With ten days left in the year, Bitcoin has failed to live up to the high expectations that dictated market sentiment at the start of 2025.

The flagship crypto opened the year strong, rising nearly 10% in January and bolstering optimism. Analysts highlighted clearer U.S. regulations, growing institutional treasury adoption, and steady ETF inflows as reasons to expect a powerful bull run.

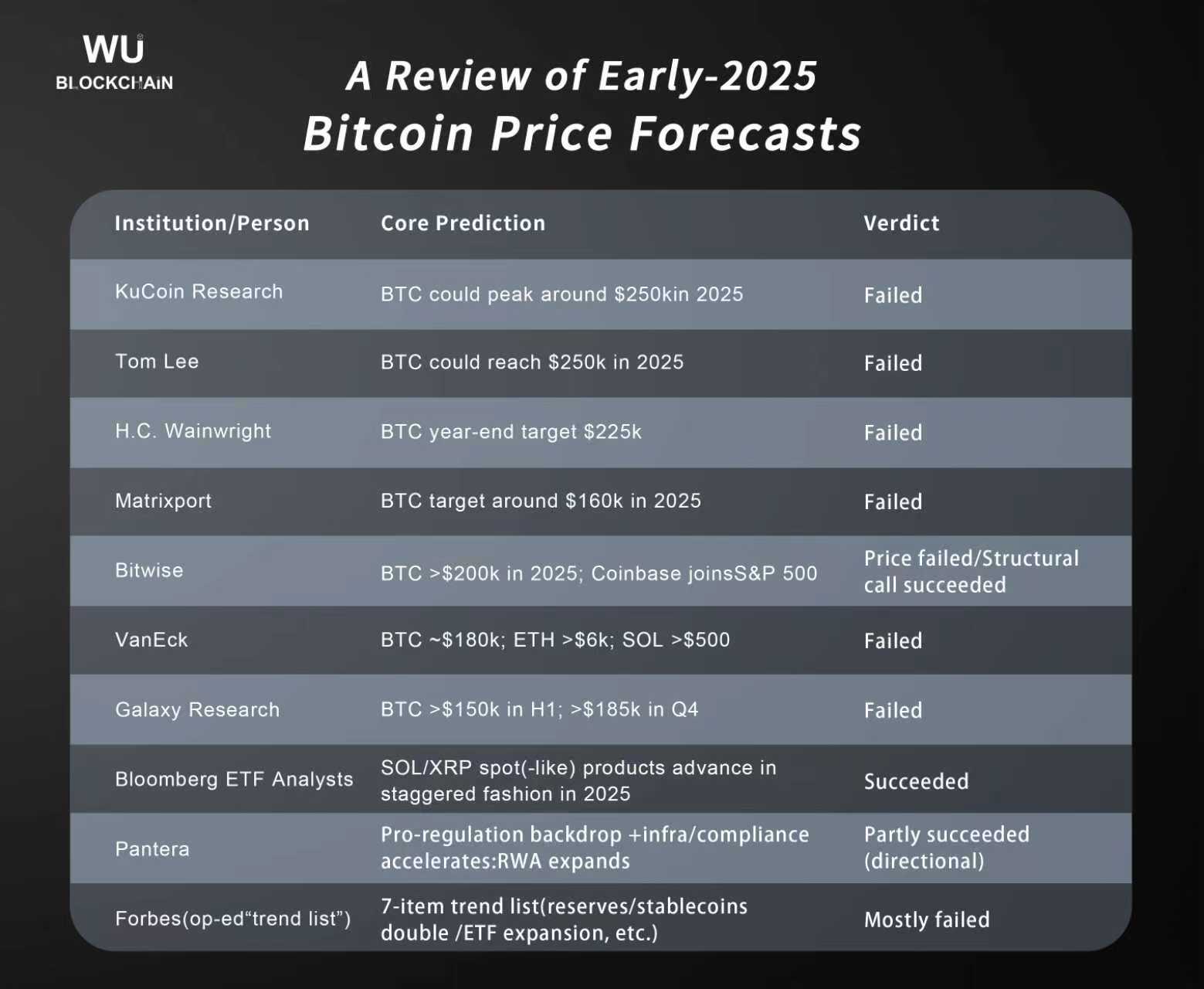

Bitcoin Fails to Hit Most Bullish Targets

These factors led to ambitious price targets, with most projections clustering between $200,000 and $250,000. However, momentum weakened sharply from October. Over the past three months, Bitcoin has fallen more than 21%, now down about 3.6% for the year, and trades near $90,130.

