Cardano price today trades near $0.2559, down over 2% in the past 24 hours after breaking below the $0.26 support zone. The move places $ADA at its lowest level since late 2024 as sellers maintain control across timeframes and all major moving averages turn into resistance.

Open Interest Ticks Higher Despite Breakdown

According to Coinglass, Cardano’s open interest increased 0.27% to $410.27M. The uptick appears counterintuitive given the bearish price action, but the data suggests traders are rebuilding positions at these lower levels rather than closing exposure entirely.

Volume dropped 14.62% to $715.53M, signaling reduced participation as price grinds lower. Lower volume on a breakdown typically indicates exhaustion rather than panic, but it also shows that buyers are not stepping in to defend support. Long/short ratios remain elevated at 2.11 on Binance and 2.29 on OKX, indicating that leverage still skews bullish despite the breakdown.

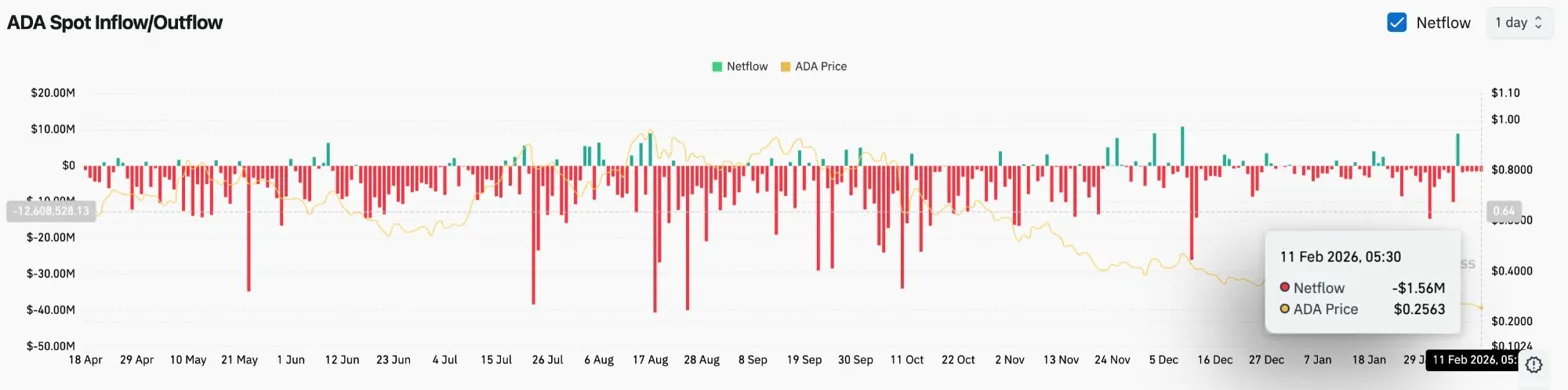

Spot Outflows Extend Multi-Week Selling Trend

Spot flows show continued distribution. Cardano recorded $1.56M in net outflows on February 11, extending a pattern of selling pressure that has persisted through much of 2026.

The outflows are not massive in scale, but they are consistent. When spot flows remain negative across multiple sessions, it confirms that holders are reducing exposure rather than accumulating at lower prices.

All Major EMAs Flip Into Resistance

On the daily chart, Cardano has broken below every major moving average. The 20-day EMA sits at $0.2987, the 50-day at $0.3450, the 100-day at $0.4155, and the 200-day at $0.5151. All four EMAs are now stacked downward, forming a clear resistance ceiling.

The chart shows:

- Price trading below the descending trendline from the August peak

- Multiple rejections at the 20-day EMA during attempts to recover

- Support zone at $0.25 now being tested

$ADA lost the $0.26 floor that held through early February, opening the door to a retest of the psychological $0.25 level. A daily close below $0.25 would confirm a clean breakdown and expose the next demand zone near $0.22, which marked the October 2024 low.

Related: River Price Prediction: Spot Listing Sparks 33% Rally As RIVER Tests Triangle Resistance

The descending trendline continues to cap rallies. Every bounce since August has been met with selling pressure at lower highs. Without reclaiming the 20-day EMA at $0.2987, the structure remains decisively bearish.

Intraday Action Shows Weak Bounce Attempts

The 30-minute chart shows $ADA trapped inside a descending channel pattern, with price testing the lower boundary near $0.2555. RSI sits at 35.08, approaching oversold conditions but not yet showing reversal signals. MACD remains negative with the histogram printing red bars and both lines trending downward.

The channel pattern has guided price action since early February. Each bounce has been met with rejection at the upper trendline, currently near $0.2650. Sellers defend every rally attempt, keeping pressure on the lower channel support.

Price is compressing near the bottom of the channel. A breakdown below $0.255 would invalidate the pattern and expose fresh lows toward $0.25. Conversely, a breakout above the upper channel line at $0.2650 would signal the first sign of trend exhaustion and place $0.27 back in range.

The structure shows lower highs and lower lows persisting across shorter timeframes. Until $ADA breaks above the channel resistance and reclaims $0.2650, every bounce remains a relief rally inside a bearish trend.

Outlook: Will Cardano Go Up?

The next move depends on whether $ADA can hold the $0.25 psychological support.

- Bullish case: A bounce from $0.25 with strong volume and a close above $0.2987 would flip the 20-day EMA and signal the first sign of trend exhaustion. That would place the 50-day EMA at $0.3450 back in range.

- Bearish case: A daily close below $0.25 confirms the breakdown and exposes the $0.22 to $0.20 demand zone. Losing $0.25 would mark a new multi-month low and shift momentum toward deeper correction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

thecryptobasic.com

thecryptobasic.com