Bitcoin largest holders are steadily increasing their exposure, even as prices weaken and global uncertainty intensifies.

Key Points

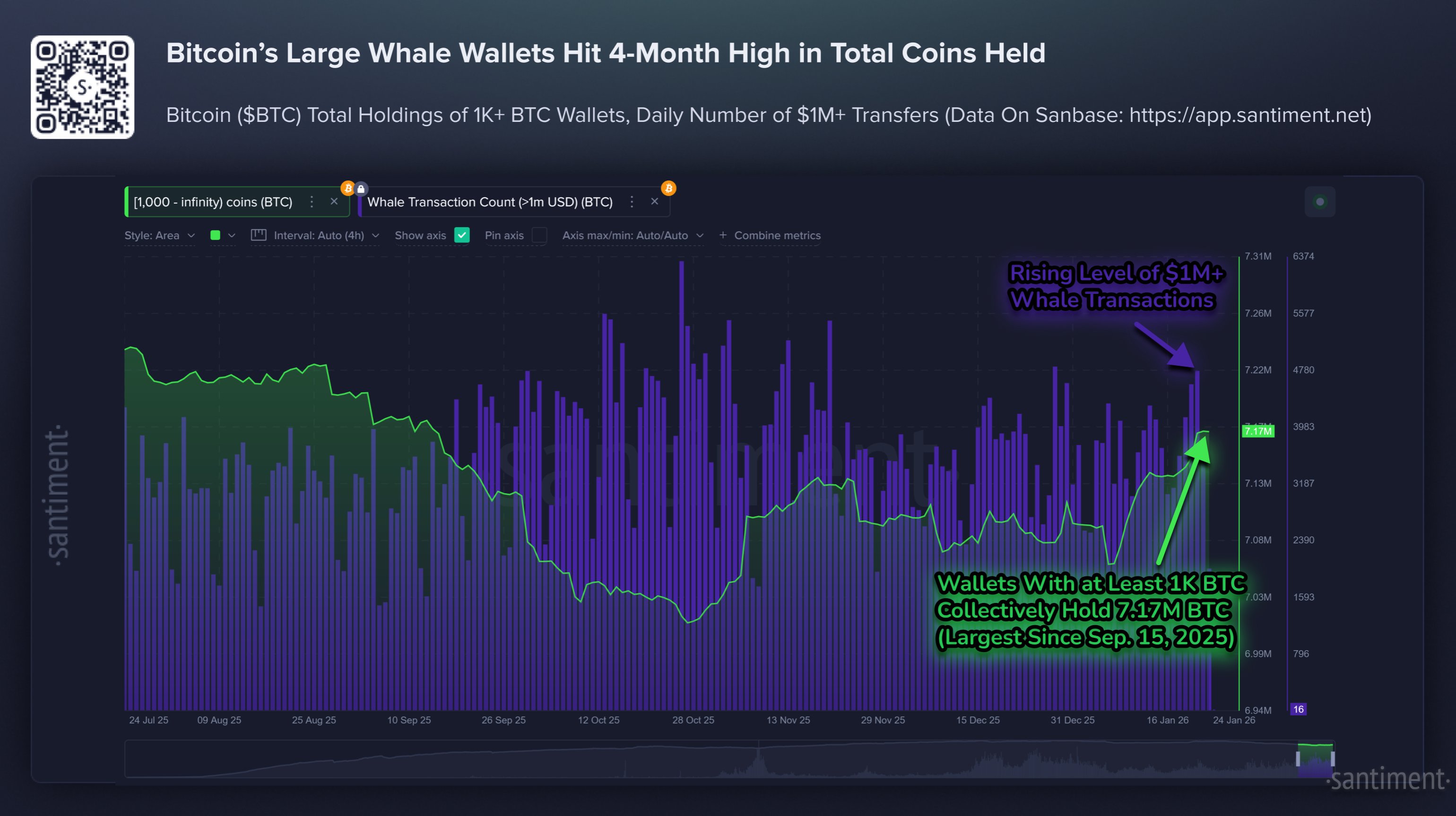

- Wallets holding at least 1,000 BTC added 104,340 BTC in recent weeks.

