Prominent economist Steve Hanke has renewed his criticism of Bitcoin (BTC) amid the cryptocurrency’s ongoing plunge.

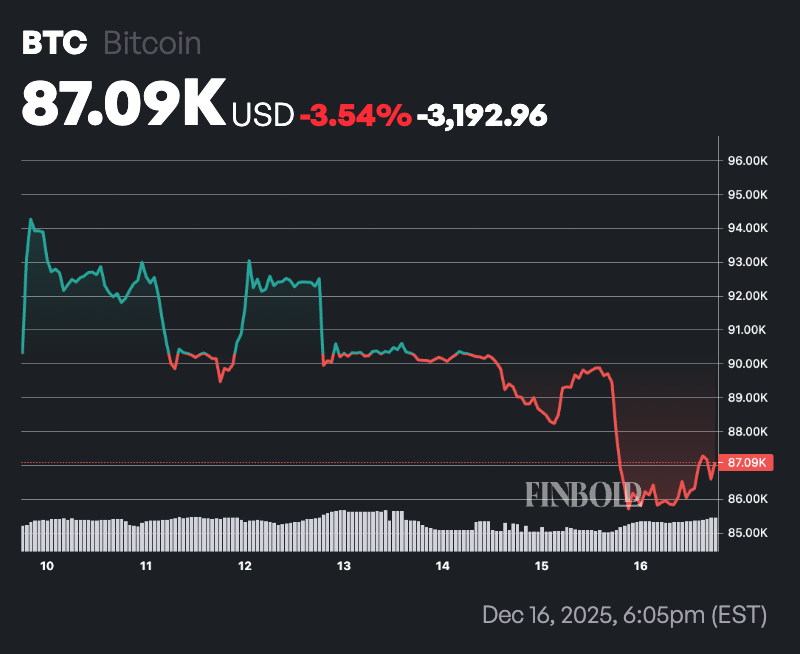

Hanke, a professor of applied economics at Johns Hopkins University, said Bitcoin’s latest crash reflects what he described as the asset’s lack of any underlying value, according to an X post on December 16.

In his view, Bitcoin is nothing more than a highly speculative investment devoid of fundamental worth, a stance he reiterated as the digital asset traded below $86,000.

The drop is part of a broader correction, with Bitcoin now down more than 30% from its all-time high of $126,000 reached in October 2025.

Market analysts attribute the sell-off to a mix of factors, including macroeconomic pressures from potential central bank interest rate changes, forced liquidations exceeding $380 million, thin holiday trading volumes, and broader concerns about a possible artificial intelligence bubble weighing on risk assets.

Warnings from the Federal Reserve have further dampened sentiment, with fears mounting over a potential $3 trillion contraction in the crypto sector if prices continue to weaken into 2026.

Featured image via Shutterstock

finbold.com

finbold.com