Bitcoin slid under $88,000 on Sunday morning, putting the market squarely in “so much for the Santa Rally” territory. With derivatives traders scrambling for footing and open interest wobbling across major venues, bitcoin is signaling that December may be more coal than candy canes.

Bitcoin’s December Stumble Sends Derivatives Markets Scrambling

Bitcoin’s drop under $88,000 threshold threw a cold towel on weekend sentiment, and the derivatives market is flashing enough mixed signals to make even seasoned traders reach for extra caffeine. The fourth quarter, which historically carries a bit of year-end sparkle, is clocking in at –22.01% so far in 2025, while December is trending at –1.63% as of Dec. 7 — both figures still in motion as the month progresses but currently offering little holiday cheer.

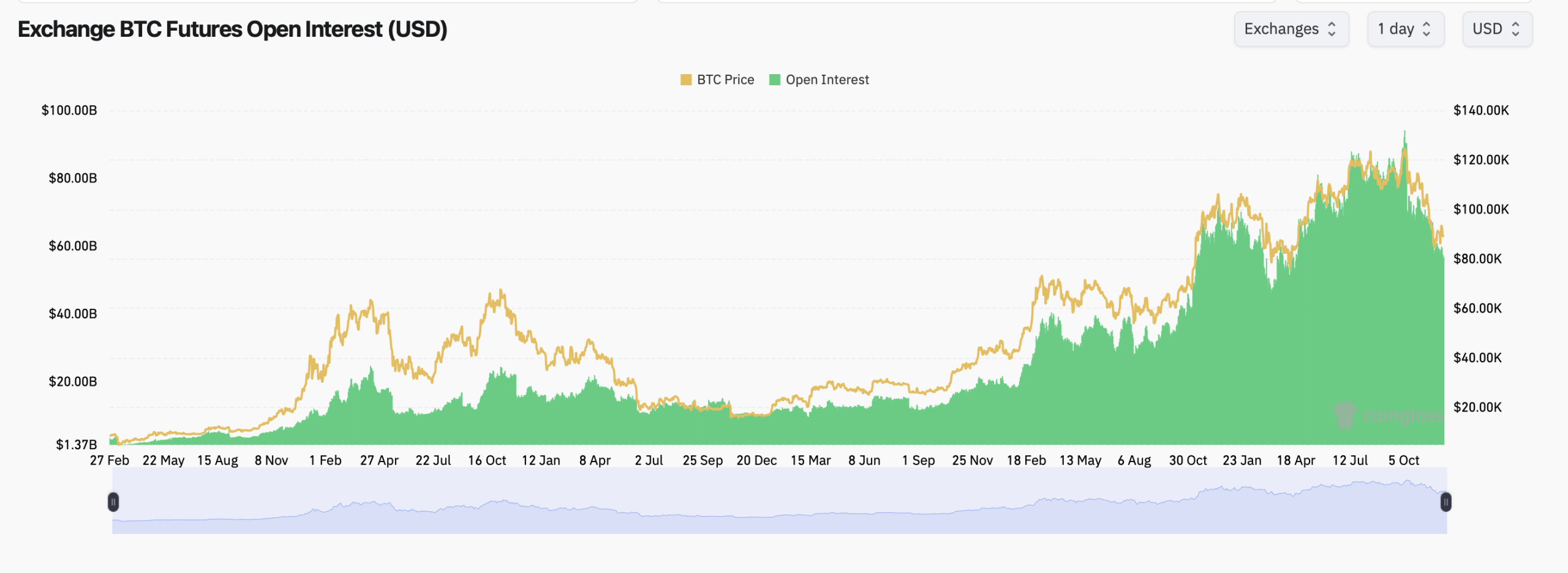

Coinglass.com stats show, bitcoin futures open interest remains elevated but directionally fragile. Total bitcoin futures open interest (OI) is sitting at 637,700 BTC ($56.82 billion), down 1.41% over the past 24 hours, suggesting traders have been quietly trimming exposure before the next week. CME leads the board today with 124,440 BTC ($11.08 billion), though its 24-hour OI slipped 0.61%, another hint that professional money may be tiptoeing away from risk.

Binance, the world’s largest crypto exchange by volume, follows closely with 121,640 BTC ($10.83 billion), showing a light 0.21% decline in daily OI and a modest positive 0.25% gain over the last four hours. Bybit’s futures book, at 63,250 BTC ($5.63 billion), slid 0.93% over 24 hours, while OKX logged a 0.62% drop despite a slight intraday uptick earlier in the morning. Gate was the lone standout with a 2.07% OI boost on the day, earning temporary bragging rights.

Still, the broader futures curve isn’t exactly screaming optimism. The long-term view shows OI retreating significantly from its recent highs, a pattern often tied to fading appetite for leverage when price momentum stalls or continues to remain bearish. If traders were hoping for an early-December squeeze to reignite bullish impulse, the data suggests someone forgot to light the match.

