Bitcoin is back breaking through $90,000, but today, the focus is on $62,000. And it is not because the price of the leading cryptocurrency might drop there. The reason is that one of the most important on-chain metrics has resurfaced for the first time in months.

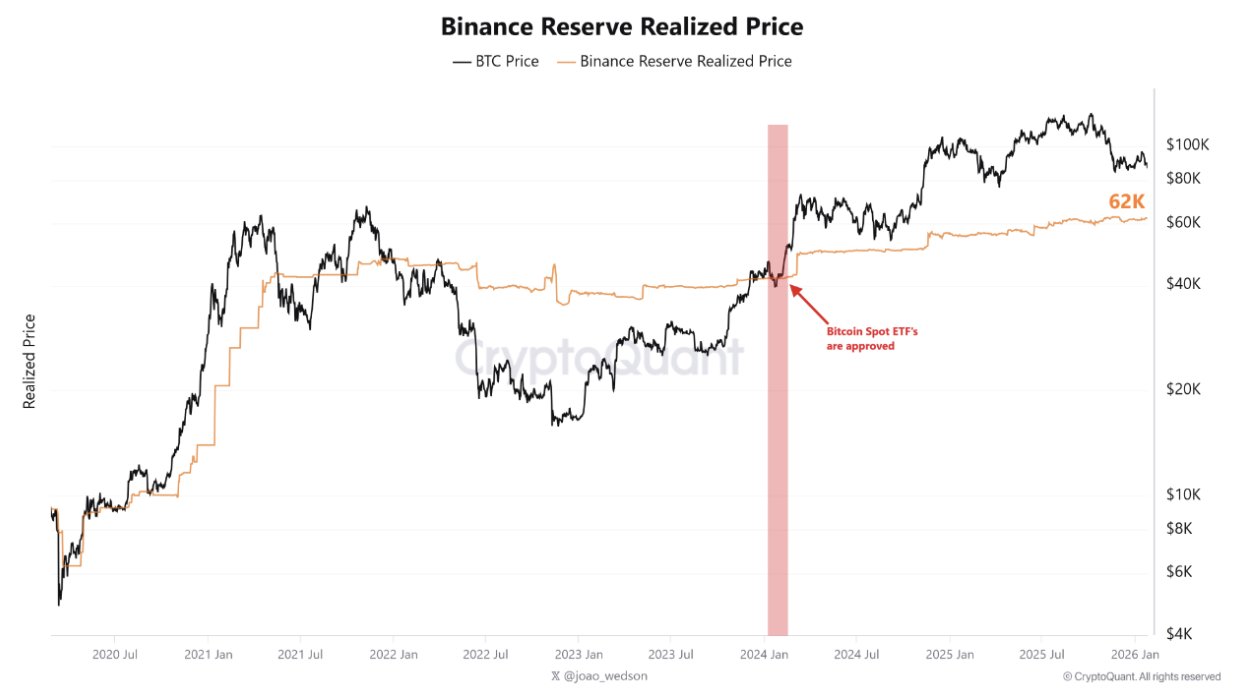

CryptoQuant analysts are talking about the Binance Reserve Realized Price this morning. For those not in the know, it is the figure that shows the average cost basis of Bitcoin held on Binance wallets.

This number has not changed since the spot ETF approvals in early 2024. Over time, it has gone up to $62,000 after some big investments from all kinds of institutions last year, but then it just disappeared from the market conversation as $BTC never came close to reaching that level again.

That silence was broken today. With Bitcoin up almost 4% today and flirting with local highs, it is no surprise that this key level has reappeared in the analytics. The Binance threshold has always been a bit of a support level, acting as the bottom during bear phases in both 2022 and early 2023, when it was at $42,000.

But in this cycle, the number changed, and the rules might have too.

Crypto winter talk is premature, for now

Bitcoin has never tested the $62,000 reserve cost since it emerged as the new post-ETF floor. All dips stopped short, but the metric has not moved. It remains untriggered and unvalidated but is now once again on the radar as a potential inflection point if the "crypto winter" continues.

This is not a Bitcoin price prediction of collapse. Rather, the market finally recognized a key point that has been hidden by all the price appreciation of the last two years. But keep in mind that the market loves testing the nerves of its participants and usually does it at such points as what $62,000 $BTC represents.

coingape.com

coingape.com

thecryptobasic.com

thecryptobasic.com

bitcoinmagazine.com

bitcoinmagazine.com