Bitcoin has faced significant pressure recently, with the price falling below $108,000 after struggling to maintain $110,000 as a support level.

This drop follows broader market factors, including the rise in the US Consumer Price Index (CPI) to 2.4%. Despite these challenges, investor sentiment remains bullish, which could fuel a price recovery.

Bitcoin Has The Investors’ Backing

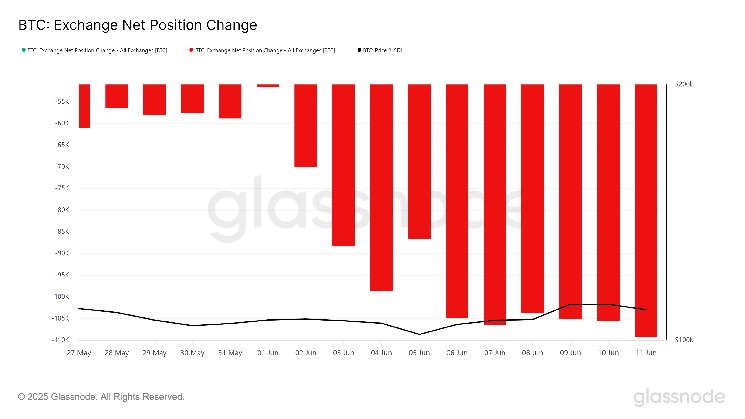

Bitcoin’s market sentiment is still dominated by optimism, as exchange net positions show consistent outflows throughout the month. Despite failing to breach the $110,000 barrier, investors continue to add to their BTC holdings, expecting further price gains. This buying pressure signals confidence in Bitcoin’s long-term potential despite short-term setbacks.

Although Bitcoin has been unable to establish support at $110,000, the lack of significant selling activity is a bullish indicator. Investors are accumulating coins heavily, which suggests that investors are confident in Bitcoin’s price recovery despite the recent challenges.

Bitcoin’s macro momentum remains strong, supported by key pricing models such as the 111-day moving average (DMA), 200 DMA, and 365 DMA. These levels have historically acted as strong indicators of market momentum. Currently, Bitcoin is trading well above these levels, which suggests the cryptocurrency has built notable market strength.

This significant deviation from the key moving averages signals a potential bullish turn in the near future. While short-term fluctuations are possible, the long-term outlook for Bitcoin remains positive, supported by these key indicators. As a result, investors are hopeful that Bitcoin’s price will recover, especially once it establishes a stable support level.

BTC Price Will Bounce Back

Bitcoin’s price is currently down by 2.3% over the last 24 hours, trading at $107,594. The dip occurred after the US CPI report showed a 2.4% year-over-year increase, with a 0.1% rise in May. As a result, Bitcoin fell below $108,000, but this decline appears temporary.

The likelihood of Bitcoin continuing its decline is low. With bullish sentiment from investors and the absence of large-scale selling, Bitcoin is expected to recover before the week ends. Breaching the $108,000 level would push Bitcoin toward $110,000. If $110,000 is secured as support, Bitcoin could inch closer to its all-time high of $111,980.

However, should the broader macroeconomic conditions worsen, Bitcoin may face further declines. If it falls below the support of $106,265, Bitcoin could test lower levels around $105,000. A break below this support would invalidate the bullish outlook and could signal further weakness in the market.

beincrypto.com

beincrypto.com