The weekend wasn't kind to risk assets. Bitcoin crashed below $80,000 on Saturday, touching lows near $74,500 before staging a modest rebound to its current level around $78,500. This marks the fourth consecutive monthly decline for $BTC—the longest losing streak since the 2018 crypto winter.

The catalyst? A perfect storm of macro chaos. President Donald Trump's tariff threats have traders running for the exits, with over $2.2 billion in leveraged crypto positions liquidated in a single 24-hour window on January 30, with bulls bearing the brunt of that forced selling.

It’s no wonder why the Fear & Greed Index has plunged to 14 today—”extreme fear” territory. Traditional safe havens offered no shelter. Gold crashed 12% from record highs above $5,500 to below $5,000 in its biggest single-day drop since the 1980s. Silver plunged 30%—its worst day since March 1980. Even the traditional "store of value" assets got sold off alongside crypto as investors scrambled for dollar safety.

But today, candlesticks are green. Almost all the coins in the top 100 by market cap are bouncing. Are we seeing the light at the end of the tunnel or is this just a bunch of bulls trying to breathe before getting drowned? Here’s what the charts say:

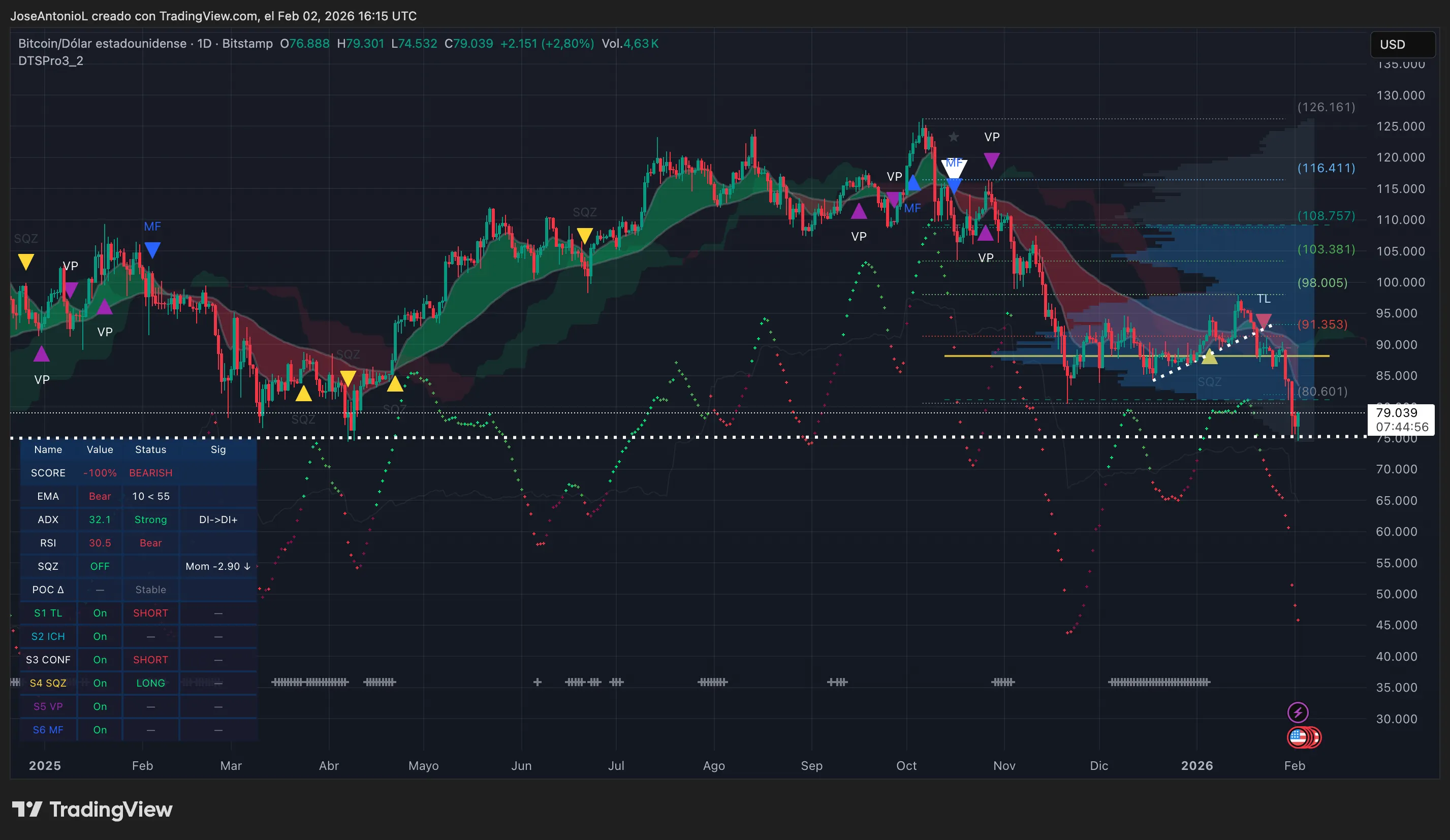

Bitcoin ($BTC) price: Bearish, but oversold

Bitcoin traders today woke up with the coin up around 1% in the last 24 hours, with $BTC trading at $78,866. But let's be clear about what the charts are telling us: The indicators are brutally bearish, even though the price just hit a level where bounces could occur.

On the daily chart, it’s hard to see a strong bullish signal. The Exponential Moving Averages, or EMAs, are firmly in bear mode. EMAs help traders identify trends by taking the average price of an asset over the short, medium, and long term. At the moment, for Bitcoin, the shorter term 50-day EMA is trading below the longer term 200-day average, confirming the downtrend. This setup tells traders that short-term momentum remains decisively negative.

The Average Directional Index, or ADX, reads 32.1—well above the 25 threshold that confirms a strong trend. ADX measures trend strength, regardless of direction, on a scale from 0 to 100. When ADX prints above 25, it signals conviction in the market's direction. Right now, that conviction is pointed south.

