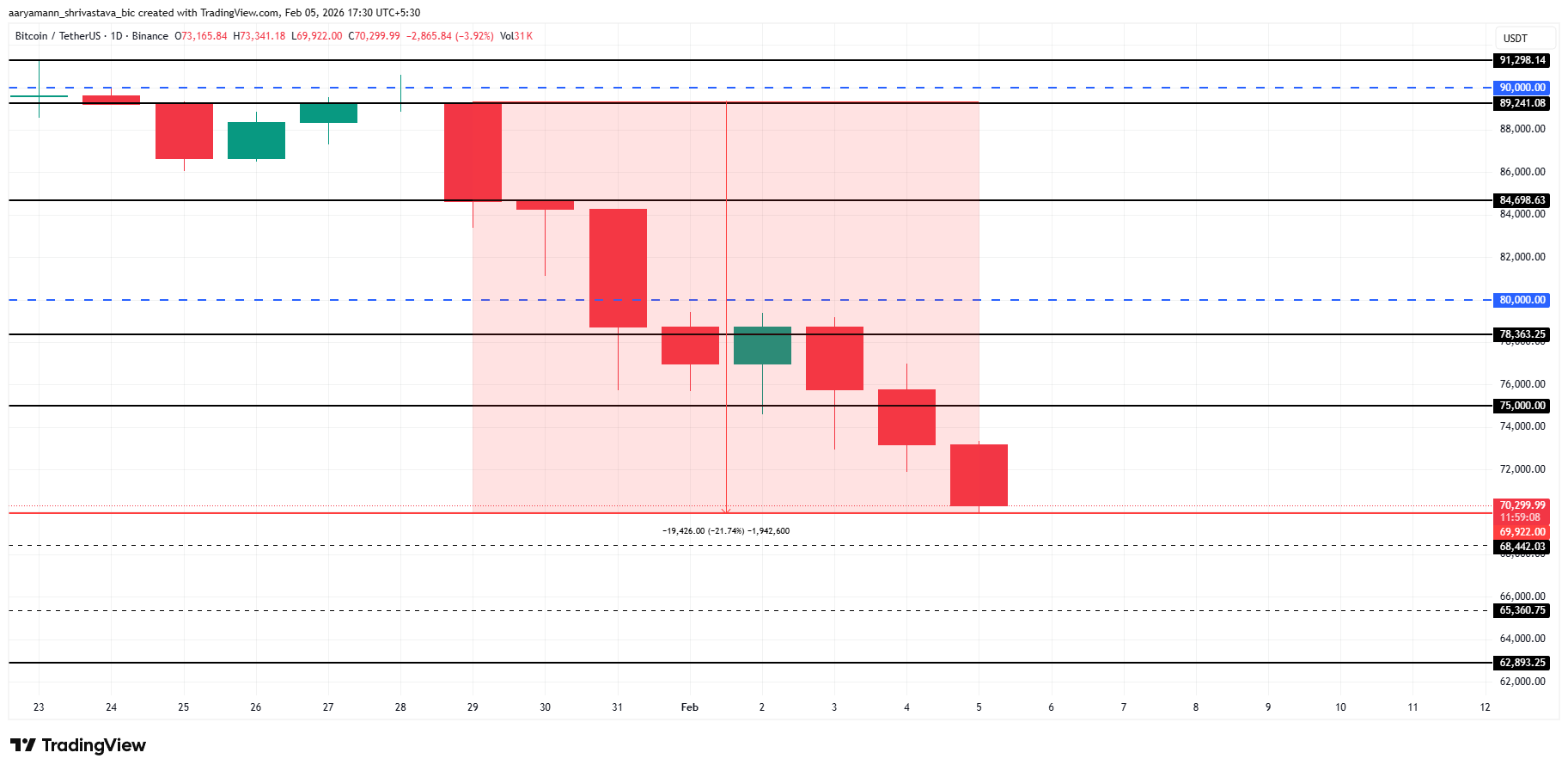

Bitcoin price fell below the $70,000 mark on Tuesday, recording an intraday low of $69,922 at the time of writing. This marks the first time $BTC has traded at this level since November 2024, highlighting the severity of the ongoing correction.

The decline followed a mix of macroeconomic stress and aggressive deleveraging across derivatives markets, intensifying downside pressure.

Bitcoin Miners At Risk

Bitcoin’s move toward $70,000 places price action near a critical zone where mining economics begin to matter more than trader psychology. At the current network difficulty and average electricity costs near $0.08 per kWh, data indicates many Antminer S21-series machines approach unprofitability within a $69,000–$74,000 shutdown range. Above this band, mining activity remains broadly viable.

