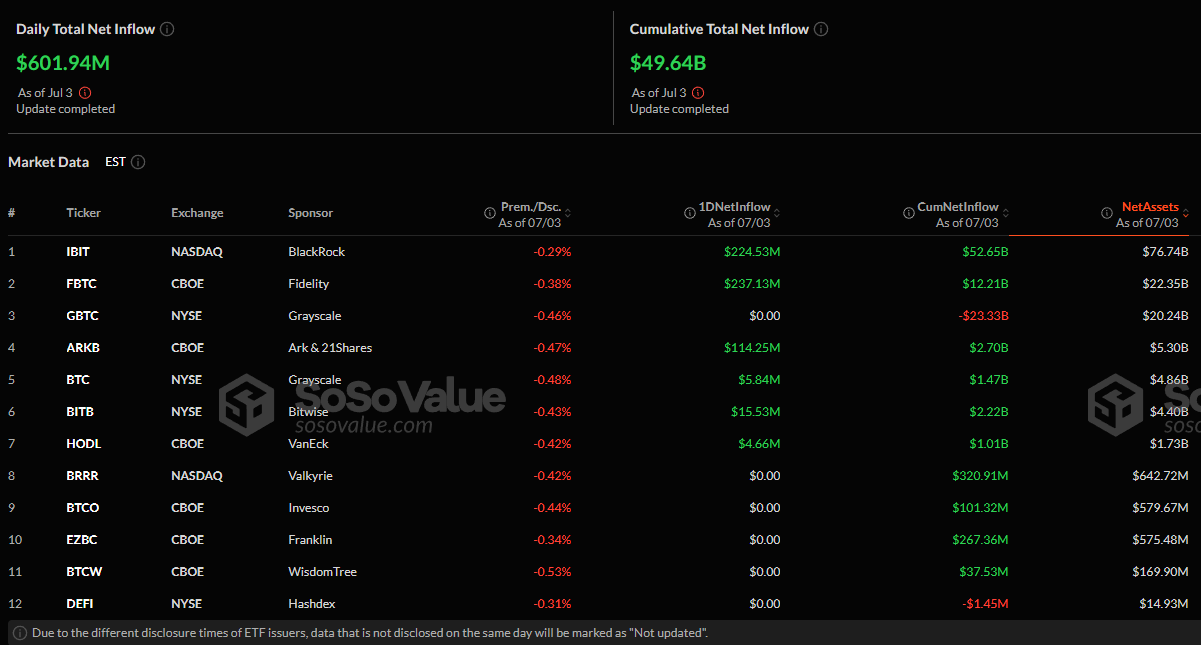

Spot Bitcoin ETFs just had one of their best-ever daily results. Over $602 million in net inflows came back into the industry on July 3, demonstrating the resurgence of investor confidence and the new demand for capital to be exposed to Bitcoin through regulated instruments.

ETF market wakes up

Fidelity's FBTC ETF spearheaded the movement with a staggering $237 million daily inflow, solidifying its position as the industry leader in Bitcoin funds. Bitwise's BITB recorded $15.53 million, while Ark's ARKB ETF came in second with $114 million. Even the Bitcoin Trust (GBTC) offered by Grayscale, which has a history of redemptions, stabilized with a small inflow of $5.84 million.

At the same time, Ethereum ETFs saw a lot of activity, bringing in a net inflow of $149 million. Grayscale's ETHE was the only significant flaw on the sheet as it lost $5.35 million due to outflows.

Bitcoin's performance

Bitcoin's push toward the psychologically crucial $110,000 price level corresponds to this spike in ETF inflows. Indicating the possibility of an accelerated bullish move, the chart displays Bitcoin recently breaking above the descending resistance trendline. But the momentum of the price is shaky.

There is potential for additional gains but also a higher risk of short-term profit-taking as the RSI approaches moderately overbought levels close to 57. All things considered, one of the main structural tailwinds for Bitcoin is the participation of spot ETFs. Bitcoin ETF net assets have reached a record $137 billion, or roughly 63.3% of the cryptocurrency's total market capitalization, thanks to cumulative ETF net inflows of over $3 billion in the last two weeks alone.

The market is currently keeping an eye on whether these institutional flows can maintain enough momentum to propel Bitcoin past the resistance level between $110,000 and $115,000. In that case, the next leg of bullish price discovery could be unlocked, and the rally could continue toward $120,000.

A healthy retracement into the $100,000-$103,000 range, on the other hand, is still feasible if buying slows down. Since macroeconomic catalysts and ETF inflows are the main forces influencing Bitcoin's future, investors should closely monitor these developments.

u.today

u.today