-

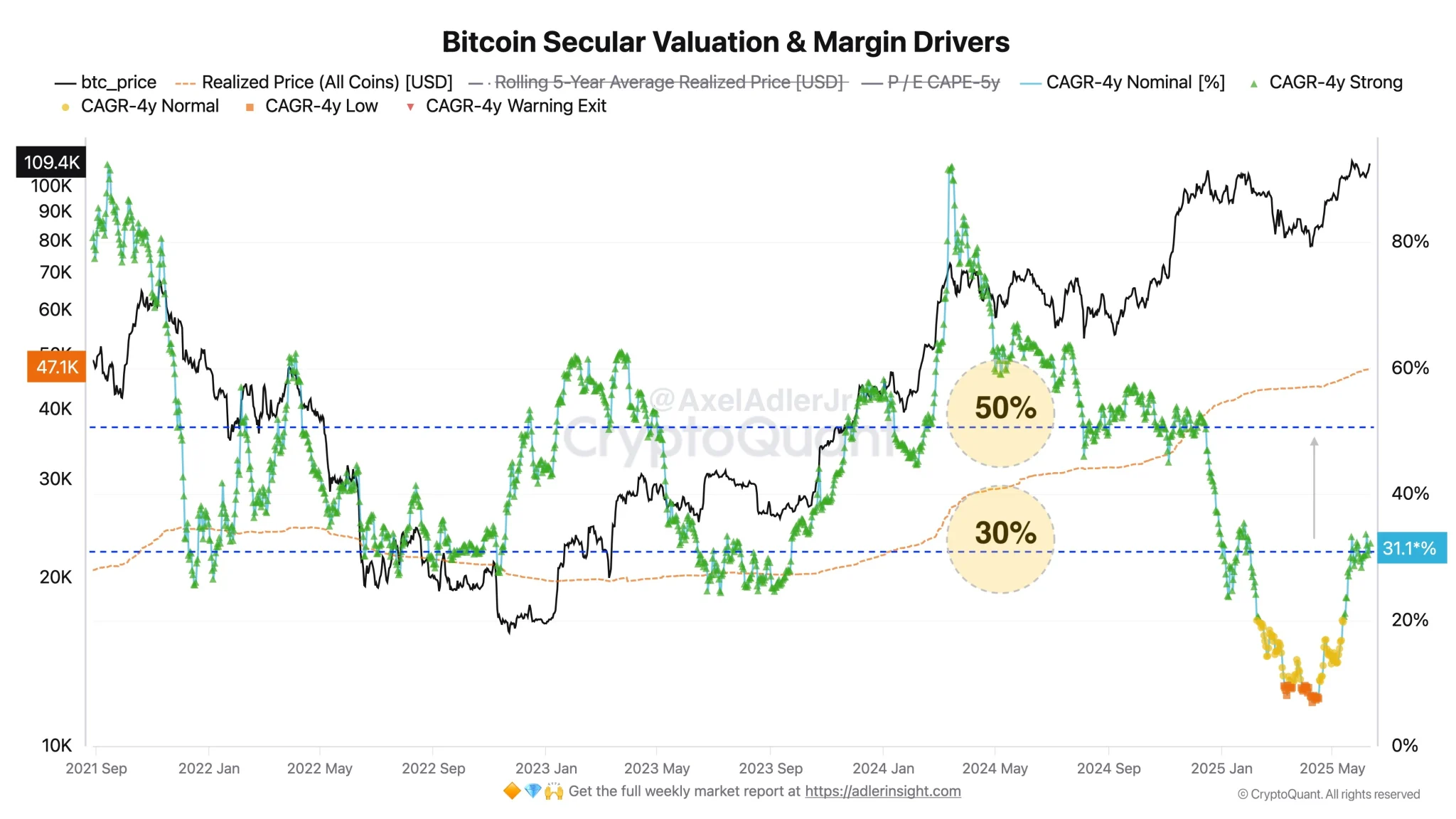

Bitcoin’s CAGR jumps from 7% to 31% as price rallies 46% in under two months, signaling renewed long-term bullish momentum.

-

Analyst Axel Adler Jr forecasts BTC could hit $168K by October 2025 if leverage and futures momentum continue.

Bitcoin’s strong performance in April and May has reignited hopes for a major bullish breakout. From April 9 to May 22, the Bitcoin price surged by 46.32%, including an 18.48% rally between May 5 and 22. The price recovery has also pushed its Compound Annual Growth Rate (CAGR) higher, signaling renewed market optimism.

BTC CAGR Spikes as Price Recovers

Crypto analyst Axel Adler Jr recently highlighted a notable spike in Bitcoin’s 4-year CAGR. In April 2025, it had dropped to just 7%, reflecting Bitcoin’s volatile start to the year. In January, BTC grew by 9.54%, but the following months saw sharp declines—down 17.5% in February and 2.19% in March. The price even touched a low of $74,446.79 in April.

However, the market rebounded strongly. By June 2025, Adler reports that Bitcoin’s CAGR climbed back to 31%.

“This sharp rebound shows how quickly the long-term trend can shift when strong buyer momentum enters the market,” Adler stated.

Yet, he notes that 31% CAGR is still below historical bull market peaks, implying more room for growth.

$168K BTC by October?

Axel Adler Jr forecasts a possible Bitcoin price target of $168,000 by October 2025, assuming momentum in the futures market and leverage continues.

He bases this projection on accelerating growth and historical patterns observed during prior bull runs.

Adjusting for Risk: CAGR vs. Standard Deviation

In the discussion thread, X user Manu suggested a more refined way to interpret CAGR—by dividing it by the standard deviation to eliminate volatility and highlight risk-adjusted returns.

Adler agreed with the approach, stating it offers a cleaner view of market performance, but also emphasized another critical point:

“The real inflection point comes when investors start taking profits based on expected returns.”

According to him, the risk of a bear market grows once BTC trading volume crosses 1 million coins, as large-scale profit-taking can disrupt supply-demand balance.

coinpedia.org

coinpedia.org