The U.S. Federal Reserve is currently conducting its two-day meeting to determine the direction of the country’s interest rates.

BTC Holds Steady Ahead of Critical Fed Interest Rate Decision

Most experts are predicting the Fed will hold rates at the 4.25-4.50% level when central bank Chairman Jerome Powell emerges from the two-day Federal Open Market Committee (FOMC) meeting tomorrow. But U.S. President Donald Trump is the wildcard in that prediction, as he has applied immense pressure on Powell to cut rates or resign. Stock indices were mixed and bitcoin was mostly flat at $117K on Tuesday, as markets braced for what will likely be a politically charged day, when Powell addresses the nation at his scheduled press conference tomorrow.

Trump hasn’t minced words about his feelings towards the Fed chair. Powell has frequently been the butt of Trump’s jokes and insults. The president turned it up a notch, when just last week, he personally toured the Fed headquarters and publicly scolded the 72-year-old former lawyer and investment banker for mismanaging a $2.5 billion renovation of the central bank’s buildings.

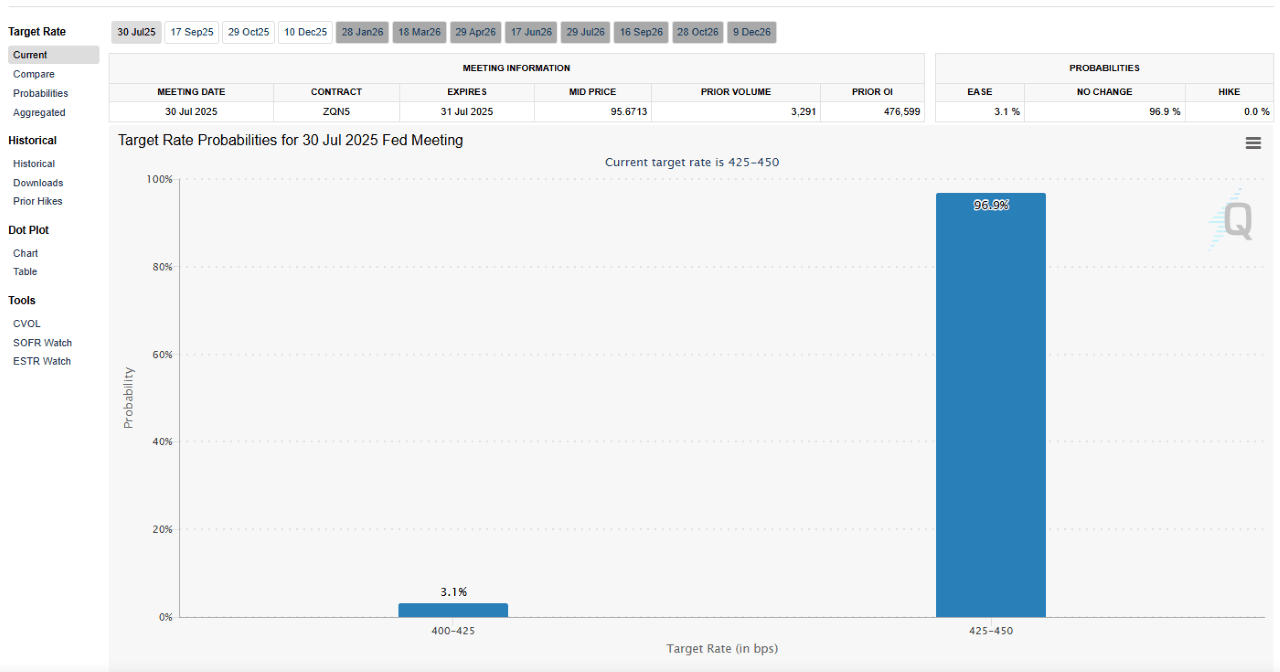

But despite the pressure, Powell appears to be steadfast in holding rates at their current level. With inflation at 2.7%, which is higher than the Fed’s 2.0% target, 97% of experts have concluded that it’s more or less assured that the central bank won’t cut rates, according to the CME Fedwatch tool. The subdued price action in both stocks and bitcoin seems to agree with that consensus.

