A recent CryptoQuant analysis reveals one of the factors behind the recent Bitcoin price collapse, which appears to have stabilized.

Notably, after reaching a peak of $126,000 in early October 2025, Bitcoin briefly stabilized around $124,000 following an initial pullback. However, this stability did not last.

From this level, Bitcoin dropped steadily and eventually bottomed at $84,000 in December, marking a decline of more than 32% over three months. Although BTC has since bounced modestly from the $84,000 low, it remains nearly 30% below the $124,000 region and currently trades near $87,000.

This prolonged downturn emerged during a broader bearish phase that has weighed heavily on the crypto market from early October through December.

Whale Capitulation Contributed to Bitcoin Drop

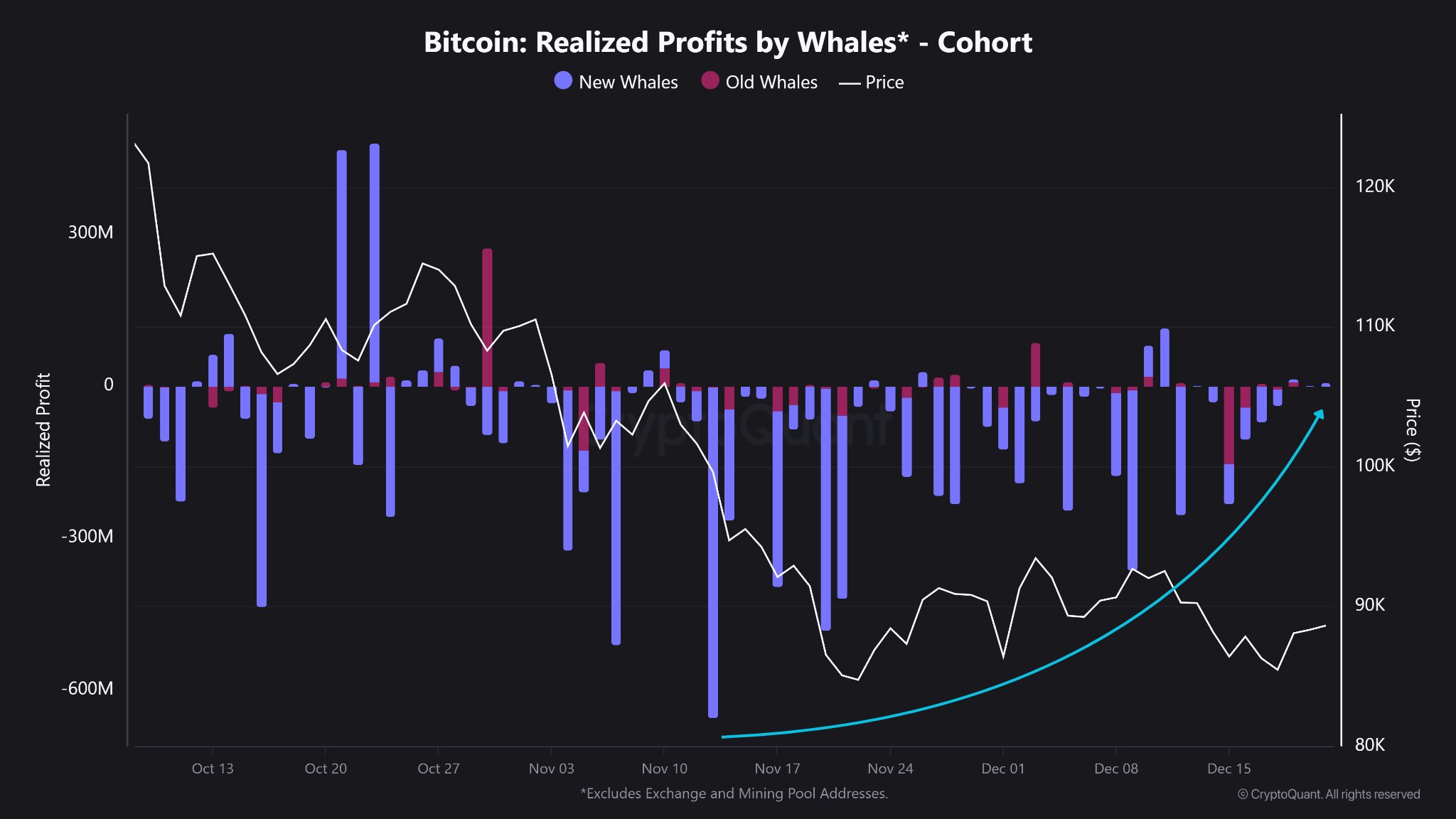

Interestingly, new on-chain data has revealed one of the factors behind the decline. Market analytics platform CryptoQuant recently identified whale behavior as a major contributor to Bitcoin’s fall from $124,000 to $84,000.

According to CryptoQuant’s analysis, realized losses from newly active large holders played a decisive role in driving prices lower.

As Bitcoin dropped from $124,000 to $84,000, losses booked by these newer whales intensified and placed sustained pressure on the market. Following the recent low at $84,000, those realized losses declined sharply and flattened out, showing a pause in aggressive selling from this cohort.

The chart data shared by CryptoQuant revealed that in early October, signs of whale capitulation began to appear but remained relatively muted. During this period, combined profits and losses fluctuated between $200 million and $100 million.

However, as Bitcoin prices weakened further later in October, selling activity accelerated significantly. New whales dominated these selloffs, and on certain days, realized profits surged as high as $400 million.

