As we close out another volatile, history-making year in 2025, it’s easy to get lost in the minute-by-minute price action. But tonight, on Christmas Eve, we are zooming out. U.Today is taking a retrospective journey through 16 years of holiday trading.

The Ghost of Bitcoin’s past

In 2009, Bitcoin was less than a year old. It had no market price, no exchanges, and could only be mined on a home computer. It was purely an idea shared among cypherpunks on mailing lists. The following year, Bitcoin was still cheaper than a gumball.

By 2011, Bitcoin had experienced its first major bubble before crashing by a staggering 90%. By Christmas, it had stabilized around $4.

Fresh off the very first "halving" event in November, supply shock mechanics were kicking in in 2012. The price had tripled from the previous year to a whopping $13. The WordPress Foundation also began accepting Bitcoin.

2013 was the year Bitcoin broke the sound barrier, soaring from $13 to over $1,100. Later, it crashed back down to the $600s after China banned financial institutions from handling it. It was the first time the “normies” started discussing Bitcoin at Christmas dinner.

Following the catastrophic collapse of Mt. Gox (which handled 70% of trades), 2014 was a painful year of decline. Bitcoin spent Christmas bleeding out.

Ten years ago, Bitcoin was trading for less than the price of a new gaming console. The market was recovering from the Mt. Gox era, and while the price was low, the conviction was building

In 2016, Bitcoin had nearly doubled from the previous Christmas, knocking on the door of $1,000. The energy was palpable; traders knew something big was coming in 2017.

Just days after nearly touching $20,000, Bitcoin corrected sharply to $14,000 on Christmas Day in 2017. It was a stressful holiday for those who bought the top, but a miraculous one for long-term holders.

After a brutal year-long decline, Bitcoin limped into Christmas at roughly $3,800. The mainstream media declared crypto "dead" (again).

The price had nearly doubled from the 2018 lows. It wasn't a moon mission yet, but stability had returned to the market.

In 2020, Bitcoin smashed its previous all-time highs just in time for the holidays, breaking $24,000. Institutional investors had finally arrived.

Following the FTX collapse, prices plummeted back to 2020 levels. It was a somber Christmas for portfolios.

The winter ended, and Bitcoin surged back over $40,000, driven by spot ETF hype. The mood changed from fear to greed once again.

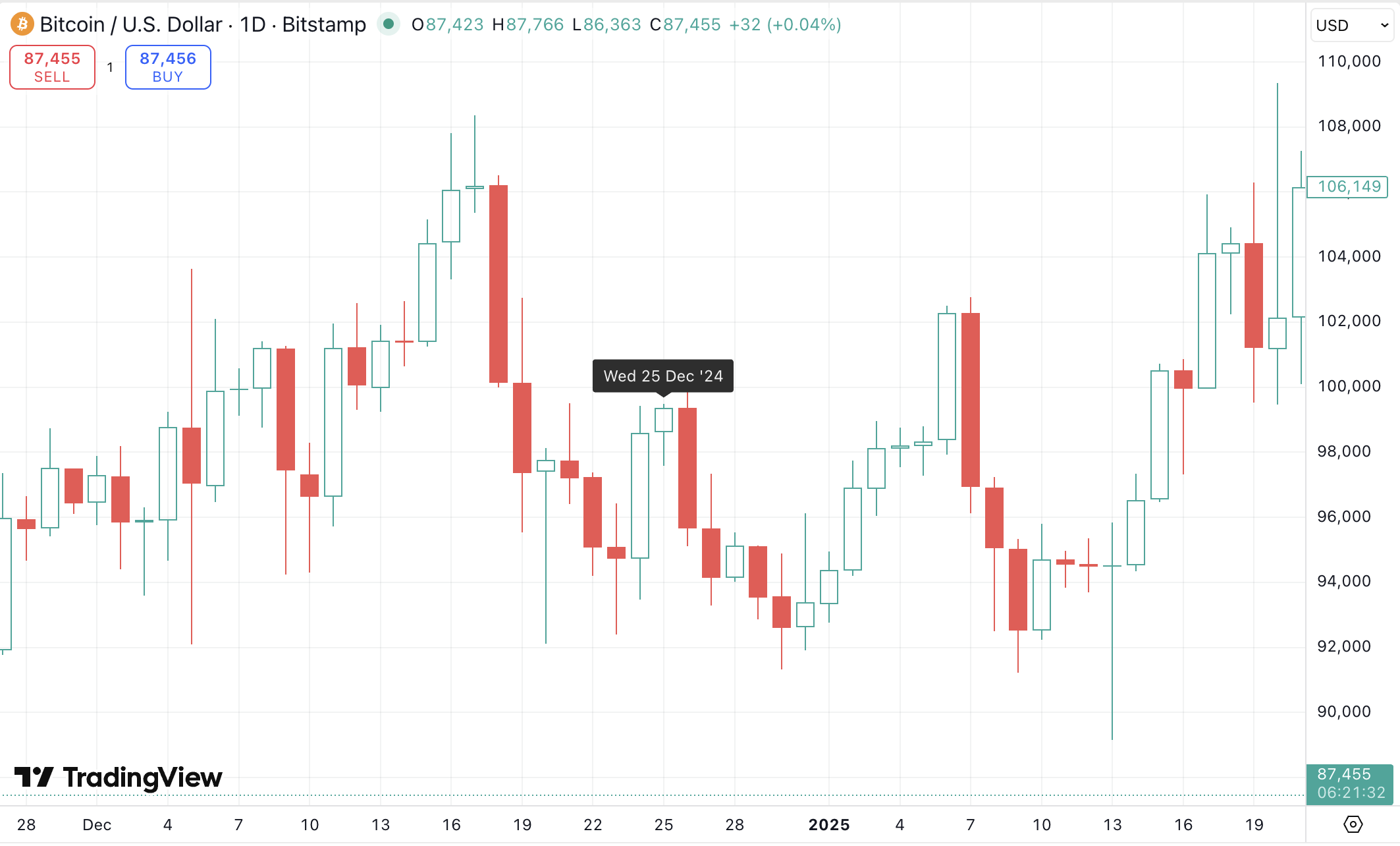

Last year, we witnessed history as Bitcoin surpassed the psychological six-figure barrier. It was the culmination of a decade of hard work, development, and community building.

What now?

After a roaring start to the year and an all-time high of $126,000 in October, gravity has taken over. We are closing out 2025 with Bitcoin trading sideways around $86,800. The market feels "stuck" between the euphoria of autumn and the uncertainty of 2026.

As reported by U.Today, Galaxy CEO Mike Novogratz recently predicted that it would be challenging for the Bitcoin price to reclaim the $100,000 level.

Yet, congratulations are in order: you have successfully survived a landmark year where Bitcoin finally shattered the six-figure ceiling. The road ahead may be challenging, but let's enjoy the festivities and get ready to defy the odds again in 2026. Merry Christmas!

coinpedia.org

coinpedia.org

cointelegraph.com

cointelegraph.com