As 2025 draws to a close, industry stakeholders, including Ripple CEO Brad Garlinghouse, have shared their predictions for Bitcoin price trajectory in 2026.

In its latest analysis, popular crypto media Wu Blockchain highlights a growing credibility gap in Bitcoin price forecasting.

According to the report, institutional predictions for 2025 collectively failed to anticipate how the market evolved this year. It emphasized that forecasts missed both the scale of Bitcoin’s price moves and the timing, volatility, and depth of its drawdowns. This miss helped erode market confidence in target-price narratives.

Notably, investors are increasingly treating price forecasts as scenario analysis rather than promise-like guidance. Rather than anchoring expectations to a single number, market participants are now interested in underlying assumptions, macro conditions, and structural drivers.

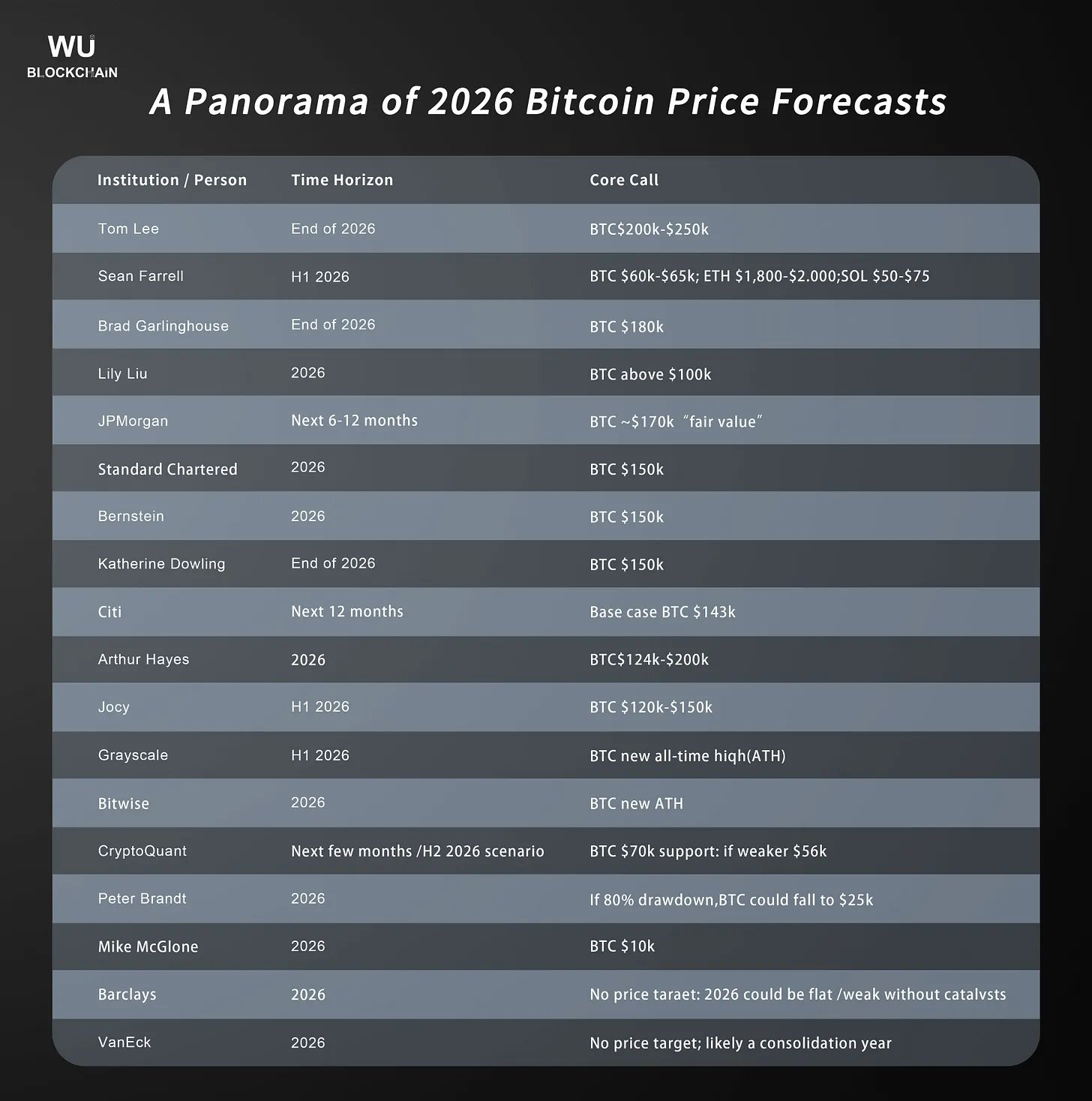

2026 Bitcoin Price Forecasts

Despite fading confidence in precise Bitcoin price targets, industry leaders and major institutions continue to outline clear frameworks for BTC’s 2026 outlook. Overall, the report divides these expectations into two broad camps: bullish and bearish.

Bullish Predictions

On the bullish side, forecasts largely cluster between $150,000 and $250,000, implying potential gains of 72% to 186% from Bitcoin’s current price of $87,279.

Prominent advocates of this view include Ripple CEO Brad Garlinghouse ($180,000), Fundstrat’s Tom Lee ($200,000–$250,000), BitMEX co-founder Arthur Hayes ($200,000), and BSTR President Katherine Dowling ($150,000).

In addition, major financial institutions such as Standard Chartered, Bernstein, and JPMorgan share similarly optimistic projections, with targets set at $150,000, $150,000, and $170,000, respectively.

Meanwhile, asset managers Grayscale and Bitwise did not mention explicit targets but still expect Bitcoin to set a new all-time high next year.

Notably, several common catalysts underpin these bullish forecasts. These experts point to improving regulatory clarity, rising institutional allocations, deeper penetration of spot Bitcoin ETFs, and a potential shift toward friendlier monetary policies as key drivers of further upside.

Bearish Outlook

By contrast, the bearish camp warns that Bitcoin could face significant downside pressure in 2026, with prices potentially falling well below $100,000.

For instance, CryptoQuant argues that Bitcoin may already be entering a bear phase. The analytics firm identifies $70,000 as a key downside level and suggests a deeper decline toward $56,000 could unfold if demand continues to weaken.

Similarly, veteran trader Peter Brandt, drawing on long-term historical patterns, contends that Bitcoin’s exponential growth has decayed, increasing the risk of a much sharper correction toward $25,000.

Taking the most extreme stance, Bloomberg Intelligence strategist Mike McGlone warns that post-inflation, deflationary macro forces could trigger a severe mean-reversion cycle, potentially dragging Bitcoin down to $10,000.

Meanwhile, institutions such as VanEck and Barclays avoid issuing specific price targets altogether. Nonetheless, they caution that 2026 may be a consolidation or transitional year for Bitcoin rather than a period of explosive growth.

cryptoticker.io

cryptoticker.io