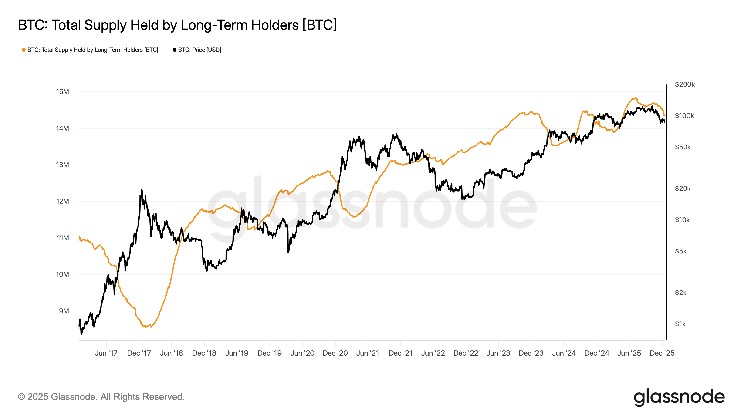

Bitcoin BTC$86,814.19 long term holder (LTH), supply has fallen to an eight month low of 14,342,207 BTC, a level last seen in May, which has coincided with bitcoin falling almost 40% from its October all-time high.

Glassnode defines a long term holder as an entity that has held bitcoin for at least 155 days, placing the current cohort cutoff around mid July, so any buyer then and has held would be classified as a LTH.

This decline marks the third distinct wave of LTH distribution in the current cycle since early 2023.

The first wave occurred from late 2023 into early 2024 following the launch of U.S. spot bitcoin ETFs, when LTH's sold into strength as bitcoin rallied from roughly $25,000 to a peak near $73,000 by March 2024.

The second wave emerged later in the year when bitcoin ran towards $100,000, driven by optimism surrounding President Trump’s election victory. The market is now experiencing a third iteration of LTH selling as bitcoin remained above $100,000 for much of the year.

Why This Cycle is Different?

This behavior stands in contrast to prior bull markets in 2013, 2017, and 2021, where LTH supply typically followed a single boom and bust pattern, bottoming near euphoric cycle peaks before gradually recovering.

Instead, this cycle has seen repeated waves of distribution without a clear blow off top, a dynamic highlighted by Alec, co-founder of Checkonchain, who noted that bitcoin LTH spending this cycle is unlike anything seen in recent history, with the market absorbing a third sell wave remarkably well.

LTH distribution remains one of the largest sources of sell side pressure in bitcoin and has been a key contributor to the nearly 40% correction from October's all-time high.

coindesk.com

coindesk.com