Whale Capitulation Goes Flat: Recovery Next?

The conditions changed again in November. As Bitcoin fell below the $100,000 mark, profits diminished even though sell pressure increased. Instead of booking gains, new whales began absorbing mounting losses.

This change led to pronounced capitulation events, with realized losses reaching peaks of up to $600 million on some days throughout November. CryptoQuant linked these heavy losses directly to the sharp price collapse during that period.

By December, the data showed a notable reduction in these whale-driven selloffs. As capitulation eased, Bitcoin entered a phase of relative stability, with prices consolidating between roughly $87,000 and $90,000.

With selling pressure from new whales now significantly reduced, the market may have room to stabilize further and potentially recover if large holders return as net buyers.

Analysts Remain Divided on Next Direction

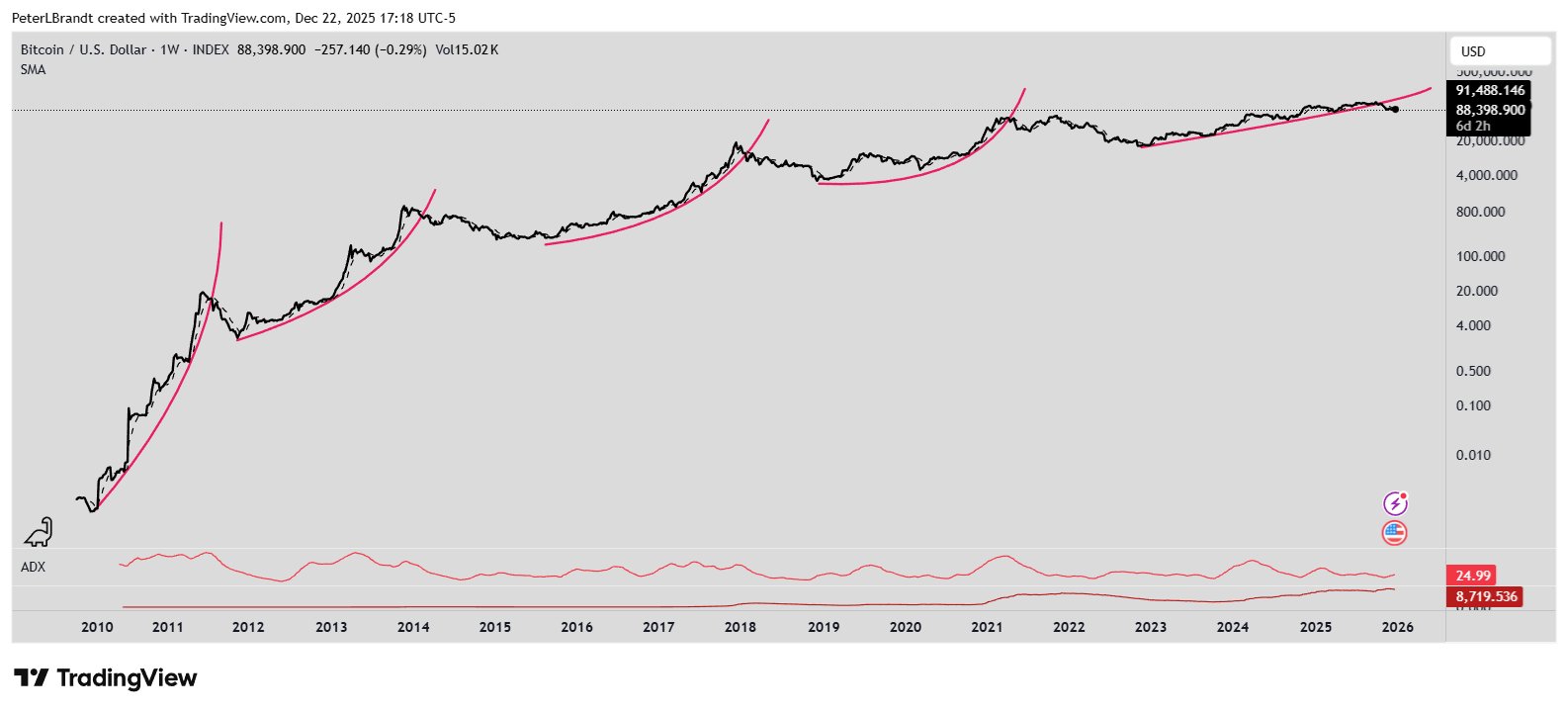

However, despite this improvement, not all analysts expect an immediate reversal. Specifically, veteran trader Peter Brandt warned that Bitcoin may still face additional downside.

Citing historical patterns, he noted that Bitcoin has experienced five major parabolic advances over its 15-year history, each followed by declines of at least 80% once those advances broke down. He believes the latest break suggests the current correction may not yet have fully played out.

Meanwhile, analyst Michael van de Poppe observed that Bitcoin recently rejected a key resistance area near $90,000 and continues to move sideways. While this rejection disappointed some traders, he noted that shorter timeframes still show signs of a developing upward trend.

He called attention to $86,000 as a major support level, suggesting that holding this area could bolster Bitcoin’s case for another attempt at breaking major resistance zones.

Van de Poppe also highlighted unusual market conditions, noting that while many traditional markets rally, crypto lags behind. Nonetheless, he believes this situation could change with time.

cointelegraph.com

cointelegraph.com

coindesk.com

coindesk.com

u.today

u.today