Bitcoin's BTC$88,539.42 stark rejection at $90,000 on Wednesday was a quick reminder for investors that precious metals like gold and silver are the real winners of the debasement trade, not — at least for the moment — digital gold.

Back in October, JPMorgan analysts said that gold and bitcoin were both benefitting and would continue to benefit from the so-called debasement trade. They projected BTC to follow gold's lead, putting a $165,000 BTC price target on a volatility-adjusted basis relative to gold.

So far, that thesis hasn't played out.

While BTC is languishing around $88,000, down 30% from its early October record, gold is trading near record highs around $4,350 an ounce and silver Wednesday hit fresh all-time highs above $66, up 40% since October.

"Bitcoiners can’t ignore the bull market in precious metals, which continues to roar," said Charlie Morris, founder of ByteTree.

Why is BTC lagging?

Bitcoin’s current weakness stems from its linkage to risky assets, Morris wrote in a Wednesday report. While stock indices have been hovering near record highs, the most speculative pockets of the equity market – data centers and artificial intelligence infrastructure bets and recent IPO names – saw heavy drawdowns over the past few weeks.

There's also a technical element behind bitcoin's relative weakness to gold. The BTC-gold ratio already peaked in late 2024, and is deep into a bear market tumbling over 50%.

In August, BTC-gold made a lower high, pointing to fading momentum, and since than has rolled over, making a fresh low on Wednesday and its weakest level in almost two years.

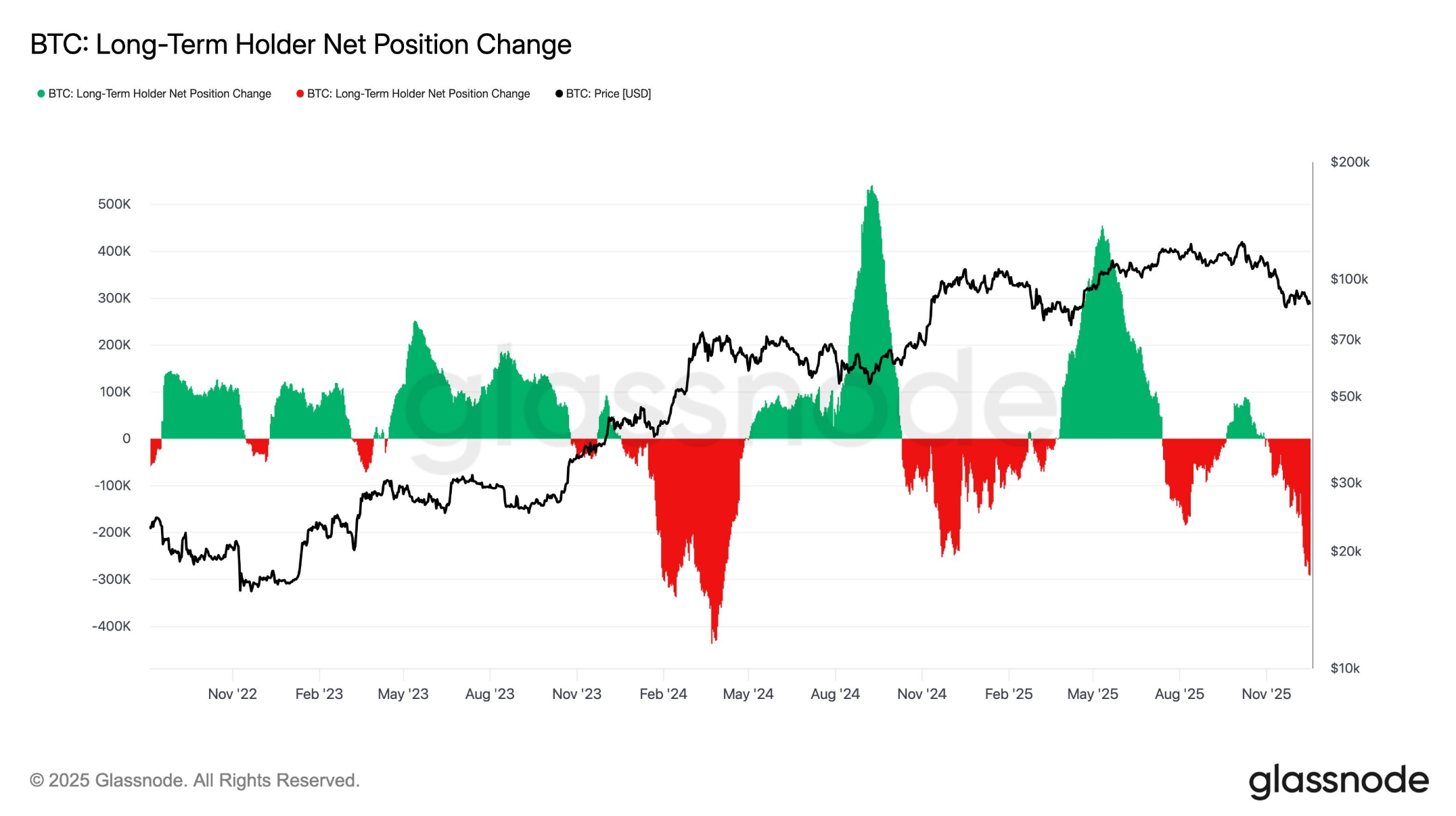

Structural selling from long-term holders has also added to bitcoin's weakness. Research from Vetle Lunde, head of research at K33, noted that BTC supply held in UTXOs (unspent transaction outputs) older than two years has been in a persistent decline, with roughly 1.6 million BTC reactivated since 2024. Separately, Glassnode data also shows that long-term investors have ramped up selling their holdings.

"This represents onchain evidence of substantial, sustained selling pressure from long-term holders," Lunde said.

There's also growing discussion around the risks quantum computing poses to Bitcoin’s cryptographic security. While the concern remains largely theoretical, it has added a layer of uncertainty for investors.

Analyst: Silver rally could set stage for BTC

The silver lining – no pun intended – for bitcoin investors is that BTC should eventually take the baton from gold as the yellow metal's rally cools.

Historical patterns show that gold peaks often precede BTC rallies by 100-150 trading days, Bitfinex analysts pointed out. They said that bitcoin's current market consolidation is a transitional phase, laying the groundwork for a catch-up in 2026.

Bytetree's Morris expressed a similar view.

“I remain bullish on silver, but it won’t go on forever," Morris said. "I suspect that when the rally runs out of steam, bitcoin will step in."

coindesk.com

coindesk.com