Bitcoin’s price has climbed back above $105,000 after a recent sharp drop, but the key $110,000 level remains a critical resistance zone.

The market is showing mixed signals, with underlying on-chain metrics suggesting strength, while a high number of short-term holders in profit poses a risk.

On-Chain Metrics Show Both Strength and Risk

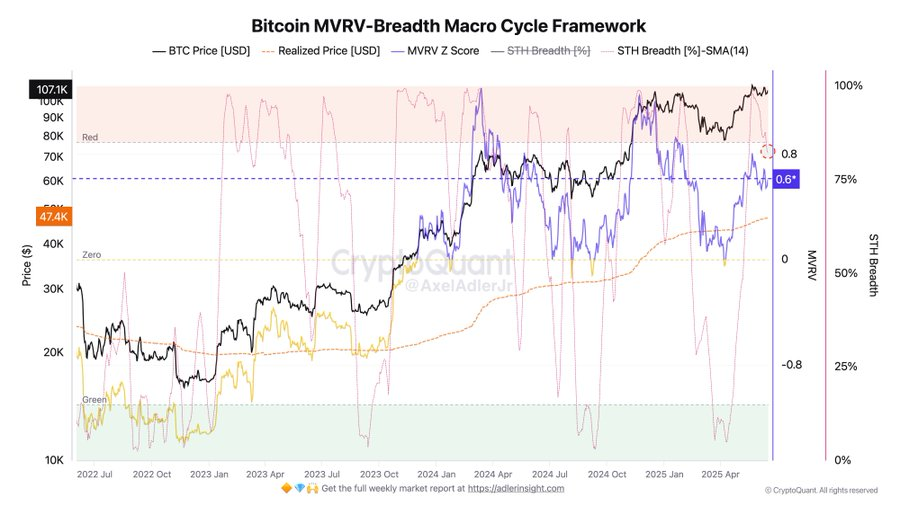

According to an analyst, market indicators show mixed signals. The MVRV Z-score, which helps measure if Bitcoin is overvalued or undervalued, currently stands at +0.6. This suggests buying strength in the market without signs of overheating.

Meanwhile, 83% of short-term Bitcoin holders are still in profit. “The market remains in a bullish trend with moderate overbought levels and strong interest from short-term holders,” the analyst wrote. But he warned that with so many short-term holders in profit, there’s a higher risk of a price dip around $110K if people begin selling.

Bitcoin Is Currently Stuck in a Range

Between June 9 and 11, BTC tried to rise above the $110k mark. However, it failed. For now, Bitcoin remains in a sideways range between $104,000 and $110,000. According to an analyst any pullback from current levels would likely be a temporary correction within a larger uptrend.

While Bitcoin is possibly in the final stages of this bull cycle, there’s still room for further price increases. Some models suggest Bitcoin could reach as high as $130,000 in this cycle. But before that happens, the market may see short dips, especially around resistance areas.

At the moment, key levels to watch for Bitcoin are resistance at $108,822 and $110,550, while support sits at $106,220 and $102,780. If the price breaks above resistance, it could open the door for a move toward $113,000. On the other hand, if Bitcoin drops below support, it may slide back into the $92,800 to $99,200 range, which the analyst has marked as a possible pullback zone.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com