Market expert Peter Brandt warns of a looming Bitcoin price correction as the asset violates the parabolic advance pattern.

The Bitcoin price has been experiencing a wild ride lately, exhibiting high volatility over the past few weeks. This has sparked concerns among investors and enthusiasts, with experts warning about the sustained negative momentum and potential downfalls.

Parabolic Advance Pattern Broken

Amid this downtrend, veteran trader Peter Brandt, in his latest X post, raised concerns over the Bitcoin price’s potential trajectory.

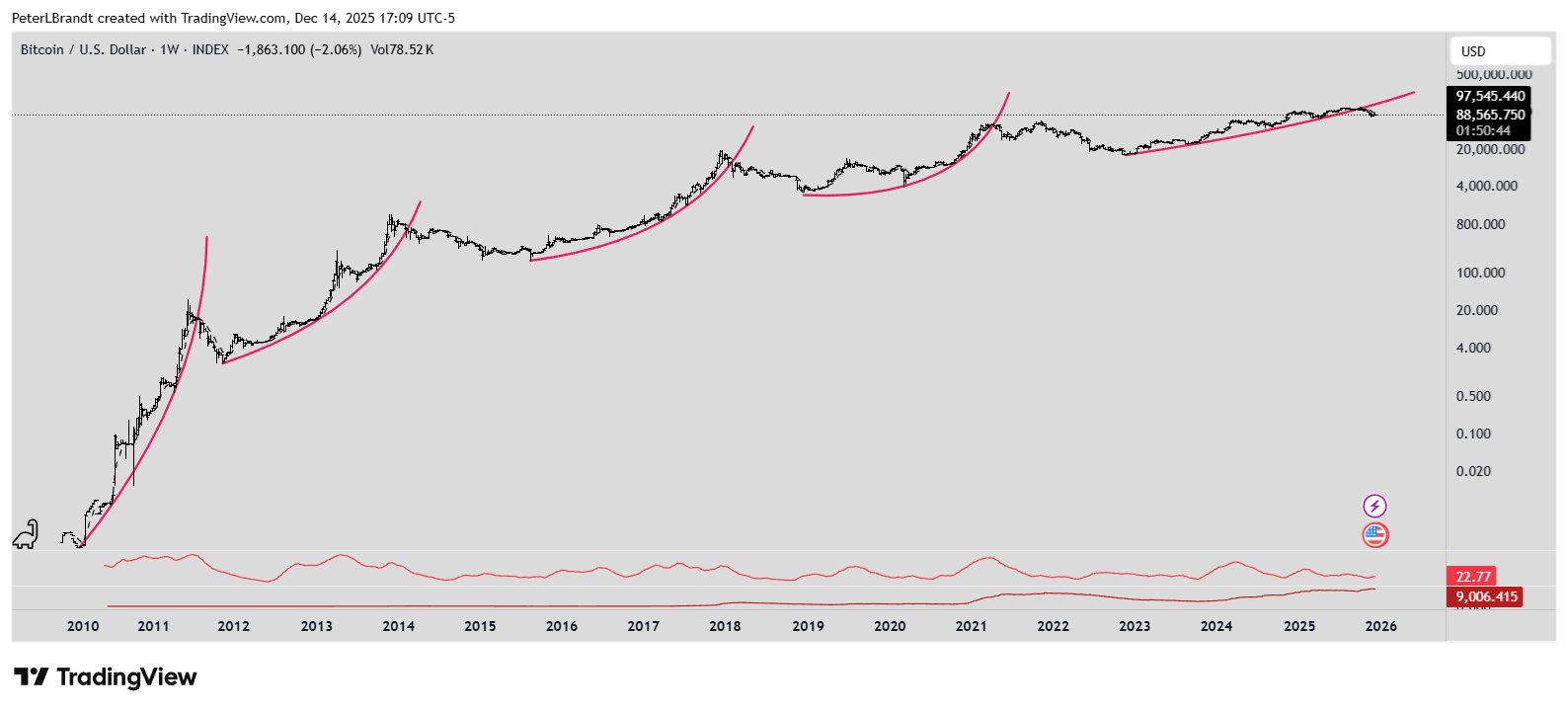

He cited the cryptocurrency’s historical pattern of parabolic advances, often followed by notable corrections. The trader’s analysis is based on BTC’s recent violation of this parabolic advance trendline.

Notably, Brandt argued that the cryptocurrency’s bull cycles have experienced “exponential decay,” indicating that each successive period has been marked by diminishing returns.

According to the chart presented by Peter Brandt, the Bitcoin price history has been marked by periods of parabolic growth, highlighted by red lines.

The chart indicates that each time BTC dropped below these lines, significant price declines followed. Specifically, the previous cycles have experienced declines of over 75% after breaching the parabolic trendline.

For instance, in the 2010-2012 cycle, the BTC price rose to a high of nearly $20, from its post-launch low. Soon, this bull run was hit by a market correction, with the price eventually reaching $4. This downtrend was foreshadowed by the parabolic line’s breach.

Another instance shown in the chart is the 2019-2021 cycle, where Bitcoin reached an all-time high of $67k, only to plummet to $16k in 2022. As the same pattern is being repeated in the 2023-2025 cycle, with the crypto currently diverging from its parabolic rise, a similar correction is likely to occur in 2026.

Market Implications: Is a Bitcoin Price Correction Ahead?

As of press time, Bitcoin is exchanging hands at $89,701, marking a marginal 0.45% dip in a day. Over the past week and month, the coin has seen more notable downticks of 1.5% and 6.4%, respectively.

After hitting $92k recently, the Bitcoin price started plummeting, breaking its parabolic advance pattern. This bearish momentum has sparked concerns among traders and investors, with analysts, including Brandt, predicting a possible crash.

As per Peter Brandt’s analysis, the current Bitcoin cycle peaked at an all-time high of $126k in October. Based on this framework, BTC could undergo an 80% correction, placing the target at a severe low of $25k.

However, analysts like CryptoBusy remain bullish about BTC’s potential future. The analyst believes that the Bitcoin price’s pullback into the Asian open is part of the broader narrative of fading year-end liquidity.

$BTC Bitcoin’s pullback into the Asian open fits the broader narrative of fading year-end liquidity,

but the chart continues to show something important beneath the surface.

Price has returned to test the multi-year trendline that has supported every major higher-low since… https://t.co/nKclkF0FFT pic.twitter.com/ydUSMS7EM6

— CryptoBusy (@CryptoBusy) December 15, 2025

As the price has returned to test the multi-year trendline, BTC is likely to continue its upward momentum, according to CryptoBusy. This current trendline is noteworthy as it has served as a major support for higher lows since 2023.

thecryptobasic.com

thecryptobasic.com