After a sharp sell-off that forced the price into an obviously bearish structure, $XRP is still attempting to find stable ground. According to the chart, $XRP is still trading inside a larger declining channel and is below important moving averages that are sloping downward. While volume spikes during the decline indicate forced selling and liquidations played a significant role in the move, the recent bounce has been modest and more in line with a relief move than a confirmed reversal.

Network stable

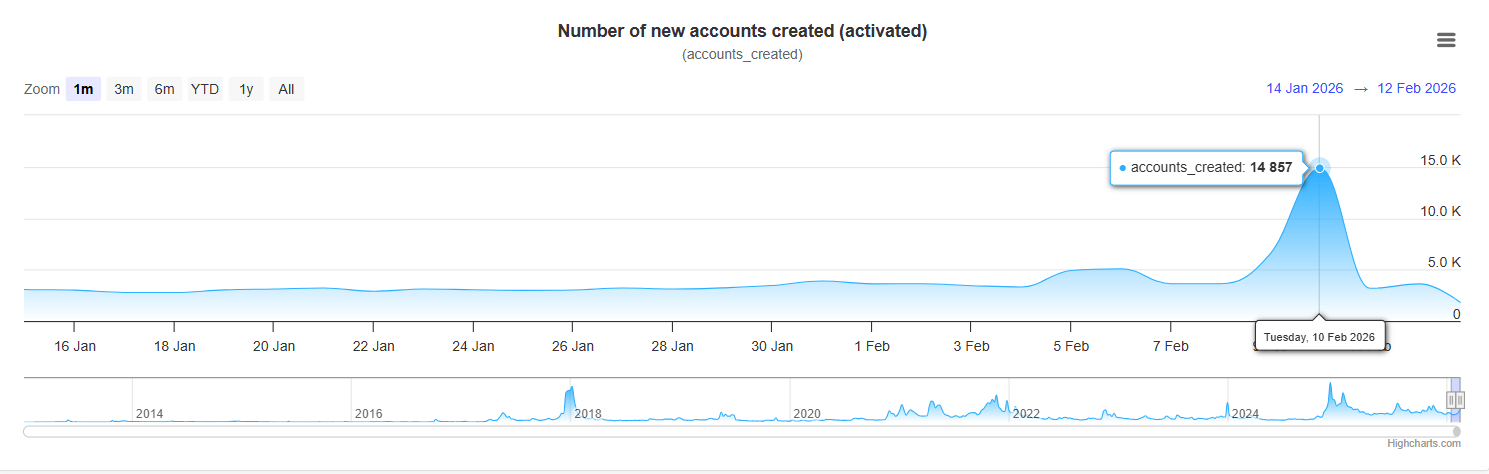

Simultaneously, the $XRP Ledger is displaying a completely different signal: a 450% increase in accounts. It appears to be an adoption story on paper because there are more users, wallets and activities. Investors should exercise caution when drawing that conclusion, though. "Accounts created" is one of the easiest metrics to inflate, and the gap between account growth and price weakness raises a legitimate question: is this real demand or automated behavior?

The spike may be real for several reasons. Since users frequently switch between exchanges, self-custody and various platforms during times of market volatility, $XRP has a long history of use as a transfer and liquidity asset.

A spike in account creation may be a result of onboarding linked to actual usage, such as payment rails, custodial integrations or speculative inflows ahead of market catalysts if activity is also increasing in successful transactions, transaction counts and payment volume.

Potential reasoning

However, a plausible explanation for automation also exists. Numerous factors, such as airdrop farming, referral exploitation, testing infrastructure, wash-like transaction patterns intended to mimic growth or straightforward spam can cause bots to generate large numbers of accounts.

When this occurs, account creation spikes, but the following do not: quality metric-like consistent fee spending across numerous distinct entities, a variety of transaction types, growing median transfer sizes and sustained active addresses.

Observe for signs of confirmation, investors. Follow-through in daily active accounts, a consistent high payment volume (rather than one-time spikes) and a wider distribution of activity rather than a few clusters are all indicators that the account spike is actually adoption.

thecryptobasic.com

thecryptobasic.com

finbold.com

finbold.com

coindesk.com

coindesk.com