Amid the ongoing downturn, Bitcoin has dropped below three critical price markers: the halving AVWAP, the $ATH AVWAP, and the SMA50.

Bitcoin has continued to weaken over the past several days, pushing its price down to $74,890. The latest level places the asset nearly 15% lower for the year so far, following a 6.3% decline recorded in 2025.

The ongoing downturn has now pushed the price below several major technical support levels, including the AVWAP anchored to the Fourth Halving, the AVWAP anchored to the latest all-time high, and the weekly SMA50. This confirms increasing bearish control.

Key Points

- Bitcoin continuously interacted with three important price markers from 2024 to late 2025: the Fourth Halving AVWAP, the $ATH AVWAP, and the weekly SMA50.

- These price markers acted as support and resistance levels throughout 2025, guiding Bitcoin’s price action.

- As Bitcoin crashes to the current price of $74,890, it currently trades below all three critical price markers, flipping them from support to resistance.

- This confirms that sellers have taken full control of the market, with further downside risk emerging.

The Crucial Bitcoin Price Markers

This is according to a recent analysis from Onchain, a pseudonymous CryptoQuant analyst. During his commentary, Onchain called attention to the AVWAP anchored to the Fourth Halving, the AVWAP anchored to the most recent all-time high, and the 50-week simple moving average, all of which recently flipped from support into resistance.

Onchain explained that these tools worked together to track Bitcoin’s trend from mid-2024. Specifically, between May and August 2024, Bitcoin’s price compressed within the upper and lower bands of the Fourth Halving AVWAP while closing above the SMA50, which maintained a positive slope.

During this period, Bitcoin climbed to peaks of $71,958 and $70,000 while holding above the $57,000 level, which acted as a strong structural support.

Bitcoin Rally Above $100K and the Formation of Repeated Market Tops

In September 2024, Bitcoin surged from $54,000 and continued climbing until it reached $108,000 by December 2024. As the price pushed upward, the AVWAP bands expanded and moved far from the average price zone.

Onchain noted that the upper band of the Fourth Halving AVWAP repeatedly marked major market tops. Bitcoin touched approximately $109,000 in January 2025, $112,000 in May 2025, $124,000 in August 2025, and eventually printed an all-time high of $126,000 in October 2025.

Each of these levels aligned with the AVWAP’s upper boundary, representing market tops and resistance levels. During this period, the original Fourth Halving AVWAP and the SMA50 continued acting as a support zone during pullbacks.

Bitcoin Breaks Below All 3 Price Markers

Notably, when Bitcoin dropped from $109,000 in January 2025, buyers defended the AVWAP and SMA50 region as the price fell to $74,000 by April 2025. However, after the October 2025 all-time high at $126,000, the trend weakened further. In mid-November 2025, Bitcoin closed a weekly candle at $94,000, marking its first move below the SMA50.

The decline continued into late November and December 2025, when Bitcoin slipped into a range between $84,000 and $80,000, once again depending on the Fourth Halving AVWAP as temporary support.

A brief recovery emerged, but the $97,000 to $100,000 zone turned into resistance. Bitcoin also formed a lower high at $93,000, confirming weakening momentum. This resistance cluster contained several technical levels, including the UTXO Age Bands for six- to twelve-month holders, the SMA50, and the AVWAP anchored to the latest all-time high.

Now, with Bitcoin trading at $74,890, Onchain pointed out that the price has closed below the Fourth Halving AVWAP at $85,257, beneath the SMA50 at $100,415, which has started sloping downward, and under the $ATH AVWAP at $97,616. This suggests sellers have taken control of the market.