Overview of Market Metrics

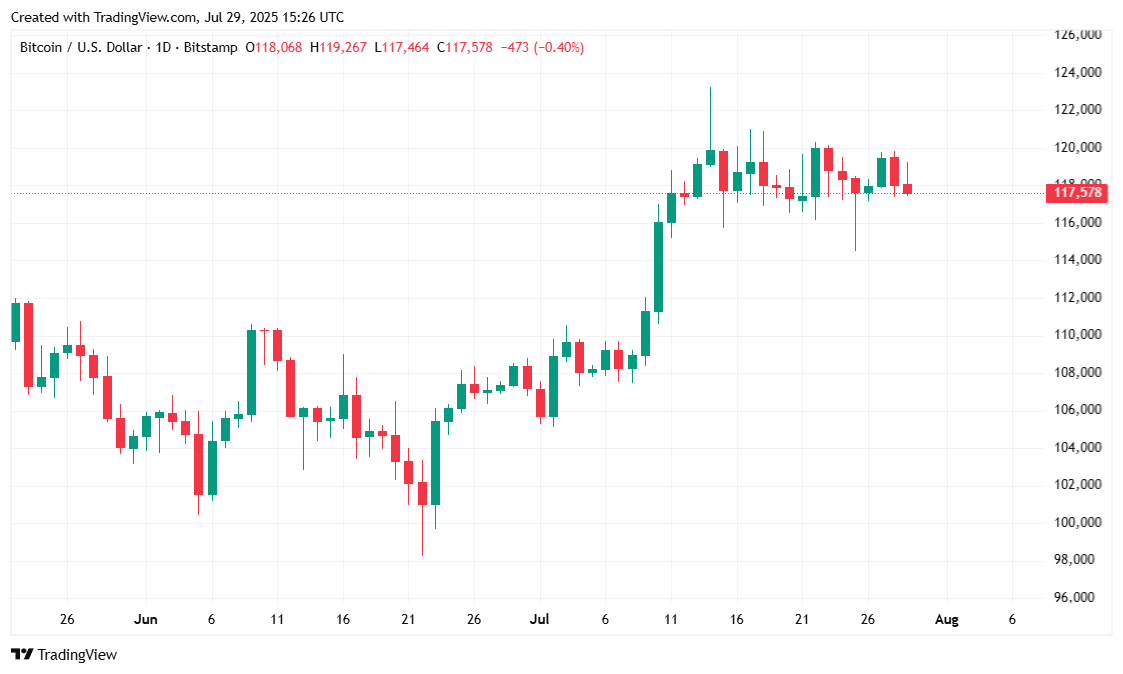

Bitcoin was quoted at $117,607.17 at the time of writing, a 0.55% decrease over 24 hours and a 1.21% depreciation for the week. BTC has traded between $117,441.44 and $119,273.87 for the past day according to Coinmarketcap.

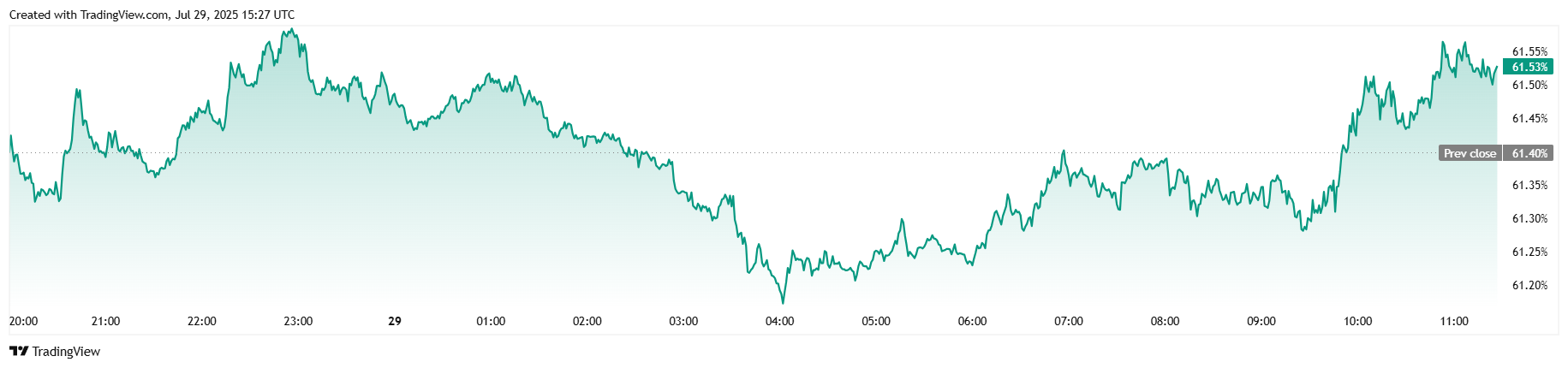

Twenty-four-hour trading volume rose 4.26% to $66.58 billion, but market capitalization dipped 0.59% to $2.34 trillion. BTC dominance inched up 0.22% and stood at 61.53% at the time of reporting.

Total bitcoin futures open interest fell 2.55% to $83.60 billion over 24 hours according to Coinglass. Twenty-four-hour bitcoin liquidations stood at a relatively low total of $3.56 million. Most of that came from bulls getting wiped out to the tune of $3.38 million. Bears with short positions had minimal liquidations of only $175,840.

news.bitcoin.com

news.bitcoin.com