Early Wednesday, Bitcoin triggered a leveraged massacre, climbing just 0.88% — but breaching $90,000 in the process — and setting off one of the most asymmetric liquidation events of 2026.

According to CoinGlass, $4,640 in longs were liquidated for every $6.63 million in shorts, creating an hourly imbalance of 142,580%.

On the surface, the price action looked normal, with $BTC rising from $89,200 to a local peak of $90,170 before pulling back. Under the hood, however, this minor upside cut through a wall of overleveraged short positions, most likely clustered just above the $90,000 psychological barrier.

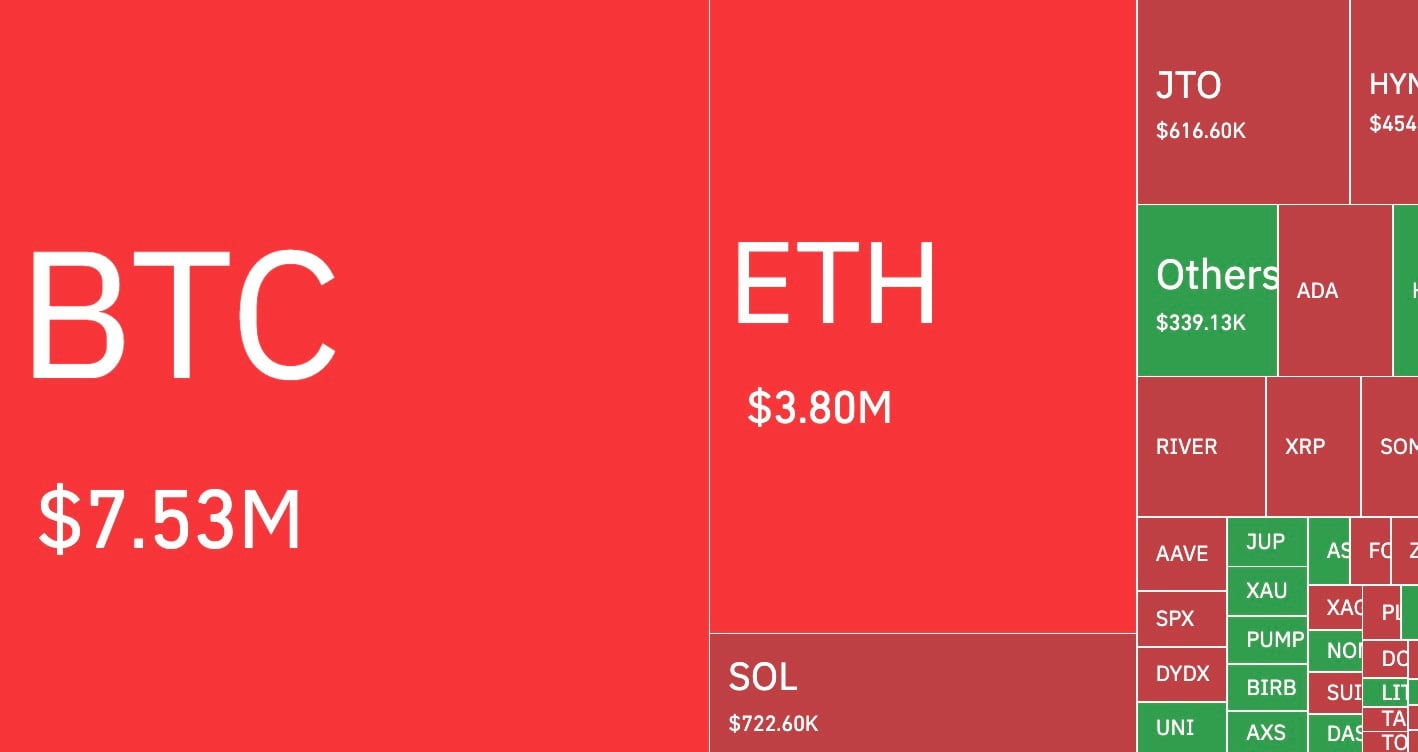

The largest liquidation order occurred on Hyperliquid — a $13.25 million $BTC/USD short that was instantly torched as the price increased. In total, $7.53 million in $BTC liquidations were recorded for the hour, with 98.5% targeting shorts. ETH, SOL and JTO followed behind in losses, but Bitcoin's asymmetric imbalance is unmatched in scale.

Bitcoin bears in danger

Over the last 24 hours, total crypto market liquidations reached $310.5 million, of which $244.85 million were shorts, mirroring the same long-short imbalance unveiled in Bitcoin’s hourly metrics.

The violent imbalance suggests that algorithm-driven short exposure was concentrated at $90,000, most likely in anticipation of another failed breakout. One thing that stood out is that Bitcoin's mechanical push forced a cascade, which is now visible as a cluster of green one-minute candles followed by chop. The price is near $89,950 per $BTC at press time.

Unless the $90,000 ceiling becomes resistance again, another wave of short-squeeze risk will likely follow.

coingape.com

coingape.com

thecryptobasic.com

thecryptobasic.com

bitcoinmagazine.com

bitcoinmagazine.com