- Total whale-held supply reached 7.17 million BTC

- Whale-held supply is at its highest level since September 15, 2025

- Bitcoin transactions worth $1 million or more reached a two-month high

- Mid-sized wallets accumulated approximately $3.21 billion in BTC between January 10 and January 19

Bitcoin Whale Holdings Hit Highest Level Since September

According to blockchain analytics firm Santiment, wallets holding at least 1,000 Bitcoin have significantly expanded their balances in recent weeks. Specifically, these large holders added 104,340 BTC, pushing total whale-held supply to 7.17 million BTC—the highest level since September 15, 2025.

The accumulation suggests that major investors are positioning for longer-term opportunities rather than reacting to near-term price volatility.

Supporting this view, Santiment reports a rise in institutional-sized network activity. Daily Bitcoin transactions valued at $1 million or more have climbed to a two-month high, signaling renewed engagement from high-value participants.

Accumulation Deepens as Retail Participation Fades

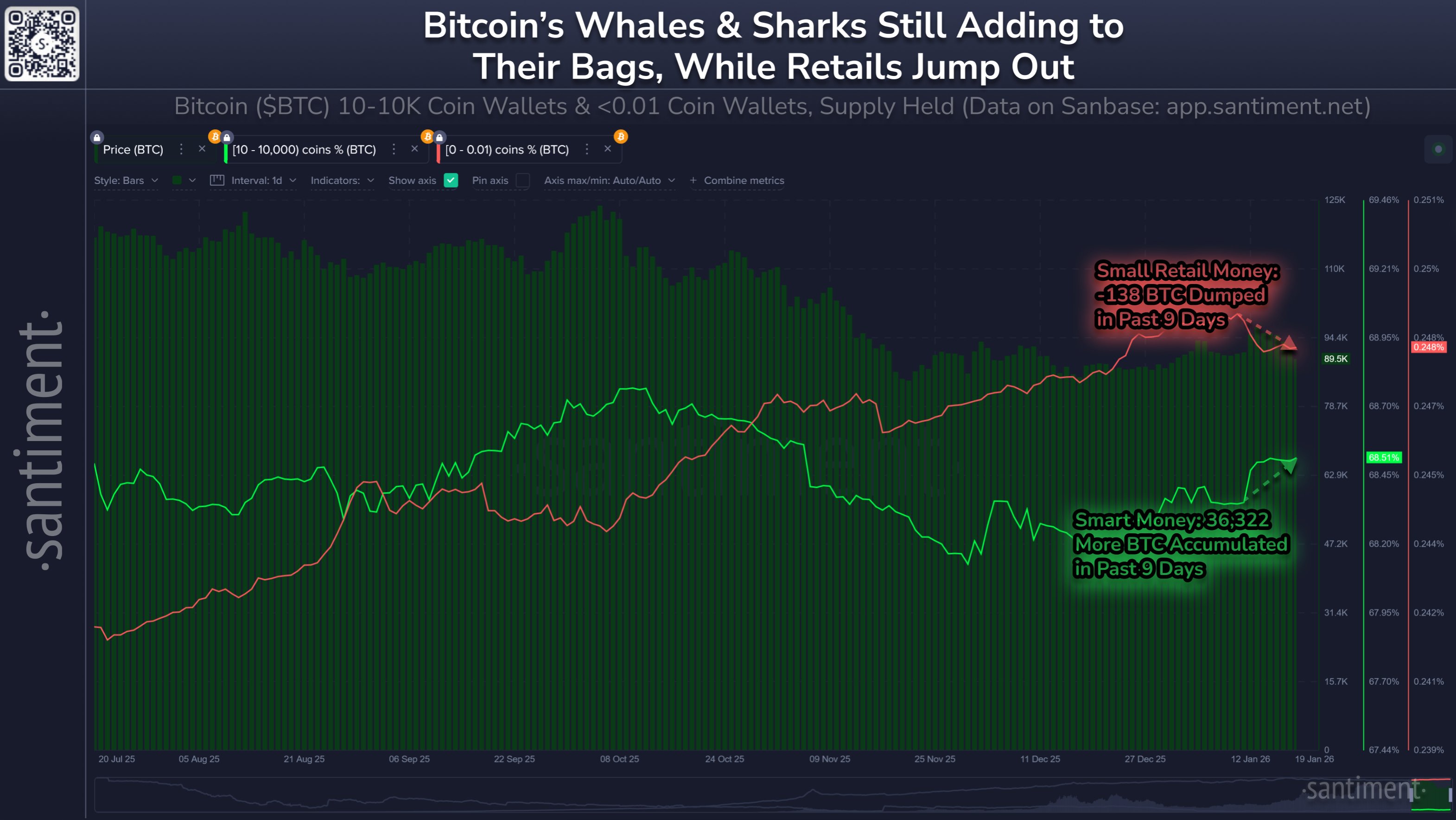

The trend extends beyond the largest wallets. Mid-sized holders, wallets containing between 10 and 10,000 BTC and often labeled “smart money”, have also increased their exposure. Between January 10 and January 19, this group accumulated approximately $3.21 billion in Bitcoin.

In contrast, smaller investors behaved differently. In the same timeframe, retail wallets with under 0.01 BTC offloaded a total of 132 Bitcoins, worth roughly $11.66 million.

Santiment highlighted the divergence, noting that markets often stabilize when larger holders accumulate while retail participation declines. Santiment added that such patterns have historically supported long-term bullish setups, even when external risks remain elevated.

Price Weakness Persists Despite On-Chain Strength

Despite constructive on-chain signals, Bitcoin’s price performance has remained under pressure. Over the weekend, the cryptocurrency slipped below the $88,000 level amid continued selling.

At the time of writing, Bitcoin was trading at $87,736, down 0.5% over the past 24 hours and 5.4% over the past week. This disconnect between price action and accumulation trends highlights the growing influence of macroeconomic and geopolitical forces beyond the crypto market.

