As Bitcoin (BTC) battles sustained bearishness around the $90,000 level, insights from a trading expert suggest the asset could see further correction toward the $37,000 zone.

In this case, insights from cryptocurrency analyst Ali Martinez identified this potential move based on Bitcoin’s quarterly price structure.

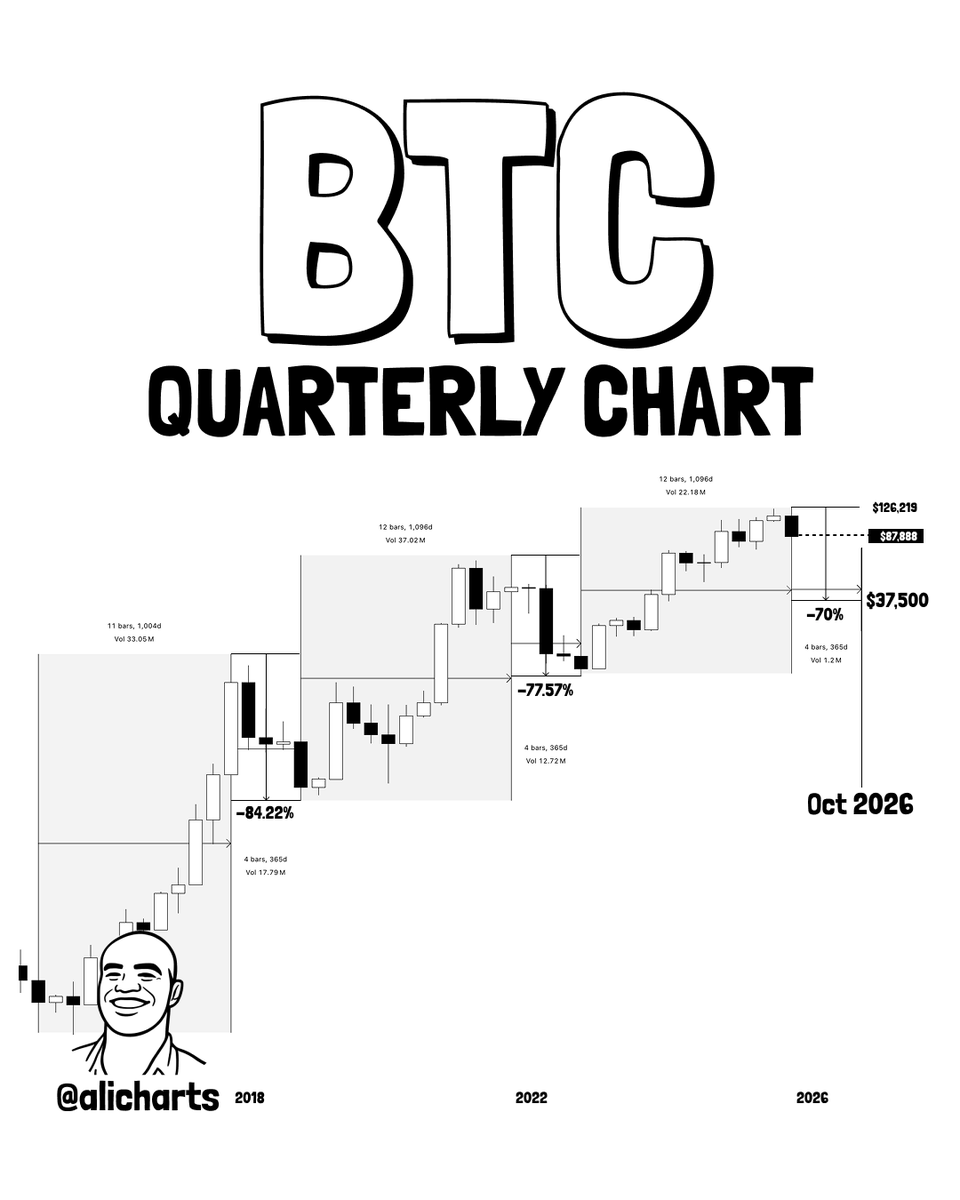

In an X post in December, the analysis highlighted a recurring boom-and-bust cycle that has defined every major bull and bear market since Bitcoin’s inception. Historically, each major rally has been followed by a prolonged correction lasting roughly one year, with drawdowns ranging between 70% and 85% from peak levels.