Here's the one hopium indicator: the Relative Strength Index, or RSI, has fallen to 30, officially entering oversold territory. RSI measures momentum on a scale from 0 to 100, with readings below 30 indicating that selling may be exhausted. Historically, oversold RSI readings have preceded relief rallies—though they don't guarantee immediate reversals.

On the four-hour chart, Bitcoin is showing early signs of attempting a bounce. After touching $74,500—around the $74K support area we identified in our last analysis—price recovered to test the EMA cloud. However, the current four-hour candle is red again, meaning the attempt to reclaim short-term moving average support is struggling. Despite the bounce, that chart also looks bearish, with ADX at a screaming 57.4—indicating extremely strong trend momentum.

That said, it is easier to see a relief bounce after a heavy dip in the short term, just not enough to consider a trend reversal.

Most of the top 100 cryptocurrencies are bouncing alongside Bitcoin today—except for outliers like XMR and PUMP—but the market-wide recovery feels tentative. “Extreme fear” still dominates sentiment.

On Myriad, a prediction market owned by Decrypt's parent company, traders have turned decisively bearish. Traders are now setting the odds at a commanding 67.9% that Bitcoin sooner falls to $69K than pumps all the way back up to $100K. Just two weeks ago, those odds were reversed, with 85% odds favoring the bulls.

That's a stunning sentiment reversal and a nice portrait of the market sentiment right now.

The $74K zone we flagged proved its importance over the weekend—price bounced almost exactly where we expected. If Bitcoin can hold this floor on any retest, the path to consolidation between $78K-$85K remains open. A break below $74K, however, opens the door to the next major support zone near $69K, which would represent a roughly 45% correction from October's $126K peak, and an unexpected win for contrarians in prediction markets.

On the upside, the $80.6K level (near the 200-day moving average zone) represents immediate resistance. A daily close above this level would be the first sign that bears are losing control. Beyond that, $91.3K marks the zone where the EMA cloud and previous support-turned-resistance converge—a formidable barrier for any recovery attempt.

Key levels to watch:

- Resistance:

- $80,600 (immediate),

- $91,350 (strong EMA zone),

- $98,000 (structural)

- Support:

- $74,500 (recent low),

- $69,000 (psychological/prediction market target)

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.