According to Sean Bill, chief investment officer at BSTR, only a few companies will ultimately stand out in the bitcoin treasury arena—and he’s placing his bet on Bitcoin Standard Treasury Company (BSTR) to be one of them.

BSTR’s Aggressive Bitcoin Accumulation and Dormant Reserve Strategy

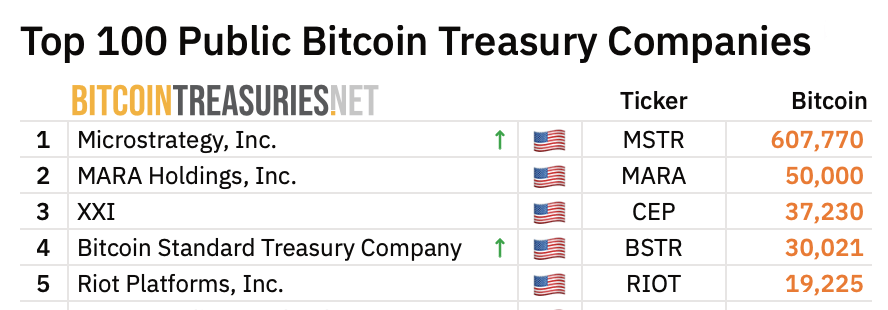

Just last week, BSTR kicked things off with a stash of more than 30,000 bitcoins. Data from bitcointreasuries.net shows BSTR now ranks as the fourth-largest holder of BTC among public corporate treasuries. On Tuesday, Sean Bill shared insights into the company’s approach on the Bloomberg Crypto show and explained what sets their game plan apart.

Bill argues that bitcoin goes far beyond being a mere bet on price—it has real-world utility. One example, he says, is generating yield by using bitcoin in financial tools like bitcoin revolvers, especially with big-name institutions like Blackrock. He also highlights a newer use case: putting bitcoin up as collateral in insurance markets.

While this isn’t yet widespread among traditional insurers, he points to the Caribbean insurance sector as an early adopter, where bitcoin is already supporting policy underwriting—a corner of the market he views as brimming with possibilities.

Bill also explained to the Bloomberg hosts that some financial firms have already begun accepting bitcoin as collateral for mortgages. Borrowers can pledge their bitcoin, receive upfront cash, and secure the loan using both the digital asset and the property—typically at a 50% loan-to-value ratio. Traditional finance (TradFi) institutions, he says, are still behind in adapting to this trend.

When asked “Why does the market need more bitcoin treasury companies? Bill said, “I’d agree that only a few will ultimately win here. But we believe BSTR will be one of them. We’re showing up with a bulldozer and a permit to clear-cut bitcoin. We’re opening in the fourth spot, but we think we’ll quickly slingshot into number two. That’s our mission,” the BSTR CIO remarked.

The BSTR executive added:

“We can issue debt at 1%, buy bitcoin, and as bitcoin appreciates, it naturally de-leverages our balance sheet. That’s a unique capability available to bitcoin treasuries that most companies don’t have.”

BSTR aims to be the top choice for firms needing bitcoin liquidity or credit. “Over time, we aim to become the preferred counterparty for financial institutions. If a bank or finance firm needs a bitcoin revolver, we want BSTR to be their first call,” he said.

Toward the end of the interview, Bill highlights that some of the earliest and most influential figures in Bitcoin’s history are backing their company—including Adam Back, whose Hashcash invention was directly cited by Satoshi Nakamoto in the original Bitcoin white paper. He describes Back as “patient zero” of the Bitcoin ecosystem, underscoring the depth of the firm’s connections.

He adds that these relationships give the company a strategic advantage in accessing significant amounts of dormant bitcoin—holdings that are not currently on exchanges. With the right network and approach, Bill said he believes they can unlock this untapped supply.

news.bitcoin.com

news.bitcoin.com