Other Analysts Warn of Broader Market Weakness

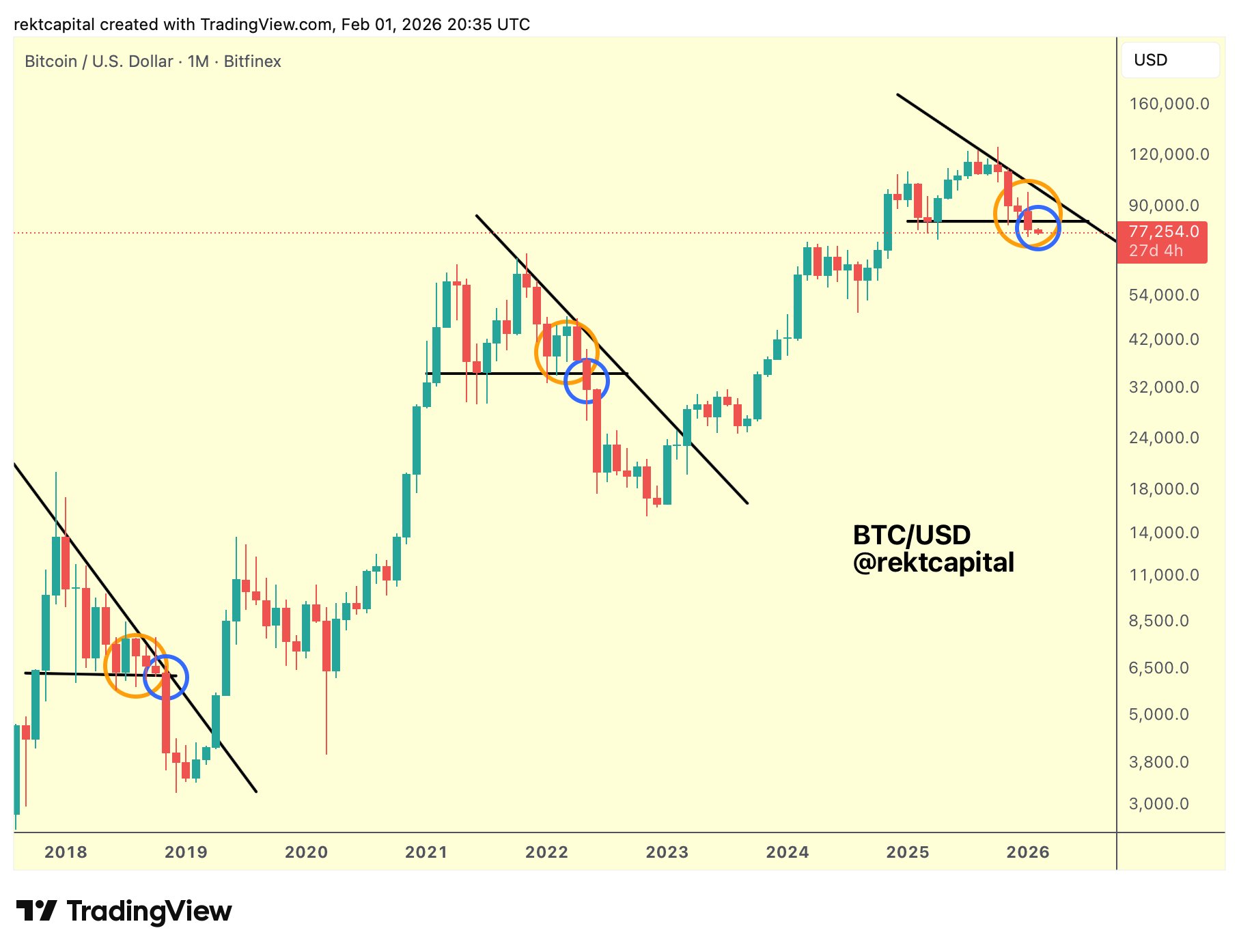

Meanwhile, other analysts have warned of a broader Bitcoin market weakness. For instance, technical analyst Rekt Capital highlighted that Bitcoin recently produced a bearish monthly close below the base of a long-term Macro Triangle pattern. According to him, the market now stands on the edge of a full structural breakdown that could trigger a bearish decline phase of the cycle.

Another analyst, Aralaz, warned that Bitcoin may be preparing for a sharp decline toward the $32,000 region. He compared previous cycle peaks and crashes, noting the 2017 high near $19,000 followed by an 84.1% collapse in 2018, the 2021 peak at $69,000 followed by a 77.4% drop in 2022, and the 2025 peak at $126,000, which he believes could lead to a potential 72.2% downturn into 2026.

news.bitcoin.com

news.bitcoin.com

bitcoinworld.co.in

bitcoinworld.co.in

u.today

u.today