Global Tensions Weigh on Risk Sentiment

Geopolitical uncertainty has intensified, weighing on investor confidence across risk assets. Concerns have risen over the possibility of U.S. military action against Iran later this year, following reports that Donald Trump deployed warships to the region.

Consequently, market participants fear that any escalation could disrupt energy markets and drive oil prices higher. Prediction market Polymarket reflects these concerns, showing the probability of a U.S. strike on Iran by June climbing to 66%, heightening worries about broader regional instability.

Meanwhile, tensions around North American trade policy have grown after Trump threatened Canada with new tariffs following its recent automotive trade agreement with China. Under the deal, China can export up to 49,000 vehicles annually to Canada at a 6% tariff, sharply reduced from the previous 100%.

The agreement will benefit Chinese automakers such as BYD and Nio. However, it has added to market unease as domestic political risks in the U.S. continue to mount.

Shutdown Fears Rise Ahead of Fed Decision

Political uncertainty within the United States has emerged as another key risk. Polymarket data shows the probability of a U.S. government shutdown has climbed above 70%. This followed protests linked to the fatal shooting of an American by a Border Patrol agent.

Such a shutdown could disrupt economic momentum and inject further volatility into financial markets.

These concerns are unfolding just ahead of the next Federal Reserve interest rate decision. Economists expect the central bank to keep rates unchanged, within the 3.0% to 3.5% range.

Taken together, the data paints a complex picture. On-chain metrics from Santiment indicate growing confidence among large and mid-sized Bitcoin holders. Meanwhile, falling prices and escalating global risks continue to weigh on broader sentiment.

As Bitcoin navigates this environment, investors are left balancing strong accumulation signals against fragile macroeconomic conditions. Ultimately, whether whale activity can offset broader uncertainty remains to be seen, but the divergence between on-chain strength and price action is becoming increasingly pronounced.

coindesk.com

coindesk.com