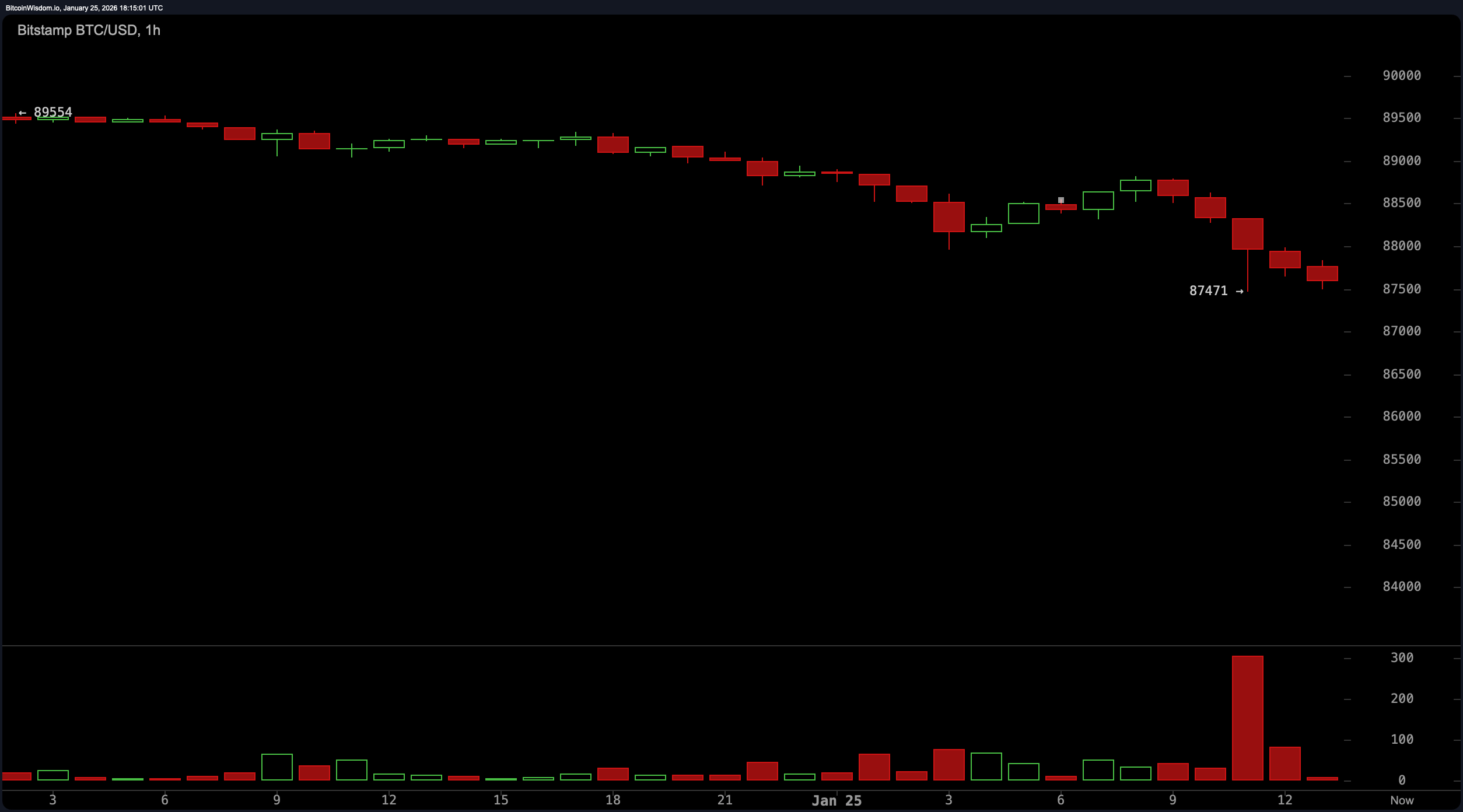

The price of bitcoin slid on Sunday, dipping below the $88,000 range and tagging a low of $87,471 per unit. Around noon (EST), the top crypto settled into a clean intraday slide, defined by a tidy staircase of lower highs and lower lows.

Thin Liquidity, Heavy Swings: Bitcoin Drops Under $88K as Liquidations Pile Up

The crypto economy is now 1.75% lighter than it was yesterday, with total valuation clocking in at $2.96 trillion. Selling picked up steam once bitcoin fell through the $88,250 area, a level that had offered brief footing earlier in the morning.

Bitcoin is off 1.7% on the day and down 7.6% over the past week against the U.S. dollar. Even so, year to date, BTC has gone nowhere fast and is up 0.30% since Jan. 1. After slipping under $88,000, downside momentum picked up pace, with several sharp drops pointing to sellers firmly in the driver’s seat rather than a lazy, low- volume fade.

Trade volume remains on the thin side at $25.11 billion, a setup that can invite sudden jolts. Volume plays a key role in Sunday’s setup, as the most pronounced burst lined up with the push into session lows. That pattern hints at forceful distribution and potential short-term seller exhaustion, often followed by either a modest bounce or a cooling-off phase.

For now, though, that optimism stays on ice. BTC touched an intraday low of $87,471 and, as of 1 p.m. EST, the leading crypto asset is hovering just above the $87,700 range. Coinglass data shows 149,139 traders were liquidated across the broader crypto derivatives market, with $343.9 million erased in the process.

About $78.36 million of those liquidations came from BTC longs, while $90 million were tied to ETH longs. Many have linked bitcoin’s slide to geopolitical and macro jitters, along with comments from U.S. President Donald Trump. Over the weekend, he spoke about Canada, saying the country is “systematically destroying itself.”

Still, bitcoin (BTC) falling on Sunday—even as markets anticipate a Strategy purchase announcement on Monday—has become a familiar pattern, repeating itself week after week. For now, the tape tells a familiar story: thin liquidity, jumpy traders, and sellers pressing their advantage.

Until volume firms up or a clear catalyst breaks the rhythm, bitcoin looks content to churn rather than charge. As recent Sundays have shown, optimism alone hasn’t been enough to change that script.

FAQ ❓

- Why did bitcoin drop below $88,000? Bitcoin fell as selling pressure increased after losing short-term support near $88,250 amid thin weekend liquidity.

- How much was liquidated during the sell-off?Roughly $269.81 million in crypto derivatives positions were liquidated, impacting nearly 140,000 traders.

- What role did trading volume play in the decline?Low volume around $25.11 billion amplified price swings and intensified the move into session lows.

- Is bitcoin’s Sunday decline becoming a trend?Recent weeks show bitcoin has repeatedly weakened on Sundays, even when positive catalysts were anticipated.

cointelegraph.com

cointelegraph.com