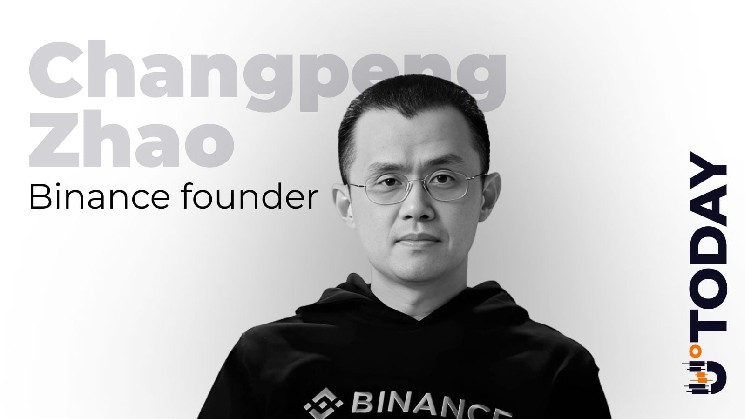

Changpeng Zhao, the founder of Binance, recently refuted allegations that big players or major exchanges intentionally manipulate the price of Bitcoin. In a Jan. 31, AMA, Zhao contended that macroeconomic news — more specifically, a tariff announcement — rather than exchange failures or concerted manipulation, caused the severe market crash occurring around Oct. 10.

CZ's point of view

He also emphasized that neither he nor Binance directly profits from cryptocurrency trading, and that purposefully altering the price of Bitcoin would require capital on a scale few actors would dare to deploy. Zhao claims that since Bitcoin is now essentially a multitrillion-dollar asset class, sustained manipulation is not feasible, as manipulators would face enormous financial risk if they attempted to significantly alter the market.

He further highlighted Binance’s regulatory oversight, particularly its compliance structure and monitoring arrangements, arguing that misconduct at the exchange level would be nearly impossible under such scrutiny. While reminding participants that no technological system can guarantee perfect uptime, he noted that users impacted by previous system outages were compensated.

Bitcoin's liquidity

Zhao has a point, but the circumstances are more complex. Because of Bitcoin’s high liquidity and widespread use, manipulating the asset on a long-term, global scale is extremely difficult. In a decentralized, fiercely competitive market, no single exchange or trader can maintain price control indefinitely.

Short-term price impact, however, is a different story, as leveraged liquidations, concentrated liquidity moves and strategic order placement are common ways that large funds, whales and institutional traders influence price action.

Bitcoin’s market structure often features liquidity sweeps, stop-loss hunting and cascades of liquidations, particularly when leverage is high, and while these actions may not constitute outright manipulation, they still allow wealthy participants to create favorable entry and exit conditions.

Recent price movements support this interpretation. Following a wave of liquidations and panic-selling, Bitcoin fell into the mid-$70,000 range, indicating that leveraged positions were flushed out rather than that a single actor was forcing price movement. When leverage declines, markets frequently overshoot in both directions.

news.bitcoin.com

news.bitcoin.com

bitcoinworld.co.in

bitcoinworld.co.in