The crypto market dipped today, February 11, as traders reacted to the latest U.S. non-farm payrolls data and the upcoming U.S. consumer inflation report.

- The crypto market dipped on February 11 after the strong US non-farm payrolls data.

- The economy added over 130k jobs in January as the unemployment rate fell to 4.3%.

- Prices also fell as the odds of a US strike on Iran rose.

Crypto market slips after US non-farm payrolls data

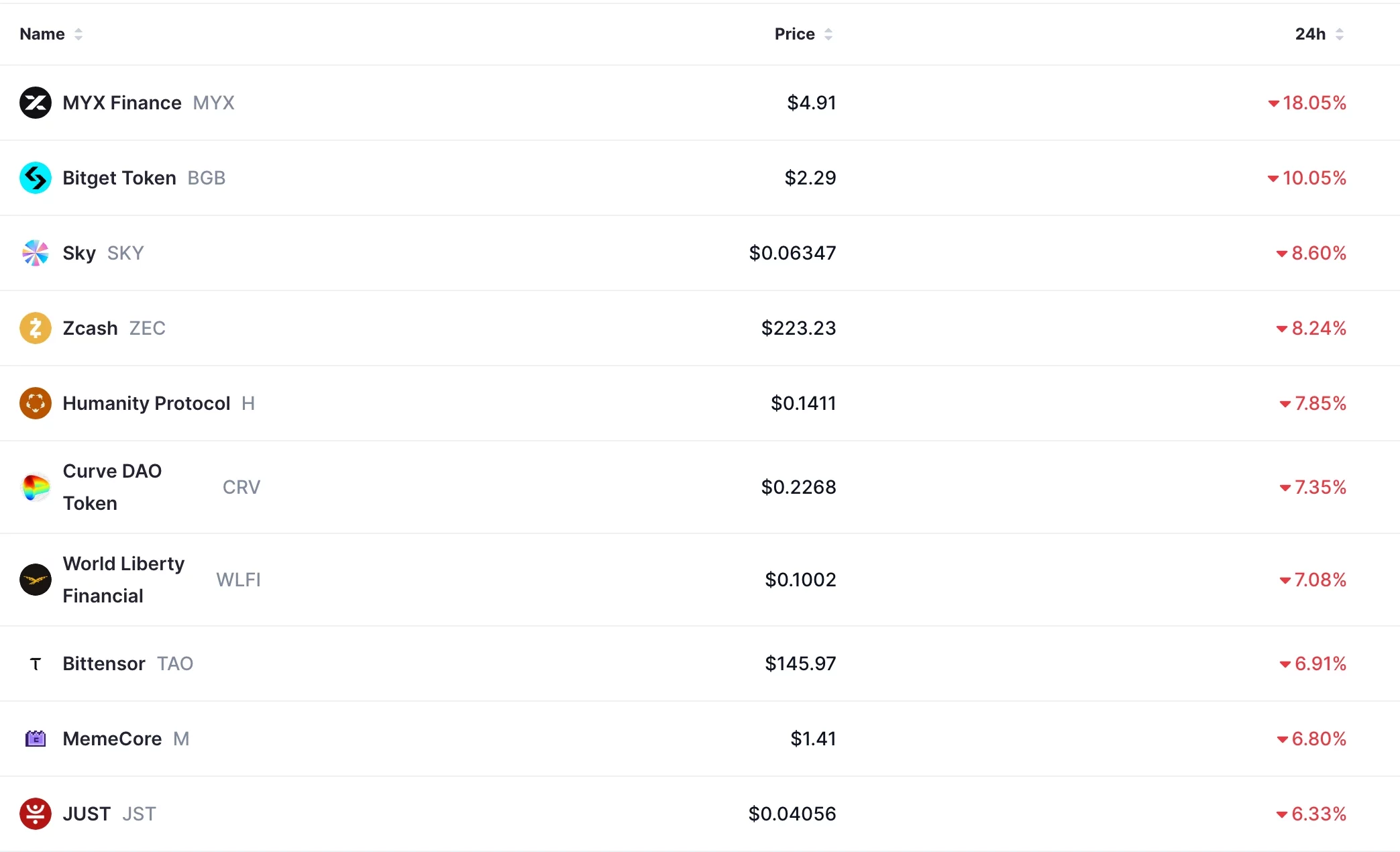

Bitcoin ($BTC) and most altcoins continued the downward trend after the latest US NFP data. $BTC dropped below $67,000, while MYX Finance dropped by over 18% in the last 24 hours. Some of the other top laggards were altcoins like Humanity Protocol, Decred, World Liberty Financial, and Binance Coin.

A report released by the Bureau of Labor Statistics showed that the economy added 130,000 jobs in January, higher than the 50,000 it added in December last year. The unemployment rate improved to 4.3%, while the average hourly earnings slowed to 3.7%.

These numbers show that the economy is still adding jobs, even after several large companies, including Amazon, Gemini, and Target, announced major layoffs to cut costs. Also, the report showed that government workers fell by 42,000, while manufacturing payrolls rose by 5,000.

Yes, but…

2025 was weaker than thought: Former Fed economist Claudia Sahm and others highlight that more than a million jobs were lost in revisions, with four months of outright payroll declines, painting 2025 as a “hiring recession.”

Good news in January, but the downward revisions are huge. More than a million fewer jobs than previously estimated by the end of 2025. And four months last year with outright declines in payrolls. https://t.co/NZ3M8V3s21 pic.twitter.com/duDQLRIgks

— Claudia Sahm (@Claudia_Sahm) February 11, 2026

Strength Is Narrow, Not Broad: Most gains came from health care, social assistance, and construction; government payrolls fell, and many sectors saw modest or negative growth, suggesting the labor market remains a “low hire, low fire” labor environment.

2025 was a hiring recession.

— Heather Long (@byHeatherLong) February 11, 2026

We already knew that. Today's data reinforced just how bad it was.

Only 181,000 job gains –>Worst outside of a recession since 2023.

The job market appears to be stabilizing. But this is still a frozen "low hire, low fire" labor market, especially… pic.twitter.com/0isEF0SUtz

In other words, the Fed may have misjudged strength, and tighter policy could be overdone.

Looking ahead, the next key catalyst for the crypto market is the U.S. inflation report, which comes out on Friday. Economists polled by Reuters expect the upcoming report to show that inflation slowed in January this year.

Trump, Netanyahu talk

The crypto market retreated as investors prepared for a potential strike on Iran by President Trump. He is considering expanding hisarmada by adding another aircraft carrier to the region.

All this is happening as the president prepares to meet with Israel Prime Minister Benjamin Netanyahu, who has always advocated for regime change in the country. Netanyahu is pushing for the U.S. to include ballistic missiles and Iran’s support of rebels in the ongoing talks.

Data compiled by Polymarket shows that the odds of a Trump attack on Iran have jumped in the past few days. This explains why the price of crude oil and safe havens such as the Swiss franc and gold have continued to rise. Bitcoin and the crypto market have proven that they are not safe-haven assets.

The crypto market also dipped as the Fear and Greed Index remained in the extreme fear zone, as the futures open interest continued falling. Open interest has remained below $100 billion, down from last year’s high of over $255 billion.

newsbtc.com

newsbtc.com