The cryptocurrency market reeled after a sharp sell-off sent Bitcoin toward $70,000, triggering a cascade of forced liquidations.

Key Points

- Bitcoin broke below key January support levels, falling more than 7% to near $70,100.

- Total crypto market capitalization dropped 6.8% in one day to about $2.49 trillion.

- Roughly $900 billion has been erased from the crypto market over the past 22 days.

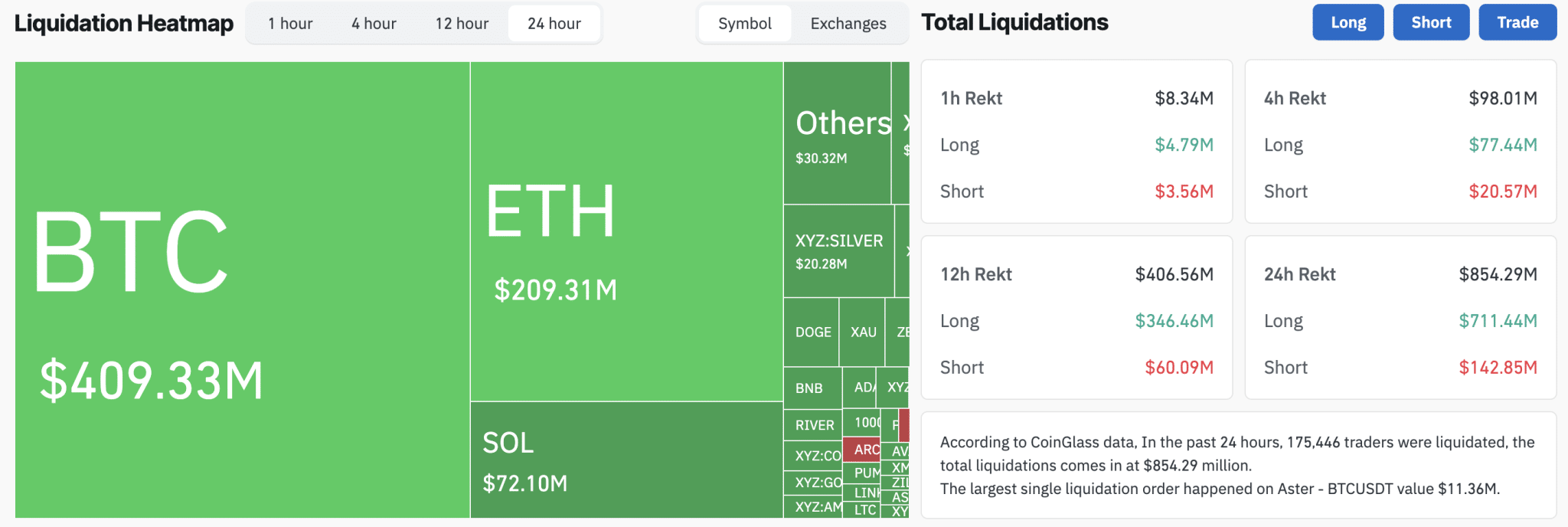

- Derivatives liquidations totaled about $840 million over 24 hours, driven by long positions.

- Major altcoins, including Ethereum and $XRP, fell between 7% and 9% amid broad-based selling.

Bitcoin Breaks Key Levels Amid Broad Market Decline

Bitcoin fell more than 7% over the past 24 hours, trading near $70,582 at the time of reporting. During the sell-off, it briefly dipped to $70,140, its weakest level since November 2024, according to TradingView data.

Consequently, the move pushed Bitcoin decisively below trading ranges that had underpinned prices for most of January, confirming a technical breakdown and thereby intensifying selling pressure.

-

Bitcoin Price Chart

Bitcoin Price Chart

Weakness in Bitcoin quickly reverberated across the market. Total cryptocurrency market capitalization slid to $2.49 trillion, representing a 6.8% decline over the day.

Viewed in a broader context, the scale of the downturn is striking: over the past 22 days, the crypto market has shed roughly $900 billion in value, marking the largest sell-off on record.

Altcoins Extend Losses Across the Market

Losses were even more pronounced among major altcoins, underscoring a widespread risk-off shift rather than isolated weakness. Ethereum dropped 7.4% to around $2,097, while $XRP fell 9% to $1.44, according to CoinGecko.

Similarly, other large-cap tokens followed suit. Solana declined 6%, Cardano slid 5%, and BNB sank 9%. In addition, meme tokens were not spared: Dogecoin fell 5%, whereas Shiba Inu slipped just over 3%. Overall, the breadth of the decline highlighted broad-based selling across the sector.

Liquidations Accelerate as Leveraged Bets Unwind

The downturn was amplified by heavy activity in derivatives markets. CoinGlass data shows that approximately 172,826 traders were liquidated over the past 24 hours, with total losses reaching about $839.5 million.

Notably, the bulk of the damage came from bullish bets. Nearly $700 million in long positions, largely tied to Bitcoin and Ethereum, were wiped out as prices fell. Liquidations accelerated after Bitcoin broke below the $75,000 and $73,000 levels in quick succession, thereby compounding downside momentum.

Large liquidation clusters were reported on major exchanges, including Binance, Bybit, and Hyperliquid. In contrast, short liquidations remained relatively limited, indicating that the move was driven primarily by overleveraged optimism rather than a sudden reversal against bearish positions.

From Late-2024 Optimism to Renewed Caution

The latest sell-off stands in sharp contrast to the rally seen late last year. Following Donald Trump’s election victory, Bitcoin rallied as investors anticipated a more accommodating regulatory environment for digital assets.

That optimism was reinforced by U.S. monetary policy. Interest rate cuts beginning in December 2024 boosted appetite for riskier assets, lifting cryptocurrencies alongside other speculative markets and supporting strong gains into year-end.

Geopolitics and Policy Uncertainty Shift Sentiment

More recently, however, market sentiment has shifted. Gold and other traditional safe-haven assets rallied on Wednesday as tensions between the United States and Iran intensified. This move signaled a broader shift toward caution among investors.

At the same time, uncertainty surrounding U.S. monetary policy has weighed on crypto markets. President Trump’s nomination of former Federal Reserve governor Kevin Warsh as the next Fed chair has raised concerns over future liquidity conditions. Warsh is widely viewed as hawkish, which has fueled fears that tighter financial conditions could lie ahead.

cointelegraph.com

cointelegraph.com