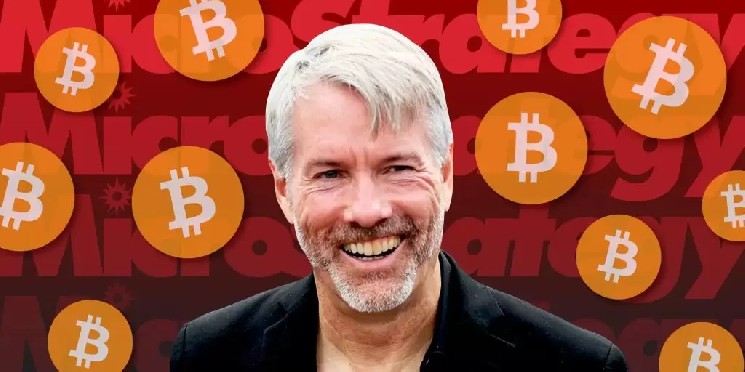

MicroStrategy founder Michael Saylor said that Bitcoin will enter a new phase by 2026, during which the main players in the market will shift from traders to bankers.

Saylor, in a previous interview with CNBC, emphasized that the Bitcoin narrative is now shaped around the direct involvement of the banking system, rather than ETFs or retail investor sentiment.

According to Saylor, the real transformative development in the Bitcoin market is banks accepting the asset and activating their lending mechanisms. He notes that in the last six months, approximately half of the major banks in the US have begun offering BTC-backed loans through Bitcoin ETFs, and this trend is accelerating.

On the other hand, Saylor stated that major financial institutions such as Charles Schwab and Citi plan to launch Bitcoin-backed loans and related financial products, along with BTC custody services, in the first half of 2026. He said these steps would integrate Bitcoin more deeply into the traditional financial infrastructure.

According to Saylor, custody, trading, and lending support from the banking system will elevate Bitcoin to an entirely new asset class level. Emphasizing that the “real story” of 2026 will be banks taking ownership of BTC, Saylor stated that this process could propel the cryptocurrency market to new heights in terms of both scale and institutional trust.

*This is not investment advice.

coinpedia.org

coinpedia.org

u.today

u.today