The heated stock market finally cooled after reaching multiple all-time highs, and bitcoin went down with it.

Bitcoin Slips as Stock Markets Slide

Stocks finally ended their record-breaking rally Tuesday morning as the S&P 500 and Nasdaq both fell 0.36% and 1.10% respectively. Bitcoin, which has been treading water for more than a week, also edged lower, dipping 1.50% at the time of writing. The lone star was the Dow which maintained its upward momentum, climbing 0.72% to reach 44,410.13 points, which is still more than 600 points shy of its December 2024 record of more than 45,000 points.

Tesla (Nasdaq: TSLA) led the stock market’s downward slide, tumbling 5.15% after U.S. President Donald Trump wrote a scathing post on Truth Social about the company’s CEO Elon Musk and the government subsidies Tesla has received.

“Elon may get more subsidy than any human being in history, by far, and without subsidies, Elon would probably have to close up shop and head back home to South Africa,” Trump wrote. “Perhaps we should have DOGE take a good, hard look at this? BIG MONEY TO BE SAVED!!!”

The friendship between Trump and Musk took an abrupt turn after Musk, who is also the world’s richest man, criticized the president’s “big, beautiful bill” which the Committee for a Responsible Federal Budget says may add $3-5 trillion to the country’s $36 trillion debt.

“It is obvious with the insane spending of this bill, which increases the debt ceiling by a record FIVE TRILLION DOLLARS that we live in a one-party country – the PORKY PIG PARTY!!” Musk wrote on X.

Overview of Market Metrics

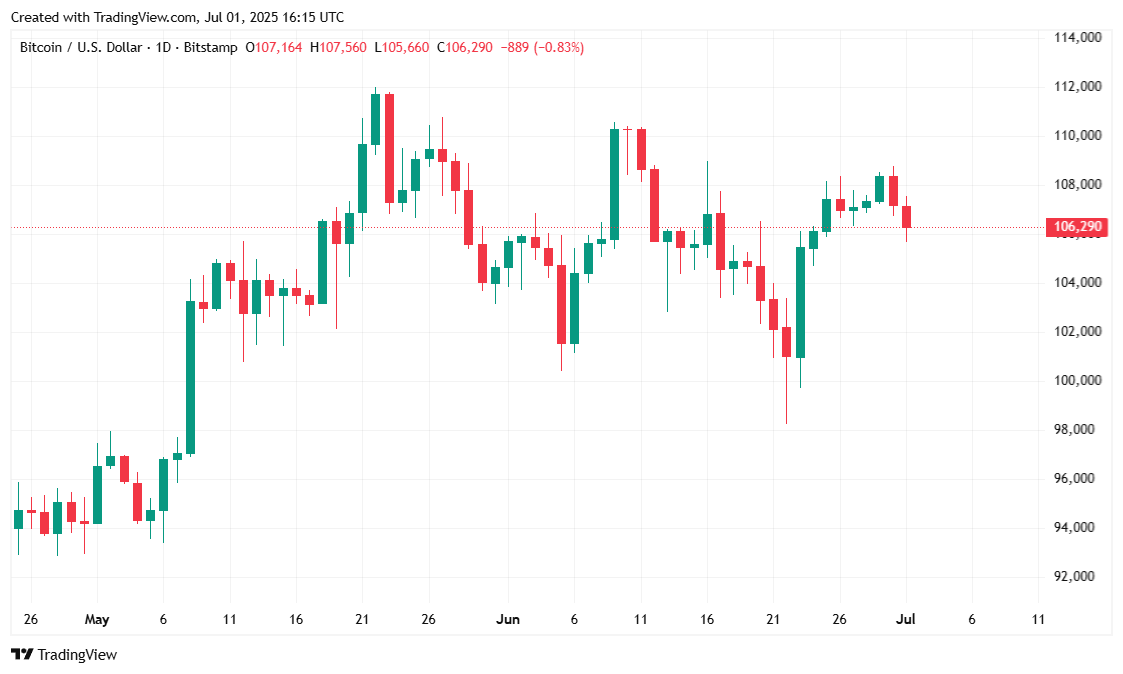

Bitcoin’s price fluctuated between $105,689.17 and $107,855.98 in the last 24 hours and is currently trading at $106,002.05 at the time of reporting, down 1.50% according to Coinmarketcap. The cryptocurrency remains up slightly by 0.56% over a seven-day period.

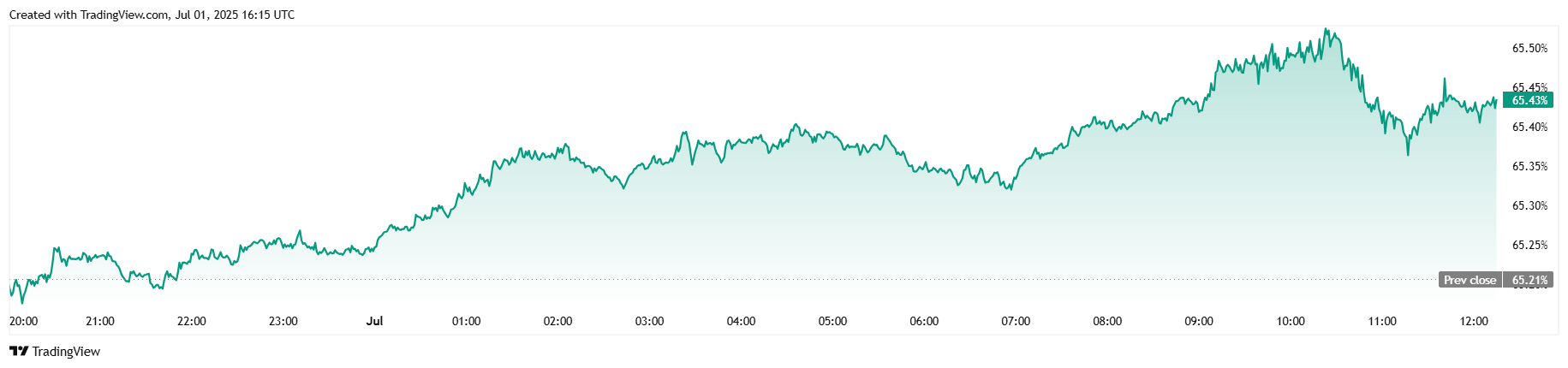

Trading volume rose 8.61% to $44.44.8 billion and BTC’s market capitalization dipped 1.48% to $2.1 trillion, which was better than the broader crypto sector whose market cap fell by 1.61%. That difference is reflected in the bitcoin dominance ratio which climbed 0.32% to 65.43%.

The value of open futures contracts fell 2.78% to $69.92 billion, indicating a decrease in speculative appetite. Coinglass data shows $60 million in total liquidations over the past 24 hours, with the bulk of liquidations, or $55.08 million, coming from long positions while bearish short sellers had $4.93 million liquidated.

news.bitcoin.com

news.bitcoin.com