Bitcoin’s recent price swings have kicked off a fresh round of debate over its long-term value, particularly after a widely discussed social media post from attorney John E. Deaton.

In a tweet shared just ahead of the upcoming Bitcoin Conference, Deaton laid out a possible, and rather volatile, price scenario: Bitcoin surging up to $125,000, only to then see a sharp drop back down to around $112,000.

BTC Crystal Ball:

— John E Deaton (@JohnEDeaton1) May 26, 2025

BTC hits $125K during the BTC Conference and then crashes to $112K and @PeterSchiff says:

“I told you so! Bitcoin is NOT a Store of Value and Saylor is a fool.” https://t.co/A7u9rElFeY

He predicted such a move would almost certainly prompt renewed, sharp criticism from noted Bitcoin skeptics like Peter Schiff. Schiff has long hammered the argument that the digital asset lacks the fundamental signs of an actual, reliable store of value. Beyond just price, Deaton also spotlighted what he sees as a more profound shift in institutional behavior. He noted that global central banks are quietly buying up gold at a record clip, gobbling up more than 1,000 metric tons annually; a figure more than twice the historical average.

Deaton: Central Banks Pile Into Gold as Dollar Confidence Wanes

John E. Deaton’s comments on central banks aggressively accumulating gold line up with broader macroeconomic signals many are watching. He observed that these powerful institutions are visibly increasing their gold reserves just as confidence in the U.S. dollar appears to be weakening on the global stage.

Peter Schiff has previously pointed to this very pattern as a clear signal of a flight towards historically resilient, tangible assets during times of economic uncertainty or currency concerns.

This isn’t a brand new trend, either. Since way back in 2014, central banks, including notable moves by Russia’s, have strategically used gold to help insulate their economies against international sanctions and the impacts of geopolitical isolation. It seems others are now clearly following suit, ramping up their gold purchases despite (or perhaps because of) recent tariff announcements and ongoing economic uncertainty.

Bitcoin Recovers to $109K After Weekend Dip; Saylor Still Buying

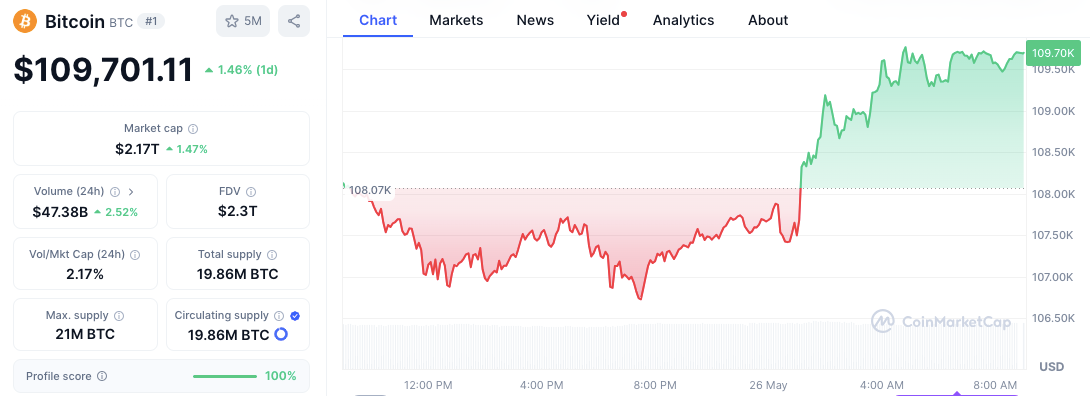

As for Bitcoin itself, following a minor dip over the weekend, the cryptocurrency regained its upward momentum. At the time of writing, Bitcoin (BTC) was climbing to $109,701.11, marking a 1.46% daily gain. According to data from CoinMarketCap, this recovery started after BTC had briefly dropped below the $107,000 mark on the previous day.

Trading volume for Bitcoin also saw an increase, reaching $47.38 billion, up 2.52% over the 24-hour period, while its overall market capitalization rose to $2.17 trillion. The price held firm around the $109,500 level into Monday morning.

Saylor Hints at More BTC Buys

As Bitcoin’s price recovered, Michael Saylor, Executive Chairman of Strategy (often referred to as “Strategy” in short form by market watchers), publicly reaffirmed his unwavering commitment to the asset.

In a characteristically bold statement on X, Saylor reiterated, “I only buy Bitcoin with money I can’t afford to lose,” a comment that underscores his long-standing, aggressive investment approach towards BTC.

I only buy bitcoin with money I can't afford to lose. pic.twitter.com/h7pnFB8yvU

— Michael Saylor (@saylor) May 25, 2025

With Strategy already holding a massive stash of over 200,000 BTC, Saylor’s comment strongly indicates that further Bitcoin purchases could be on the cards, likely made using what the company deems non-essential corporate capital.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com