Market data indicates that the Bitcoin valuation against gold currently sits much lower than it was during the Bitcoin bottom of 2015.

For context, Bitcoin’s 2015 bottom was $152, a floor price attained in January 2015 as the bear market engulfed the scene. During this period, the Bitcoin pair against gold ($BTC/XAU) stood at 0.13, with the weekly Relative Strength Index (RSI) reaching a low of 27.62. This represented one of Bitcoin’s most undervalued moments, and a sharp upsurge emerged shortly after.

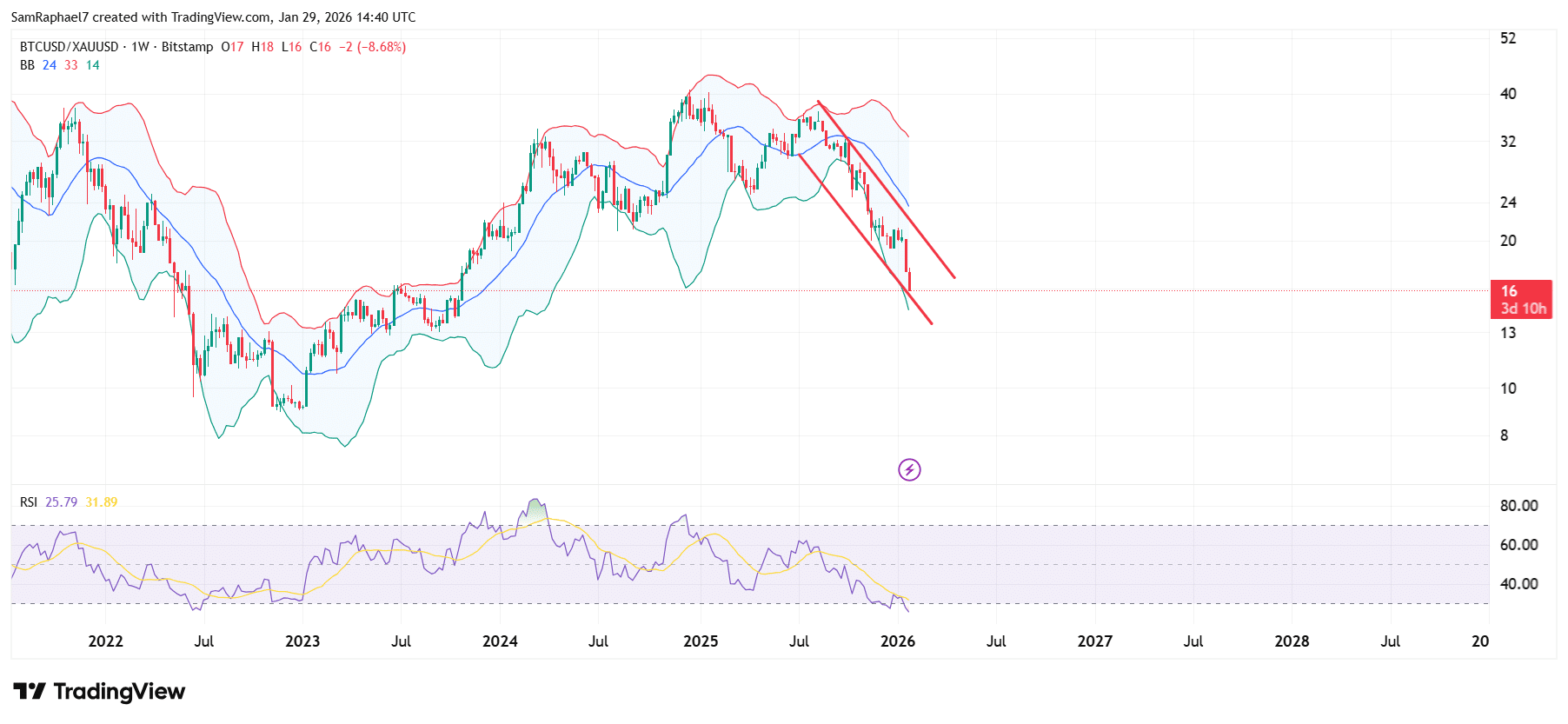

However, today, while $BTC trades above $87,000 and the $BTC/XAU ratio currently stands at 16, the RSI on the weekly chart against gold sits at 25.80, suggesting $BTC is more undervalued against gold now than in 2015. Additionally, the $BTC/XAU Z-Score sits at a lower value today than in January 2015, confirming this structure.

