Bitcoin long-term holders have flipped from distribution to accumulation for the first time since July, raising questions about a possible price recovery.

Notably, after Bitcoin reached the $126,000 peak in early October, it slipped into a period of sharp price declines that have pushed the price below the $90,000 mark. With BTC currently trading for $87,932, the asset has dropped more than 30% from the October peak amid heavy selling from long-term holders.

Bitcoin LTHs Flip to Accumulation

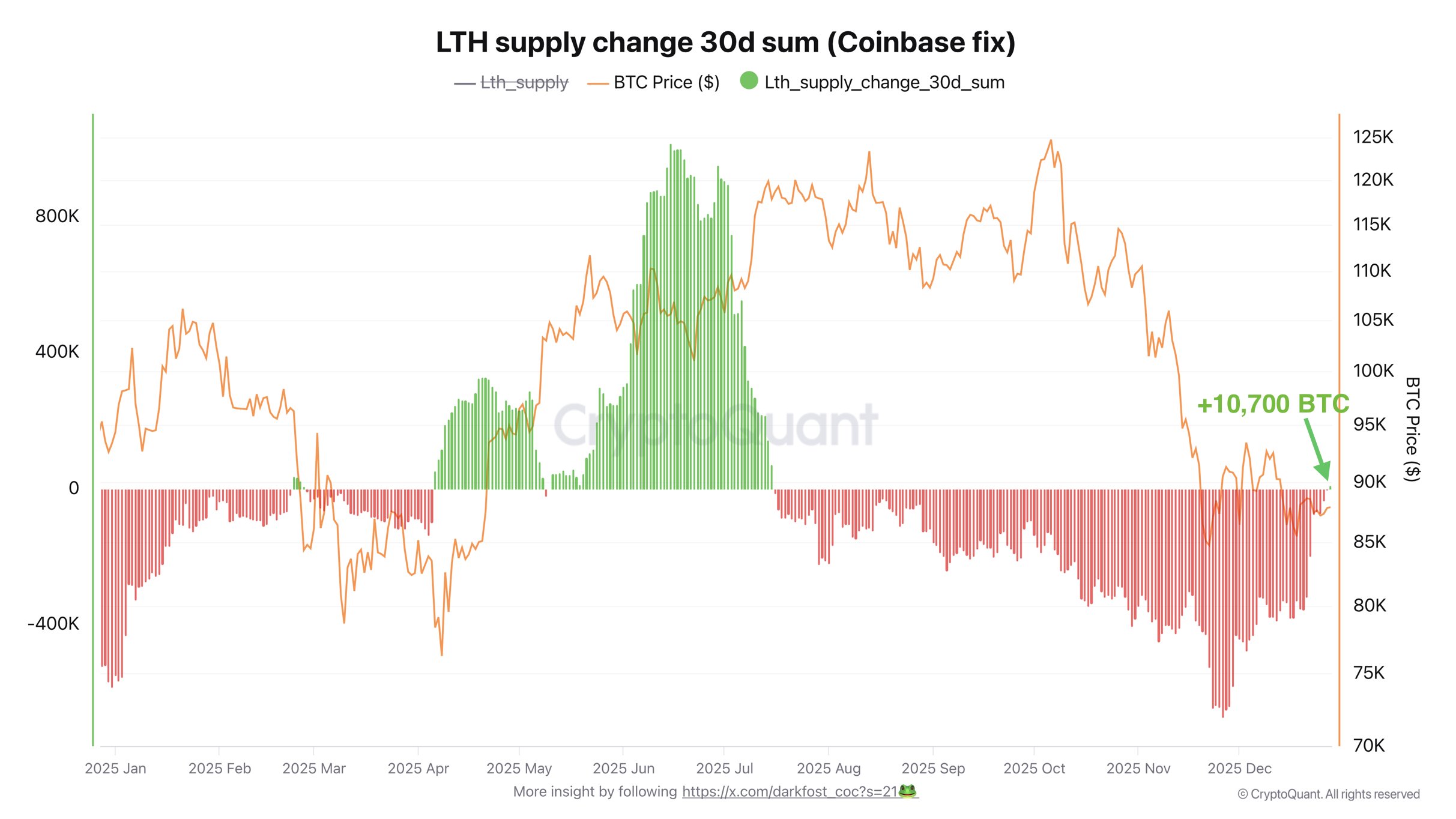

However, recent on-chain data now suggests that this selling phase may be easing. CryptoQuant analyst Darkfost reported that long-term holders, or investors holding Bitcoin for more than six months, have started accumulating again for the first time since July.

This change often plays an important role in determining Bitcoin’s next major move. Darkfost explained that many claims about continued heavy selling from long-term holders do not align with the adjusted data.

In his assessment, he removed the impact of nearly 800,000 BTC moved from Coinbase, which had distorted the figures. After this adjustment, the data showed a change in supply trends.

According to Darkfost, the 30-day cumulative change in long-term holder supply remained negative from July 16, confirming months of distribution. During this period, long-term holders steadily reduced their share of the total supply. This trend has now reversed, with about 10,700 BTC recently moving back into long-term holding status.

While the increase remains modest, Darkfost noted that it still matters. He said long-term holders have slowed their selling enough for their total supply to begin rising again, while short-term holders continue to hold. In past cycles, similar changes often appeared before consolidation or early recovery phases, depending on broader market conditions.

Bitcoin LTHs Behavioral Trend

Data from the accompanying CryptoQuant chart supports his claims. Specifically, from April to July 2025, monthly long-term holder supply changes stayed mostly positive, showing steady accumulation.

Accumulation climbed to nearly 400,000 BTC in mid-April before cooling, though the overall trend stayed positive. By mid-May, accumulation increased again and rose above 800,000 BTC in June.

After peaking, the trend weakened and turned negative in July. It remained negative for several months, reaching beyond -400,000 BTC in November, a period that matched Bitcoin’s weak price performance in the fourth quarter of 2025. The metric only recently flipped back to positive.

Bitcoin’s Recent Rebound Effort

This positive change came alongside a brief price bounce, though the move did not last, and prices have since corrected. Darkfost addressed this rally, noting that Bitcoin jumped by about $3,000 within a few hours.

He attributed the move mainly to derivatives activity rather than spot buying. During the same period, open interest rose by roughly $2 billion. However, he warned that rallies driven by leverage often fade quickly and rarely support a strong, lasting recovery.

Moreover, technical analyst Lennaert Snyder also called attention to the recent rebound effort. According to him, BTC pushed into the $90,600 resistance area without testing the lower levels he preferred.

$BTC pumped to key ~$90,600 resistance.

Bitcoin pumped without testing the lower levels I preferred. Part of the game, I'd rather miss a good trade than enter a bad one.

The weekly open at ~$87,800 is really weak, so taking that out this week is probable.

If we sweep the… pic.twitter.com/WDphtPH3hI

— Lennaert Snyder (@LennaertSnyder) December 29, 2025

He pointed out that the weekly open near $87,800 appears weak and could get tested soon. Snyder explained that if Bitcoin sweeps liquidity above $90,600, he would wait for a break in the 15-minute structure before considering shorts toward the weak low.

If Bitcoin instead reclaims $90,600 on a 4-hour timeframe, he would look for continuation longs toward the $93,500 resistance. Snyder added that liquidity below $87,490 could offer long opportunities after a sweep and reversal.

He also noted that losing $86,900 on a higher timeframe would open the door to shorts targeting the $85,000 lows. He concluded by saying that low volume and choppy price action during the holiday period have led him to reduce risk until market conditions improve.

cryptoticker.io

cryptoticker.io