Cardano trades below the Ichimoku cloud as the market tests immediate support, while mixed futures flows drive volatility.

Cardano ($ADA) is trading at $0.2617, down 0.23% on the day, reflecting a modest pullback as short-term momentum cools. Market activity is heavily driven by derivatives, with 24-hour futures volume reaching $842.74 million compared to $86.88 million in spot volume. Open interest stands at $421.62 million, a structure that can intensify volatility if the price begins to move aggressively in either direction.

Recent performance presents a mixed picture. Specifically, $ADA is down 0.80% over the past four hours and 0.27% over the past 24 hours, yet remains up 6.87% over the past seven days.

However, the broader trend remains under pressure, with losses of 37.90% over 30 days, 47.49% over 90 days, and 71.59% across 180 days. Year-to-date performance shows a 21.37% decline, while the one-year change shows a 67.26% drop. What’s next for Cardano?

Cardano Price Analysis

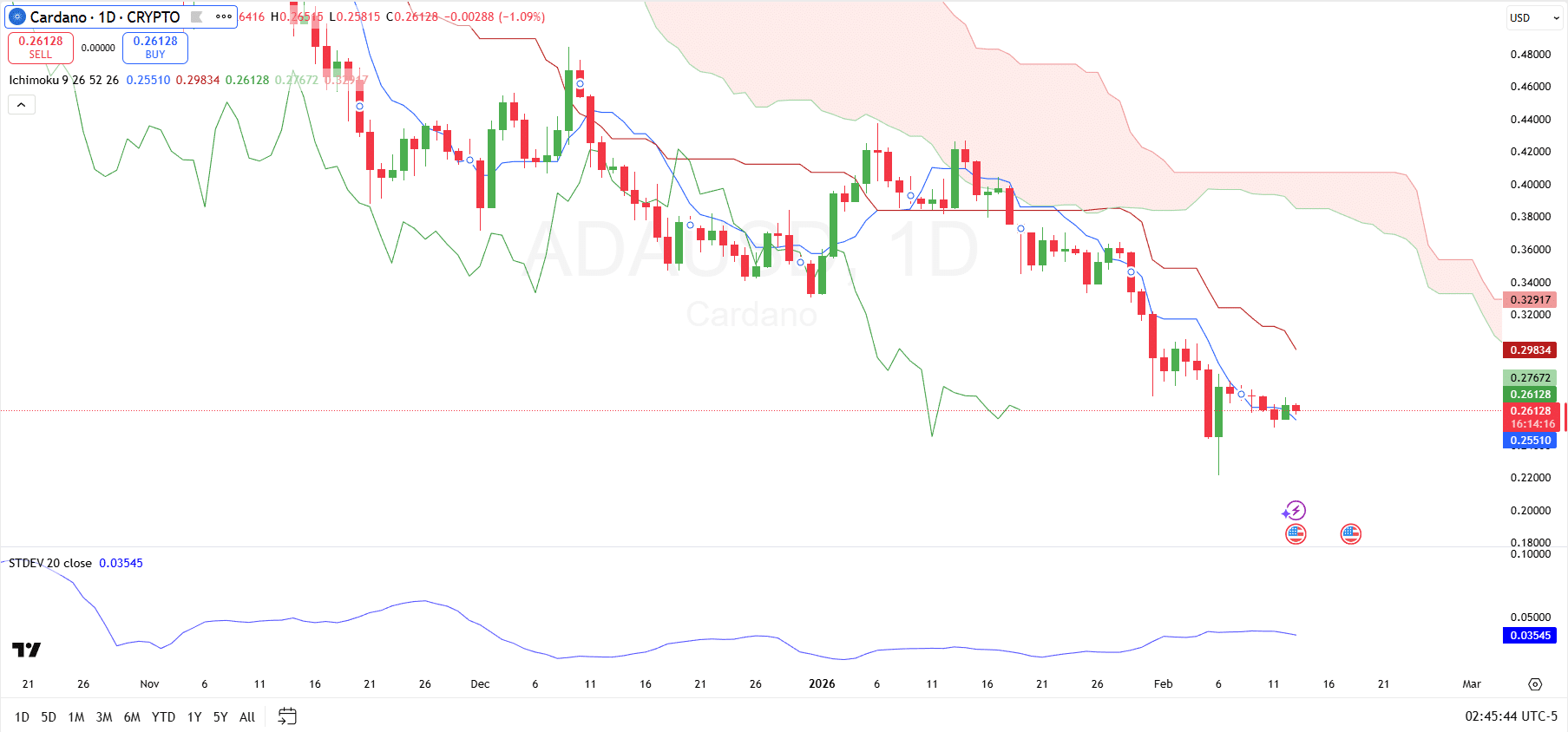

Cardano remained under pressure on the daily chart. Nearby support emerged first at the day’s low around $0.2583, with a deeper technical cushion aligning with the Ichimoku conversion line near $0.25510. If that area fails to hold, the chart leaves $ADA leaning on the $0.24 zone as the next visible defense before the selloff structure risks extending.

Overhead, resistance remained tightly above spot. The first hurdle sat around the lower boundary of the Ichimoku cloud near $0.27672, followed by the baseline, or Kijun-sen, near $0.29834. The cloud thickened higher up toward roughly $0.32917, which stood out as a larger barrier and a level that $ADA would likely need to reclaim before the broader trend could flip neutral rather than bearish.