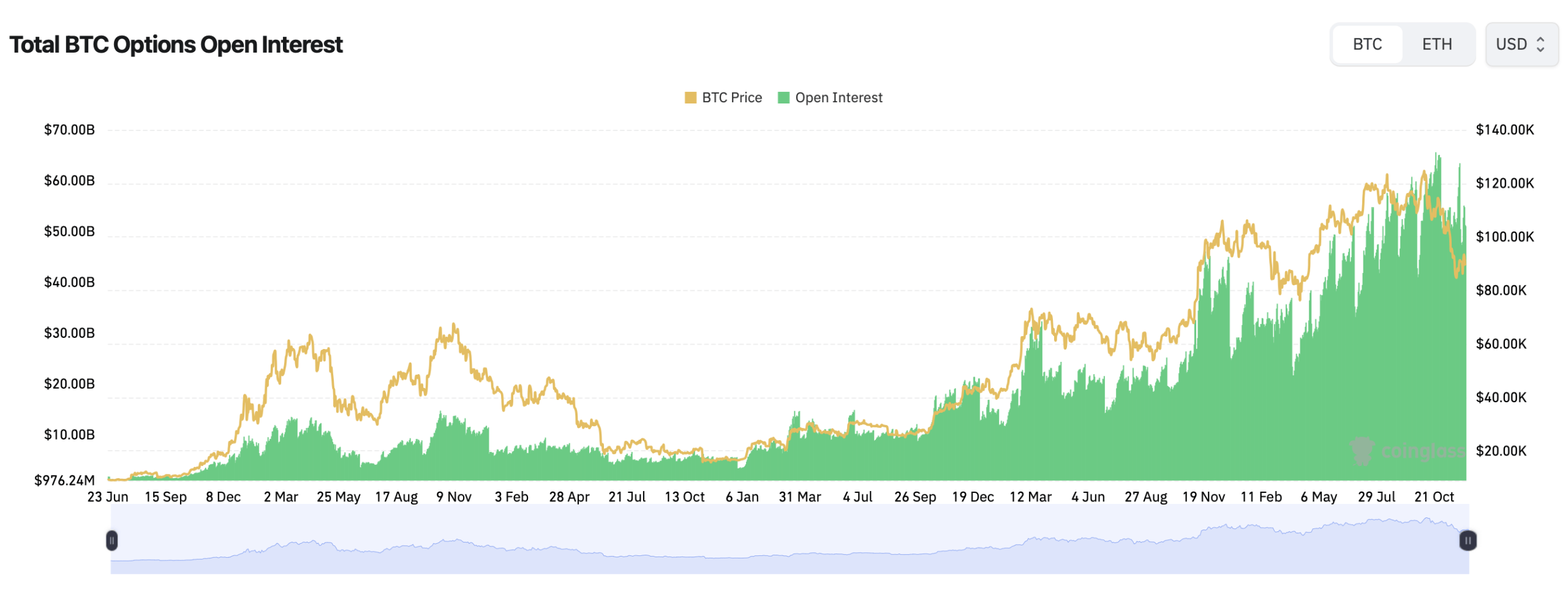

Options markets are equally lively — and conflicted. Calls continue to dominate open interest at 64.16%, with 333,190 BTC in call exposure versus 186,160 BTC in puts. Over the last day, call volume held 55.56%, while puts captured 44.44%, indicating traders are still willing to dream, just not loudly.

Deribit’s open interest leaderboard is a shrine to strike-price optimism: contracts from $100,000 to $118,000 still lead the rankings, with the $100,000 strike commanding 17,774 BTC. Yet short-dated volume is clustering around $87,000 to $91,000 range, reflecting hedging pressure as traders recalibrate to bitcoin’s current snooze-level price action.

Max-pain levels across the major options venues paint the December battlefield in bright, unforgiving neon, with Deribit anchoring around $90,000 as notional value spikes sharply into the Dec. 26 expiry. Over on Binance, max pain drifts into the mid-$110,000 range for longer-dated contracts, even though December positioning still hovers just under the six-figure mark.

Read more: Bitcoin Price Watch: Bulls Stall Below $90K While Bears Lick Their Chops

OKX clusters between $90,000 and $93,000, forming that familiar year-end hump where traders’ hopes traditionally go to be gently steamrolled. Put another way, max pain levels remain well above spot, but the gravitational pull of reality — and some very poorly timed leverage — isn’t exactly helping bullish traders fulfill their holiday wish lists.

Zooming back out, the historical heat maps add further context. Q4 has ranged from euphoric blowouts to Grinch-level disappointments, and 2025’s –22.01% is far closer to the latter category. Monthly returns for December have been notoriously bipolar across the years — from +46.92% in 2020 to –36.57% in 2018 — but this particular December is currently leaning toward the “bah humbug” end of the spectrum.

Despite all this, derivatives traders are nothing if not resilient. High call OI at frothy strikes means there are still plenty of moon-targeting optimists out there, even if the charts suggest someone stole the fuel. And with bitcoin wobbling under $88,000, the once-whispered “Santa Rally” looks increasingly like a myth — or at best, a seasonal rumor.

FAQ ❓

- What’s driving bitcoin’s weakness below $88,000 today?Traders unwound leveraged positions across futures markets, putting immediate pressure on spot.

- How are global bitcoin futures reacting this weekend?Open interest dipped across key exchanges, signaling reduced appetite for risk heading into mid-December.

- What do options traders expect for bitcoin’s near-term direction?Calls still dominate open interest, but max-pain levels suggest spot could stay pinned lower.

- Is a Santa Rally likely for bitcoin this year?Based on Q4 performance and derivatives flow, a strong year-end rebound looks increasingly unlikely.

news.bitcoin.com

news.bitcoin.com