If the current momentum holds, Bitcoin will secure a yearly close in the red for the first time since the 2022 bear market, leaving many bullish forecasts unfulfilled.

Crypto journalist Colin Wu recently highlighted how far these predictions missed their targets. In a Substack article, he explained that from late 2024 into early 2025, the market rallied around a shared narrative around post-halving strength, ETF expansion, institutional adoption, and friendlier regulation.

This outlook encouraged institutions and prominent commentators to publish aggressive price targets. Wu noted that while expectations around regulation, compliance, and industry structure mostly moved in the right direction, most price forecasts overstated Bitcoin’s rally throughout 2025.

KuCoin Research

KuCoin Research entered 2025 with one of the most ambitious outlooks in the market. The firm combined historical post-halving trends with expectations of strong institutional and ETF-driven demand to argue that Bitcoin could peak near $250,000 during the year.

KuCoin also projected that the crypto market, excluding Bitcoin, could reach about $3.4 trillion, which could be due to a massive altcoin season.

While the firm correctly anticipated progress in compliant products, including Solana and XRP ETFs, Bitcoin’s price action moved in a different direction. The asset peaked just above $126,000 before sliding back to the current price of around $90,000, leaving the price forecast far out of reach.

Tom Lee

Meanwhile, in January 2025, Fundstrat’s Tom Lee publicly shared a $250,000 Bitcoin target. He based his view on improving liquidity conditions, regulatory tailwinds, and what he described as growing market resilience.

As the year unfolded, repeated drawdowns and elevated volatility prevented Bitcoin from sustaining upward momentum. Despite several rallies, the price never came close to Lee’s projected level.

H.C. Wainwright

Investment bank H.C. Wainwright also presented a highly bullish stance at the start of the year, lifting its year-end Bitcoin target to $225,000. The firm relied on historical cycle behavior, expectations of regulatory improvement, and rising institutional participation. Like other forecasts above $200,000, this projection failed to materialize.

Matrixport

Matrixport had a more restrained outlook compared to its peers, calling 2025 a breakout year but setting a $160,000 target for Bitcoin. However, even with this lower ceiling, the forecast failed to play out. While sentiment improved at times, Bitcoin’s final price remained below the projected mark.

Bitwise

Asset manager Bitwise opened its December 2024 “Top 10 Predictions for 2025” with an ambitious call that Bitcoin would trade above $200,000 during the year.

The firm linked the price target to expectations around industry growth, including Coinbase joining the S&P 500 and continued expansion in stablecoins and tokenized assets. Some of the structural developments did occur, but Bitcoin ended the year far below the forecasted price level.

VanEck

VanEck also presented a roadmap for the 2025 cycle. The firm expected an early-year peak, followed by a sharp correction and renewed momentum later in the year.

Notably, it placed Bitcoin’s cycle-top target near $180,000. As of August 2025, VanEck maintained this target. While the market did experience large swings and notable drawdowns, Bitcoin never reached the projected highs.

Galaxy Research

Meanwhile, Galaxy Research argued that adoption by institutions, corporations, and even governments would push Bitcoin above $150,000 in the first half of 2025 and toward $185,000 by year-end.

However, in practice, adoption moved too slowly to offset faster forces such as macro shocks, risk-off sentiment, and leverage-driven liquidations.

Pantera and Forbes Outlooks

Investment firm Pantera focused on improving policy conditions and infrastructure growth, later acknowledging that price performance lagged expectations.

Meanwhile, Forbes trend forecasts also leaned bullish, expecting developments such as strategic Bitcoin reserves and stablecoins doubling toward $400 billion. While some directional progress emerged, the combined assumptions were too ambitious for a single year.

bitcoinmagazine.com

bitcoinmagazine.com

beincrypto.com

beincrypto.com

coindesk.com

coindesk.com

newsbtc.com

newsbtc.com