and analysts noted the similarities between $BTC’s February trajectory – or rather, Bitcoin’s trajectory since hitting the all-time high (ATH) in early October – and previous cycles, Bernstein analysts voiced their vehement disagreement.

According to the trading house, the changes in the regulatory climate, institutional adoption, and spot exchange-traded fund (ETF) approvals have all altered the cryptocurrency landscape so significantly that attempting to predict the future based on the past is pure folly.

Featured image via Shutterstock

cryptobriefing.com

cryptobriefing.com

protos.com

protos.com

coinfomania.com

coinfomania.com