In practical terms, rallies that stall below $0.27672 keep the market under immediate resistance. A push back through $0.29834 would be the first stronger signal that sellers are losing control. Volatility also appeared to be declining, with STDEV 20 at 0.03545, supporting the view that any rebound attempts could be modest but may still run into heavy resistance unless $ADA can reclaim the cloud zone above.

Cardano Futures Flows

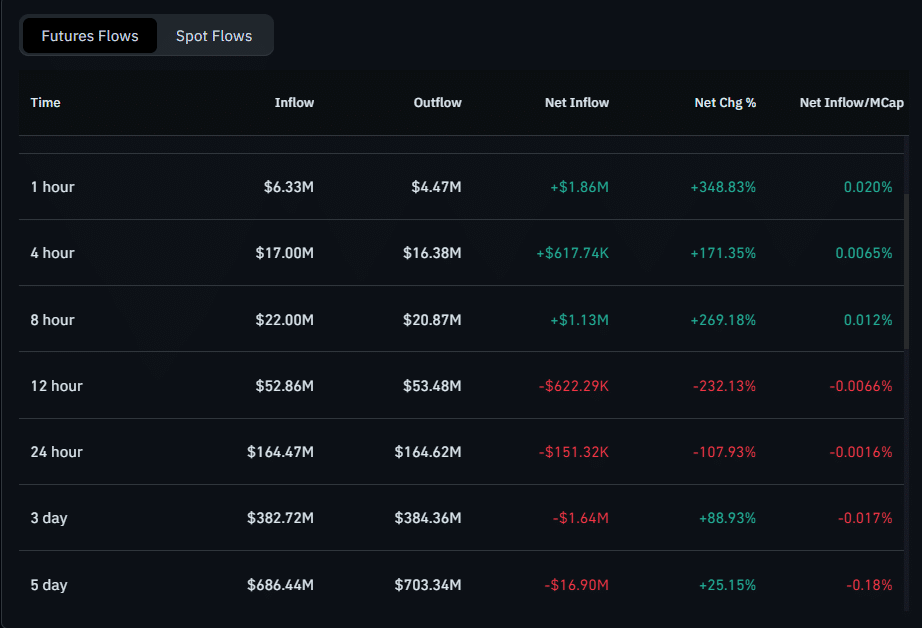

The futures flows table showed short-term positioning turning constructive, with net inflows positive across the 1-hour, 4-hour, and 8-hour windows. In the last 1 hour, inflows of $6.33M versus outflows of $4.47M produced a $1.86M net inflow, with a net change at +348.83%.

Over 4 hours, net inflow remained positive at $617.74K on $17.00M inflow and $16.38M outflow, while the 8-hour window posted $1.13M net inflow.

That short-term bid did not carry cleanly into the broader windows, where flows leaned marginally to decisively negative. The 12-hour window flipped to a $622.29K net outflow, and the 24-hour view stayed negative at $151.32K.

Over longer horizons, the skew worsened, with 3-day net outflow at $1.64M and 5-day net outflow at $16.90M, while net inflow to market cap stood at -0.017% and -0.18% respectively.

coindesk.com

coindesk.com

cryptopolitan.com

cryptopolitan.com

u.today

u.today

coinpedia.org

coinpedia.org