Bitcoin’s latest drop wasn’t loud or dramatic — it was clinical, deliberate, and ruthless.

Bitcoin Drops After Key Price Floor Cracks Beneath the Market

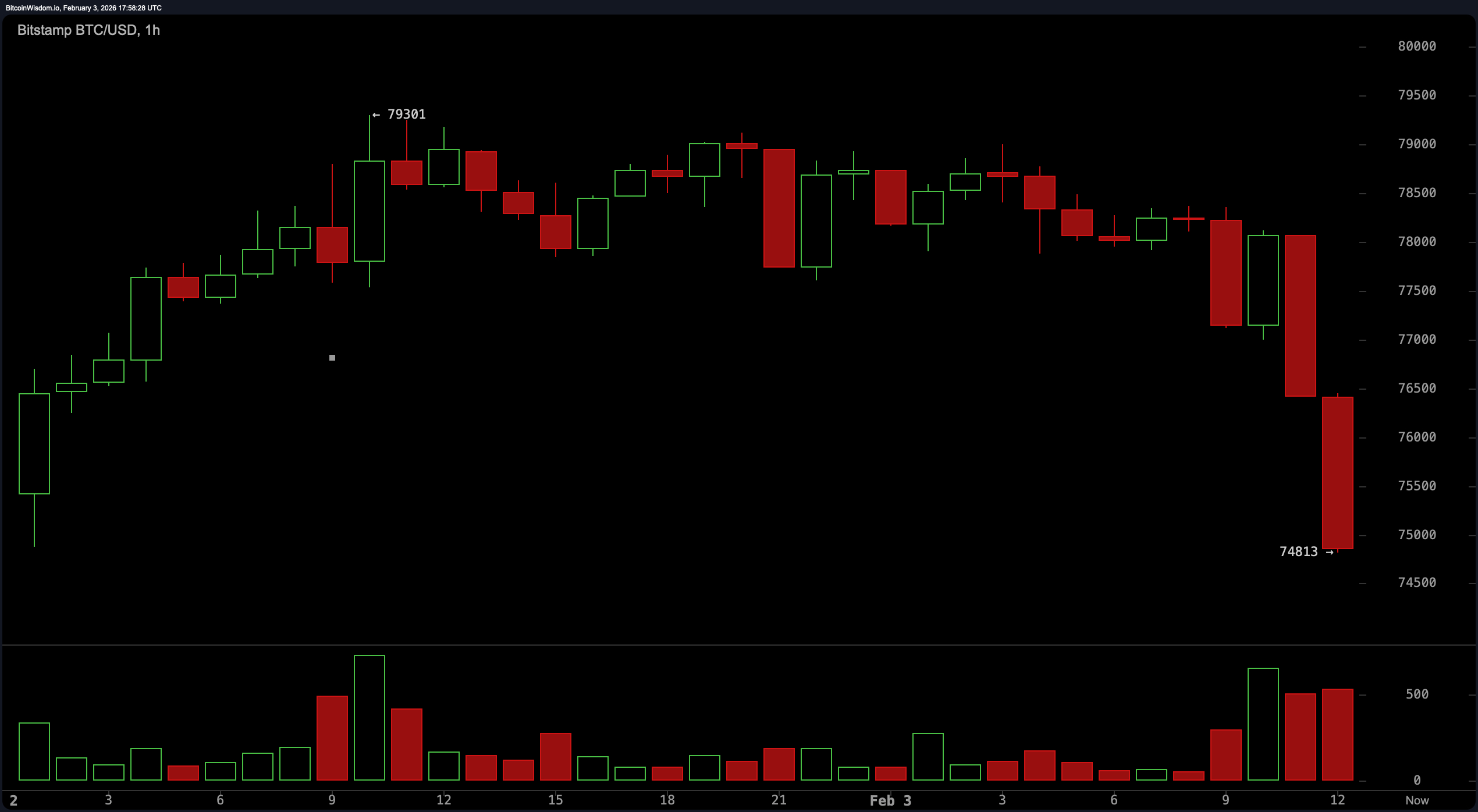

Charts show how the slide was set up long before the final flush. Bitcoin topped near $79,300 and spent hours carving out lower highs while momentum quietly faded.

Attempts to reclaim the $78,500 to $79,000 zone have stalled repeatedly, with sellers stepping in faster each time. By early afternoon Feb. 3, the structure cracked, producing a sequence of large red candles that drove price sharply lower. Volume expanded into the decline, confirming that the move was not an accident or a thin-market wobble.

Once $77,500 failed, price floors below offered little friction until the mid-$75,000 range, turning prior support into an overhead problem rather than a safety net. Volume spikes appeared on down candles, which was sell pressure, not rebounds, reinforcing the imbalance.

Coinglass liquidation stats show $347.13 million wiped out across the last 24 hours with $238.27 million being longs. ETH and $BTC are leading the liquidations with bitcoin seeing $82 million in longs wiped and ethereum long positions losing $78.82 million.

The absence of a meaningful reaction at $75,000 added to the unease, suggesting traders were more interested in exiting than defending levels. The plunge ends quietly near $75,100, not with panic, but with something colder — acceptance.

FAQ 📉🐻⬇️

- Why did bitcoin drop today?Short-term charts show repeated failures near $79,000 followed by heavy selling and expanding volume.

- What price level did bitcoin fall to? bitcoin dropped from the $78,000–$79,000 range to roughly $75,100.

- Which charts confirm the move?The 1-hour, 5-minute, and 3-minute charts all show lower highs, breakdowns, and strong downside momentum.

- Is this move backed by volume?Yes, volume increased during the selloff, especially on the fastest time frames, confirming selling pressure.

coindoo.com

coindoo.com

coincodex.com

coincodex.com

bitcoinmagazine.com

bitcoinmagazine.com