Below this range, profitability narrows to only the most efficient operators. This increases financial strain across the mining sector. While miner shutdown levels do not guarantee a price floor, they often mark points where behavior shifts materially. Prolonged trading below $70,000 could force weaker miners to liquidate $BTC reserves or power down equipment.

Such actions may reduce hashrate while adding sell-side pressure. These risks compound existing headwinds, including tight liquidity, reduced risk appetite, ETF outflows, and ongoing derivatives liquidations. Together, mining stress and market weakness could amplify downside volatility without signaling any fundamental breakdown in Bitcoin’s long-term network security.

Analysts Highlight Fall Risks

Bitcoin slid to $73,000 on February 3, extending a broader sell-off that has erased roughly 41% from its October 2025 peak above $126,000. The decline coincided with rising geopolitical and macro uncertainty, including renewed US–Iran tensions. These developments pushed the VIX up about 10% and drove the Crypto Fear & Greed Index into “extreme fear.”

As risk appetite faded, investors rotated into traditional safe havens. Gold gained 6.8%, while silver rose 10%. Bitcoin failed to capture defensive inflows during this period. Analysts say this divergence has weakened Bitcoin’s short-term safe-haven narrative, contributing to continued selling pressure.

Market views remain sharply divided. Bearish analysts warn the correction may deepen, citing historical drawdowns of 78% to 86% in prior cycles. If repeated, that would imply a move toward $35,000. Technically, Bitcoin trades near $74,400, close to MicroStrategy’s reported cost basis.

A sustained break below $70,000 could open downside toward $55,700–$58,200 near long-term averages. Conversely, on-chain data shows profitable supply falling from 19.8 million to 11.1 million $BTC, a condition historically associated with stabilization phases.

Michael Burry Warns Of a Crash

Michael Burry, known for “The Big Short,” has highlighted similarities between Bitcoin’s current structure and past market tops. On a macro scale, $BTC formed a double top in 2021, followed by a sharp crash in early 2022. Burry suggests a comparable pattern has emerged since the fourth quarter of 2025.

According to this view, Bitcoin now sits near a breakdown point. A confirmed failure could trigger a deeper correction. While historical analogies do not guarantee outcomes, they reinforce caution among investors already steering elevated volatility and weakening momentum across crypto markets.

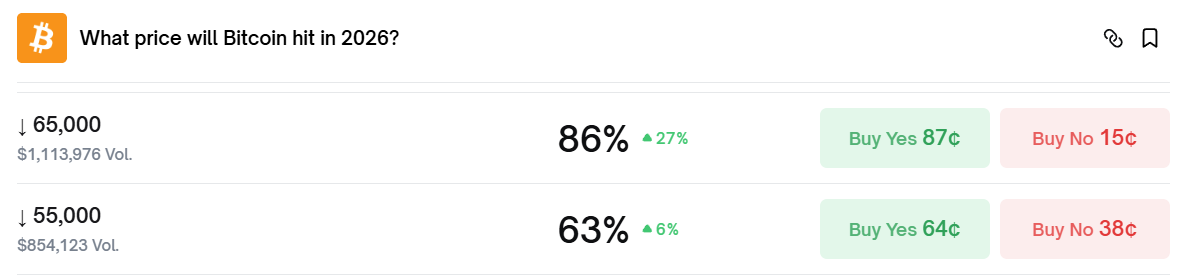

Polymarket Says 63% Chance of $BTC Crash to $55,000

Prediction markets also reflect growing bearish conviction. Polymarket traders currently assign an 86% probability to Bitcoin falling to $65,000. The market also shows a 63% chance of a decline to $55,000. These expectations broadly align with BeInCrypto’s macro outlook.

Sponsored

Based on technical analysis, Bitcoin appears to be forming a Head and Shoulders breakdown, projecting a 37% drop toward $51,511. Confirmation would come if $BTC decisively breaks $63,000. That scenario places the likely bottom between the $65,000 psychological level and the $63,000 technical support, intensifying focus on the coming sessions.

Bitcoin price on Tuesday fell below the $70,000 mark, recording an intraday low of $69,922 at the time of writing. This move marks the first time $BTC has traded at this level since November 2024, highlighting the intensity of the ongoing correction.

The decline was fueled by a combination of macroeconomic bearish signals and aggressive deleveraging across derivatives markets. Over the past 24 hours, cascading liquidations reached approximately $451 million, amplifying selling pressure and accelerating losses.

With key psychological support now breached, Bitcoin’s price is increasingly exposed to further downside, with $65,000 emerging as the next critical level to watch if bearish momentum persists.

u.today

u.today

bitcoinworld.co.in

bitcoinworld.co.in