Bitcoin key price levels to watch

The analysis argues that Bitcoin’s current structure closely resembles past cycle tops. After peaking near $126,000, a potential 70% decline is projected, consistent with previous bear markets, implying a bottom in the $37,000–$38,000 range that aligns with former major support zones.

Historically, bear-market declines have unfolded over about four quarterly candles, or roughly 12 months. Using this pattern, the analyst estimates the next major low could form in about 288 days, placing the likely bottom around October 2026.

Past market bottoms have also tended to develop through prolonged periods of low volatility and thinning volume rather than sharp reversals, suggesting that even near $37,000, consolidation is more likely than an immediate rebound.

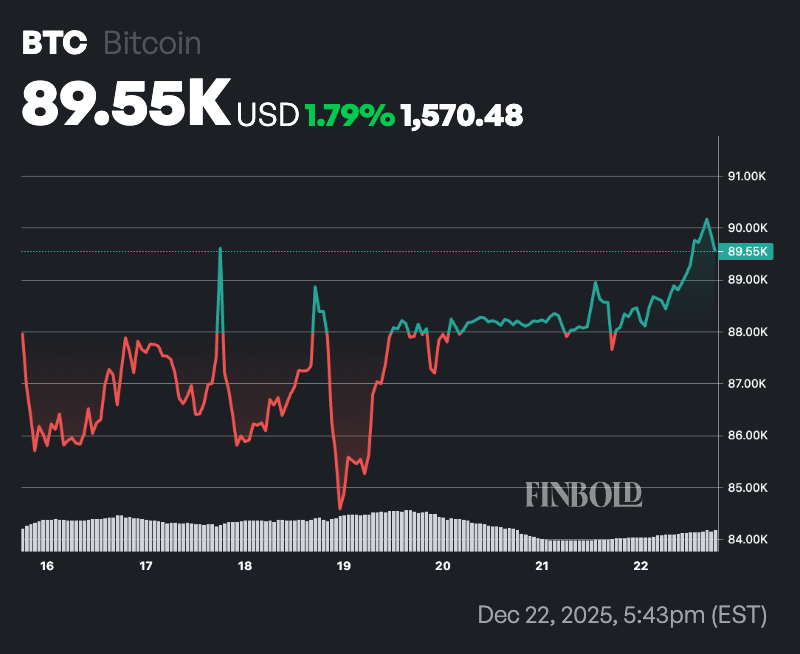

This outlook likely adds further pressure to Bitcoin’s price, which has struggled in recent sessions to mount a decisive move above $90,000. These struggles have been driven in part by cooling demand from institutional vehicles in exchange-traded funds (ETFs) and cautious positioning ahead of the year-end holiday period.

Bitcoin price analysis

At press time, Bitcoin was trading at $89,506, up 1.7% over the past 24 hours, while on the weekly timeframe, the asset has posted a modest gain.

Notably, at the current price, Bitcoin sits below both its 50-day simple moving average (SMA) of $93,693 and its 200-day SMA of $101,460, signaling bearish momentum across both short- and long-term trends, with these levels acting as key resistance.

Meanwhile, the 14-day relative strength index (RSI) at 46.17 remains neutral, indicating neither overbought nor oversold conditions and suggesting a lack of strong directional bias for an imminent reversal.

Featured image via Shutterstock

cryptobriefing.com

cryptobriefing.com

finbold.com

finbold.com

decrypt.co

decrypt.co