Bitcoin fell below $73,000 for the second straight day, extending a volatile week in which it lost nearly 18% of its value and erased about $500 billion from its market cap since mid‑January.

Bitcoin Erases Gains as Liquidations Mount

For the second consecutive day, bitcoin slid below the $73,000 threshold, extending a volatile week that has seen the cryptocurrency lose nearly 18% of its value. Mirroring the previous session, the digital asset plunged from a high of $76,300 to $72,000 by 12:40 p.m. EST—a 3% intraday drop. This performance continues to track the tech-heavy Nasdaq, which was down 2.36% at the time of writing.

This latest decline pushed bitcoin’s market capitalization down to $1.45 trillion. Since hitting a year-to-date high of $97,500 on Jan. 15, the asset has erased approximately $500 billion in value. Meanwhile, the Feb. 4 crash triggered a wave of liquidations, wiping out $125 million in long positions within just four hours. Over the last 24 hours, total leveraged liquidations exceeded $830 million, with bullish “long” bets bearing the brunt of the losses.

Notably, the downward move coincided with $272 million in outflows from spot bitcoin exchange-traded funds. Sentiment also remained bearish despite news that the U.S. Senate plans to discuss the CLARITY Act, a bill aimed at establishing a comprehensive regulatory framework for the crypto market. Additionally, the U.S. House’s successful vote to end the partial government shutdown late on Feb. 3 failed to provide the “risk-on” boost many investors expected.

AI Sector Rout Drags Down Tech Indices

According to reports, the broader market malaise was driven largely by the artificial intelligence (AI) factor.” Major semiconductor and AI-related stocks faced a reality check, led by Advanced Micro Devices (AMD), which plummeted over 16% following conservative guidance. This sell-off weighed heavily on the Nasdaq, with Nvidia (down 4%), Broadcom (down 7%) and Intel (down 3.5%) all deep in the red. While the S&P 500 and Dow Jones Industrial Average also traded lower, their losses were contained to under 1%.

Meanwhile, bitcoin’s persistent correlation with the Nasdaq—and its deepening divergence from traditional safe-haven assets like gold—has reignited a debate over the asset’s digital gold narrative. This decoupling from the precious metals rally suggests that $BTC is currently behaving more like a high-beta tech play than a store of value. Furthermore, the market is beginning to question the waning influence of Strategy. Since pivoting its approach to financing bitcoin acquisitions, the firm’s near-weekly purchases have failed to provide the spark that sustained its previous rallies.

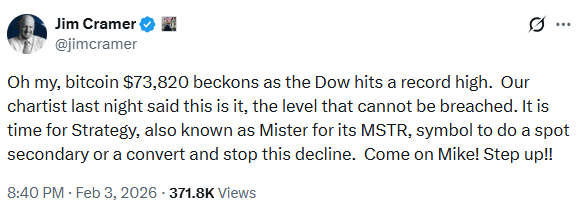

This diminishing impact has prompted critics and high-profile observers to call for a tactical shift. Jim Cramer, the prominent TV personality and bitcoin investor, took to X to urge Strategy Chairman Michael Saylor to reconsider his aggressive funding strategy.

“Memo to Michael Saylor: we think that $73,802 is the line in the sand for bitcoin,” Cramer posted. “Time to do another zero-coupon convert and stop this decline. Strategy’s earnings depend upon it and what will you talk about when you report Thursday? Let’s get this done!”

Read more: XRP Derivatives Paint a Cautious Picture as Price Stalls Under $1.65

While bitcoin is currently trading below the average cost basis of Strategy’s 713,502 $BTC treasury, analysts remain divided on the firm’s stability. A growing consensus suggests that even a prolonged downturn will not push the company to the brink in the short term. Optimists point to the company’s substantial cash reserves as a sufficient bulwark, capable of insulating the firm’s balance sheet from the current bout of extreme volatility.

FAQ ❓

- Why did bitcoin drop below $73K again? It tracked Nasdaq’s tech sell‑off and broader market weakness.

- How much value has bitcoin lost in 2026? $BTC erased about $500B since its Jan. 15 peak of $97,500.

- What triggered the latest liquidations? Over $830M in leveraged bets were wiped out in 24 hours.

- Is Strategy at risk from the downturn? Analysts say its large cash reserves buffer short‑term volatility.

cryptonewsz.com

cryptonewsz.com

u.today

u.today

cointelegraph.com

cointelegraph.com