After retreating from just above the $60,000 level yesterday, Bitcoin recorded a strong rebound on Friday and retested the $70,000 threshold.

The market’s leading crypto asset is currently trading at around $70,165, up approximately 10%.

While a recovery was noticeable as the week entered its final trading day, yesterday’s sharp sell-off indicated continued market fragility. Bitcoin briefly dropped below $61,000, falling to the $60,000 mark. This morning, however, it showed signs of recovery towards the $66,000 range.

The decline in Bitcoin began after it reached an all-time high of over $126,000 in October. Since then, there has been a sharp correction in prices, and a bearish trend has become evident in the market.

There are multiple factors behind the selling pressure. The ongoing decline in US technology stocks has also dragged down Bitcoin, which has a high correlation with risky assets. High volatility seen in traditional safe havens like gold and silver in global markets has also been among the factors reducing investor risk appetite.

One of the most significant factors accelerating the decline in the crypto market was mandatory liquidations. When the price fell to certain levels, the automatic closing of leveraged positions triggered chain sales.

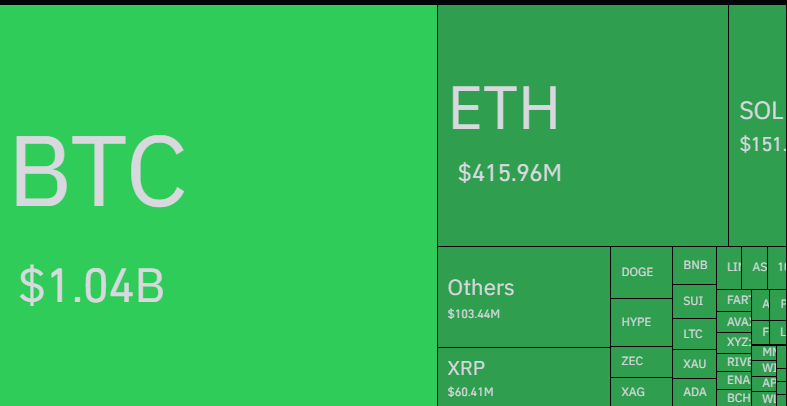

According to Coinglass data, over $2 billion in long and short positions were liquidated yesterday. Today, this figure is around $800 million. The total liquidation amount over the last 24 hours is $1.99 billion, with $1.44 billion from long positions and $550 million from short positions.

On the other hand, on-chain and ETF data indicate that institutional investors are also reducing their positions. According to CryptoQuant data, US-based spot ETFs, which bought 46,000 Bitcoin around this time last year, will be net sellers in 2026.

*This is not investment advice.

coingape.com

coingape.com

u.today

u.today

cointelegraph.com

cointelegraph.com