Key Points

- Bitcoin has continued to decline against gold, with the $BTC/XAU pair dropping from 29 in Q4 2025 to the current figure of 16.

- This comes as Bitcoin witnesses consistent declines since reaching the $126,000 peak in October 2025, while gold sees new all-time highs.

- Amid the ongoing trend, the RSI on the $BTC/XAU weekly chart has dropped to 25.80, representing the lowest reading in 15 years.

- This reading confirms that $BTC is more undervalued against gold today than it was during the 2015 bottom, when the reading was 27.62.

- Market data also shows that the $BTC/XAU Z-Score is lower than it was during the 2015 bottom, confirming this extreme undervaluation.

Bitcoin Has Continued to Slip Against Gold

Michaël van de Poppe, a crypto market veteran, highlighted this during one of his recent analyses, as Bitcoin continues to slide against gold. For context, $BTC has underperformed against gold since August 2025, when it collapsed from the peak of 37 ounces of gold.

A recovery effort took it to 29 ounces in Q4 2025, but the downturn persisted shortly after, and now the $BTC/XAU pair currently sits at 16 after months of consistent declines. This comes as $BTC drops to $87,274 from the $126,000 peak in October 2025, while gold rises to new all-time highs around $5,500.

Bitcoin Now Extremely Undervalued Against Gold

Amid this downturn, Bitcoin is now extremely undervalued against gold, according to van de Poppe. Notably, the analyst cited the $BTC/XAU Z-Score, which measures whether $BTC is undervalued or overvalued against gold relative to its fair value.

Data shows that the Z-Score has dropped closer to the -2 level, the lowest it has been since the metric was established. Interestingly, the current $BTC/XAU Z-Score reading is lower than the reading that emerged when $BTC dropped to its bottom price of 2015, which van de Poppe suggested was around $160. At the time, the $BTC/XAU pair stood at 0.13.

This confirms that, while $BTC currently changes hands at a much higher price of $87,000, and the $BTC/XAU pair stands at 16, Bitcoin is currently more undervalued against gold than it was in 2015. Notably, such low Z-Score readings typically point to an imminent trend reversal to the upside.

BTCXAU RSI Confirms the Undervaluation

Moreover, the $BTC/XAU weekly RSI also confirms the undervaluation. Specifically, during the Bitcoin bottom of 2015, the weekly RSI for Bitcoin against gold stood at 27.62, representing the lowest reading in years. This marked extreme Bitcoin undervaluation against gold.

Today, the weekly RSI has dropped to a lower reading of 25.80, indicating that Bitcoin is more undervalued against gold in the current cycle than it was when it reached the 2015 bottom. In addition, the 25.80 reading represents the lowest figure for the weekly RSI in 15 years.

Is a Reversal Coming?

According to van de Poppe, if he had another opportunity to buy Bitcoin at the 2015 bottom, he would have taken it. This is largely due to $BTC’s valuation at the time. With Bitcoin now trading at a much lower valuation than gold today, the analyst may be suggesting taking this opportunity in the current cycle. However, this represents his personal conviction.

He pointed out that after the 2015 bottom, Bitcoin saw a 100x rally. Market data corroborates this claim. Notably, following the drop to $160, $BTC soared to a peak of $19,666 by December 2017, representing a 122x increase within two years. Whether another recovery push could emerge from here remains uncertain.

decrypt.co

decrypt.co

bitcoinmagazine.com

bitcoinmagazine.com

u.today

u.today