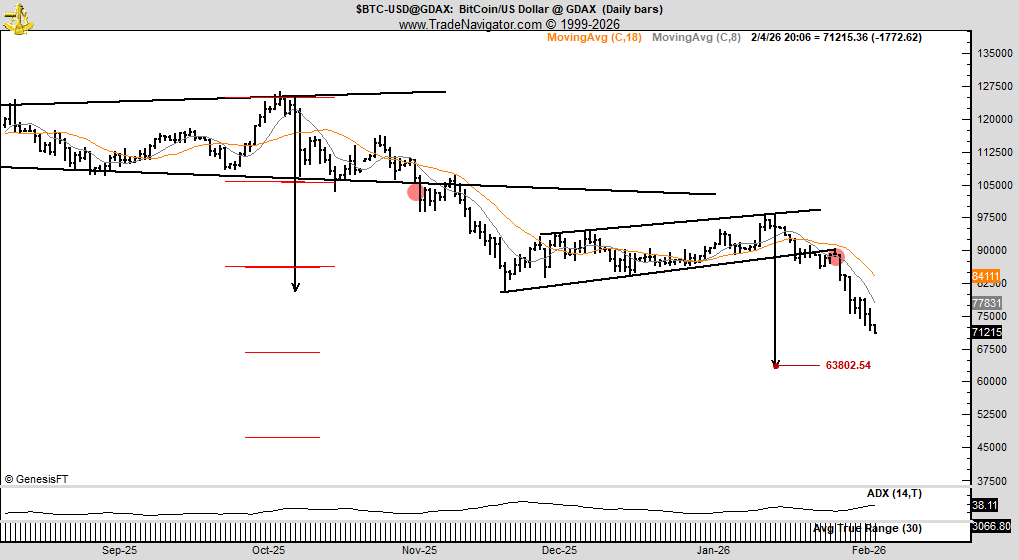

According to veteran chartist Peter Brandt, the current eight-day downtrend on Bitcoin ($BTC) shows all the hallmarks of a calculated campaign sell-off, not a random liquidation. His analysis points to two critical levels now in play: the already-breached $70,000 and a far more ominous target at $63,800, based on a measured move from the recent wedge breakdown. With over $850 million wiped out in liquidations and fear metrics collapsing, this is not a normal dip.

If Brandt’s structure plays out, the market may be staring down a deeper flush that few retail holders are ready for.

Who is selling Bitcoin?

In his latest public Bitcoin outlook, Brandt pointed to the ongoing eight-day streak of lower highs and lower lows in $BTC’s price, characterizing the formation as a textbook example of "campaign selling" — in which institutional-sized flows systematically get rid of excessive exposure to the cryptocurrency.

His current projection outlines two major price zones: $70,000, which Bitcoin is already testing, and a deeper target near $63,800.

Price action confirms the stress. Since the beginning of 2026, $BTC has broken down from a rising wedge pattern, lost both short-term moving averages and is being pushed lower by continuous liquidation pressure worth $850 million in just 24 hours alone. In this case, $63,802.54 emerges as the full measured-move target, going along with breakdown dynamics last seen in the October 2023 collapse.

It is important to note that the pain is not limited to crypto: equities and commodities are also deep in red this week, reinforcing the idea of a synchronized deleveraging phase.

Brandt’s annotated chart sketches out a technical playbook, not a gut call, even though he has 50 years of experience. Each price level, he points out, is derived from historical repetition — not speculative guessing. And as the formation continues to unfold, the lower boundary — $63,800 for $BTC — could become the market’s next battleground.

cryptobriefing.com

cryptobriefing.com

thecryptobasic.com

thecryptobasic.com