A recent analysis from Bloomberg strategist Mike McGlone shows Bitcoin has now lost its volatility premium against silver without breaking below its long-term support.

Notably, Bitcoin has remained under selling pressure since reaching its all-time high of $126,000 in early October 2025. From this peak, BTC sold off aggressively and slid to a cycle low of $80,537 in late November, representing a 36% decline in less than two months.

Bitcoin Stalls While Silver Gains

A rebound followed in early December, pushing the price briefly above $90,000, but the recovery was fragile. Each subsequent attempt to climb higher has stalled within the $90,000 to $94,000 resistance zone, forcing Bitcoin back into the upper $80,000 range. BTC now trades around $87,990.

Meanwhile, silver (XAG) has moved in the opposite direction within the same period. From October 2025, the metal sustained a steady uptrend while Bitcoin declined. That rally culminated on Dec. 29, 2025, when silver surged to a new all-time high of $84.

However, the strong selling pressure emerged immediately at this level, triggering a sharp 9% single-day decline. Silver now trades near $76, confirming that its momentum cooled just as Bitcoin approached technical support.

Bitcoin Loses Volatility Premium Against Silver

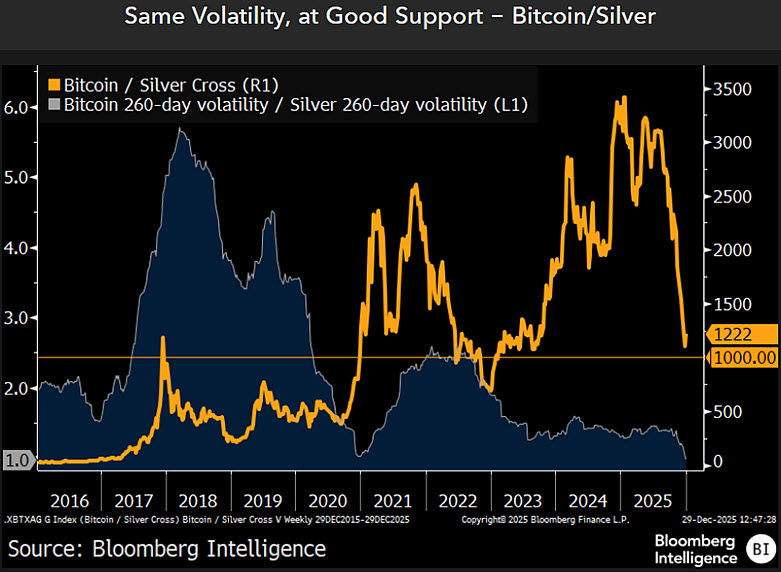

Bloomberg Intelligence strategist Mike McGlone recently highlighted this divergence in performance in his latest analysis of the Bitcoin-silver relationship.

Notably, his accompanying chart calls attention to the Bitcoin-to-silver ratio and the 260-day volatility of both assets. By Dec. 29, 2025, Bitcoin’s volatility fell to the same level as silver’s, with the ratio dropping to 1.0 for the first time ever.

For context, in earlier cycles, Bitcoin always carried much higher volatility. The ratio climbed above 5.0 in 2017 and peaked near 2.5 in 2021. Importantly, the recent decline to parity with silver shows that Bitcoin has attained some level of maturity and no longer behaves like an extreme outlier.

Bitcoin-to-silver Ratio Maintains Long-Term Support

At the same time, the Bitcoin-to-silver price ratio has fallen toward a major long-term support level near 1,000x. This came as silver soared to the $84 peak on Dec. 29, while BTC stalled.

Notably, this 1,000x level has acted as a floor in past cycles, including 2018/2019 and again in 2022. Specifically, each time the ratio approached this zone, selling pressure on Bitcoin eased and longer-term recoveries followed.

Importantly, those turning points emerged while volatility compressed, not when it spiked. McGlone highlighted this metric to show that Bitcoin now sits at support while risk conditions calm. Notably, this combination has historically led to trend reversals.

Silver’s inability to cross $84 helped BTC maintain the 1,000x support and left both assets near major technical levels rather than in runaway trends. Essentially, if Bitcoin regains even a modest volatility edge from here, the price ratio could expand again, allowing Bitcoin to outperform silver without needing extreme speculation.

Metals Could Outperform Crypto in 2026

Meanwhile, in a secondary analysis, McGlone compared the Bloomberg All Metals Total Return Subindex with the Bloomberg Galaxy Crypto Index. He confirmed that metals are reclaiming strength in 2025, with the ratio rising from roughly 13 to about 28 by year-end.

This move occurred as the S&P 500 120-day volatility stayed above the ultra-low levels seen in 2021. McGlone argued that this environment tends to favor metals over high-risk crypto assets, especially when volatility stays elevated but controlled. He expects precious metals to continue outperforming crypto assets going into 2026.

Bitcoin’s Near-Term Outlook

For now, Bitcoin’s near-term outlook remains uncertain amid the strong resistance above $90,000. Notably, market analyst Lennaert Snyder recently called attention to $86,900 as key support, noting that Bitcoin recently swept liquidity there and now tries to hold the level.

$BTC is trying to hold ~$86,900 support.

As mentioned in yesterdays analysis, sweeping into ~$86,900 liquidity could be interesting for longs after reversals.

Bitcoin did the sweep, and as you can see, is trying to hold.

Before entering longs, I'd prefer to see some… pic.twitter.com/ZKCW0T6M1x

— Lennaert Snyder (@LennaertSnyder) December 30, 2025

He sees stronger long opportunities closer to $85,000 or slightly lower and watches $90,600 as a critical line. A failed move above it could invite shorts, while a clean reclaim would signal continuation.

Meanwhile, Michaël van de Poppe highlighted the repeated rejections above $88,000, noting that Bitcoin has spent several weeks moving sideways. He believes this extended range increases the odds of a sharp move once the market breaks free.

coinedition.com

coinedition.com

u.today

u.today

coingape.com + 1 more

coingape.com + 1 more