The recent Bitcoin surge shows strong short-term inflows, but longer-term data hints at recovering momentum.

Bitcoin has recently surged above the $89,000-mark, trading at $89,042.27 with a 1.1% increase in the last 24 hours. This price action comes after a volatile period where Bitcoin’s value fluctuated between $87,655 and $89,542. The positive momentum is clear as the price continues to climb, notably showing a significant rise after 02:00 UTC, with steady growth towards the 10:00 mark.

Over the past seven days, Bitcoin has experienced a solid 5.8% increase. In addition to the daily gains, BTC has also shown consistent performance over the longer term, with a 2.4% increase in the past two weeks.

Bitcoin Price Prediction

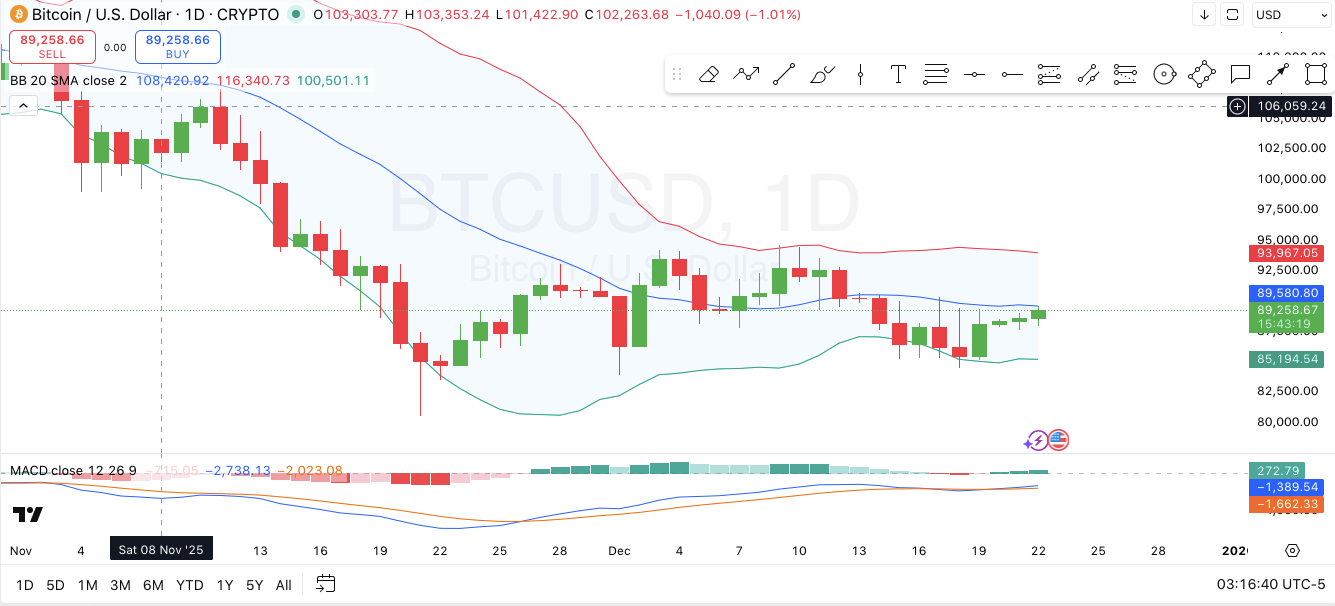

Notably, a chart from TradingView shows Bitcoin’s recent price movements with key indicators, including the Bollinger Bands and the MACD. Specifically, the Bollinger Bands are widening, suggesting increased volatility and a possible surge.

This implies that Bitcoin is in a consolidation phase, with the potential for a breakout either above the upper band (around $94,000) or a retracement to the lower band (around $85,000), both serving as important support and resistance levels. The price action indicates that Bitcoin is testing the support zone near $89,000, where the 20-SMA aligns, which could offer short-term support in the face of selling pressure.

The MACD (Moving Average Convergence Divergence) also supports the analysis of momentum. Currently, the MACD line is positioned above the signal line, suggesting a bullish trend, albeit with some weakening momentum, as the histogram shows reduced buying pressure.

If Bitcoin continues to maintain price levels above the $89,000 mark and breaks through resistance around $90,000–$95,000, we could see further upward movement.

However, if it fails to hold the support at $85,000, a deeper pullback towards lower support levels could occur, testing the market’s strength in the short term.

Bitcoin Futures Data

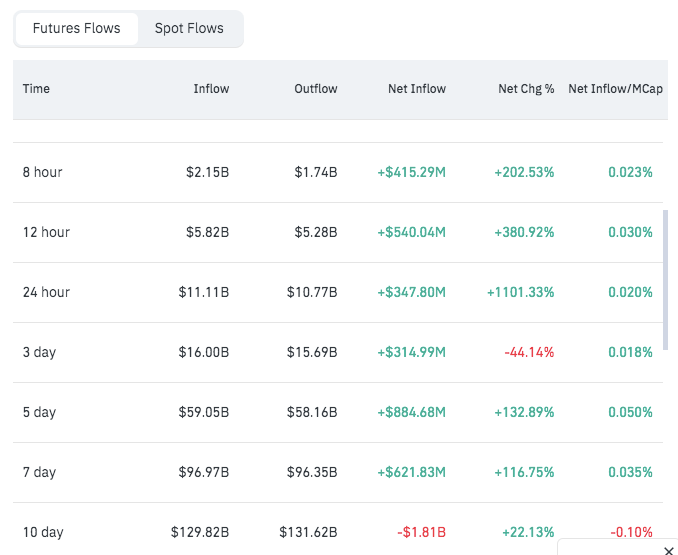

Further, futures data shows a strong inflow of capital into Bitcoin, particularly in the short to medium term, indicating a bullish sentiment. Over the past 8 and 12 hours, Bitcoin saw notable net inflows of $415.29 million and $540.04 million, respectively, with dramatic percentage increases of 202.53% and 380.92%.

This surge suggests heightened market interest and growing investor confidence. Even over the 24-hour period, Bitcoin experienced a robust net inflow of $347.80 million, marking a massive increase of 1101.33%, further confirming that buying pressure has been dominant in the market recently.

However, the longer-term data reveal a shift in sentiment. In the 3-day and 5-day periods, Bitcoin’s net inflows of $314.99 million and $884.68 million show continued positive sentiment but with a reduction in the rate of increase, especially in the 3-day period where the net change dropped by 44.14%.

The 7-day data reflects a slowing in inflows, with net inflows of $621.83 million, and the 10-day data shows a negative shift, with a net outflow of $1.81 billion.

thecryptobasic.com

thecryptobasic.com

cryptobriefing.com

cryptobriefing.com

coindesk.com

coindesk.com

bitcoinworld.co.in

bitcoinworld.co.in

cryptoticker.io

cryptoticker.io