Zcash ($ZEC) remains under pressure, with the privacy-focused cryptocurrency dropping more than 25% this month amid broader market weakness.

However, beneath the surface, some on-chain and mining indicators suggest structural confidence in the network.

Zcash Price Falls in Risk-Off Market as On-Chain Data Shows Growing Network Participation

$ZEC was one of the few assets that initially defied the broader sector-wide downturn in October 2025. According to CryptoRank data, the token surged more than 440% during the month.

Although November and December brought heightened volatility, $ZEC still closed both months in the green with modest gains. However, 2026 has not been as favorable for the privacy-focused cryptocurrency.

A broader risk-off sentiment across financial markets, combined with concerns surrounding the Electric Coin Company (ECC) team’s split from Bootstrap, weighed on the asset. $ZEC declined more than 41% in January.

The coin has extended its downward trajectory into this month. At press time, $ZEC was trading at $227.22, down 4.29% over the previous 24 hours.

$ZEC) Price Performance">

$ZEC) Price Performance">

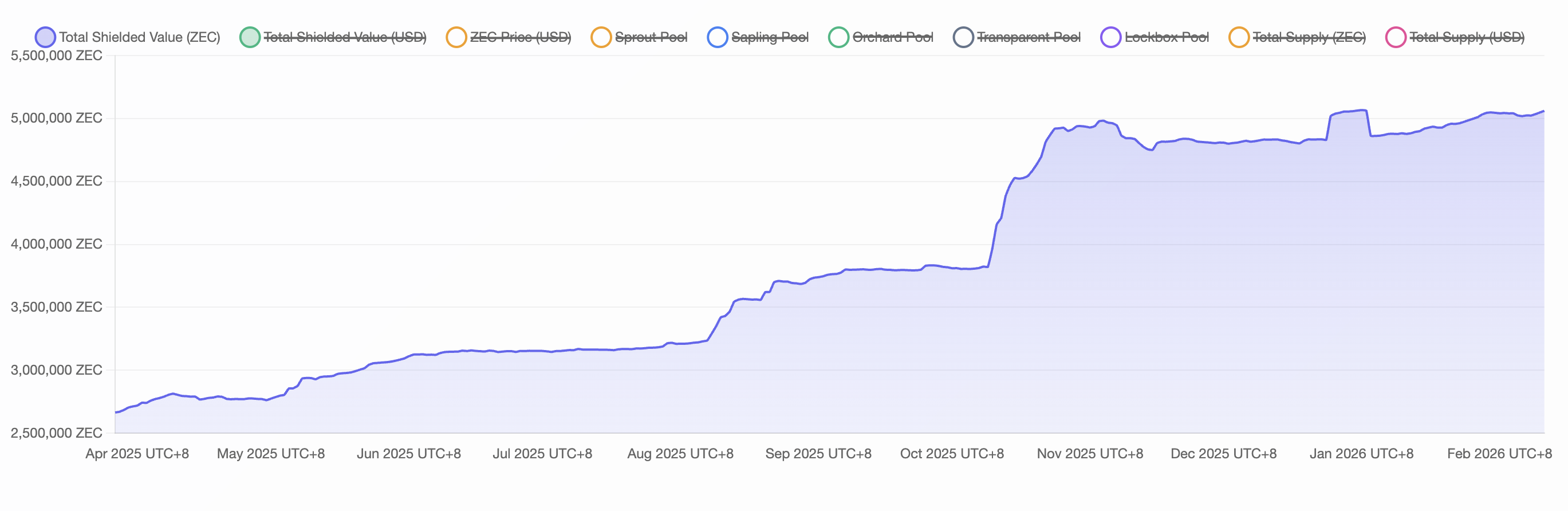

Despite the sustained price weakness, on-chain data suggests emerging positive signals. After a modest dip in early January, the amount of $ZEC held in shielded pools began rising again.

At press time, more than 5 million $ZEC were held in shielded addresses, accounting for roughly 30% of the coin’s circulating supply.

“That means real people are sending shielded tx every single day, even when there’s zero profit in it,” an analyst wrote.

$ZEC Held In Shielded Pools">

$ZEC Held In Shielded Pools">

The steady increase in shielded supply suggests sustained user engagement and may reflect continued confidence in Zcash’s privacy infrastructure despite short-term market pressure.

In addition, Zcash mining difficulty reached an all-time high in early February. Because difficulty adjusts in response to aggregate computational power, the move signals heightened competition among miners and a stronger security profile for the network.

An increase in difficulty indicates that additional hash power has joined the network, whether through new participants, expanded industrial operations, or more efficient hardware deployment. While this strengthens network security, it also raises competition, reducing the expected block reward per unit of computing power.

The rise in difficulty despite broader market weakness suggests that mining economics remain viable for at least a segment of operators.

It's currently exceptionally profitable to mine Zcash with the right hardware.

— Maxime Desalle (@maxdesalle) February 10, 2026

An Antminer Z15 Pro will repay itself in just ~4 months at current returns, not taking electricity into account. pic.twitter.com/3FF7eCQRZm

This may reflect competitive electricity costs, operational efficiency, strategic positioning, or expectations of future price appreciation. Overall, the data confirms growing network participation and security.

The post $ZEC Price Slides 25%: Why Are Miners and Privacy Users Doubling Down? appeared first on BeInCrypto.

thecryptobasic.com

thecryptobasic.com