Solana is showing signs of stress after months of sustained losses, growing outflows, and weakening price structure. Recent on-chain and market data suggest traders may be approaching a decisive moment. While price action remains fragile, historical patterns are drawing attention as selling pressure intensifies and long-term holders reposition.

Exchange Outflows Signal Stress, Not Confidence

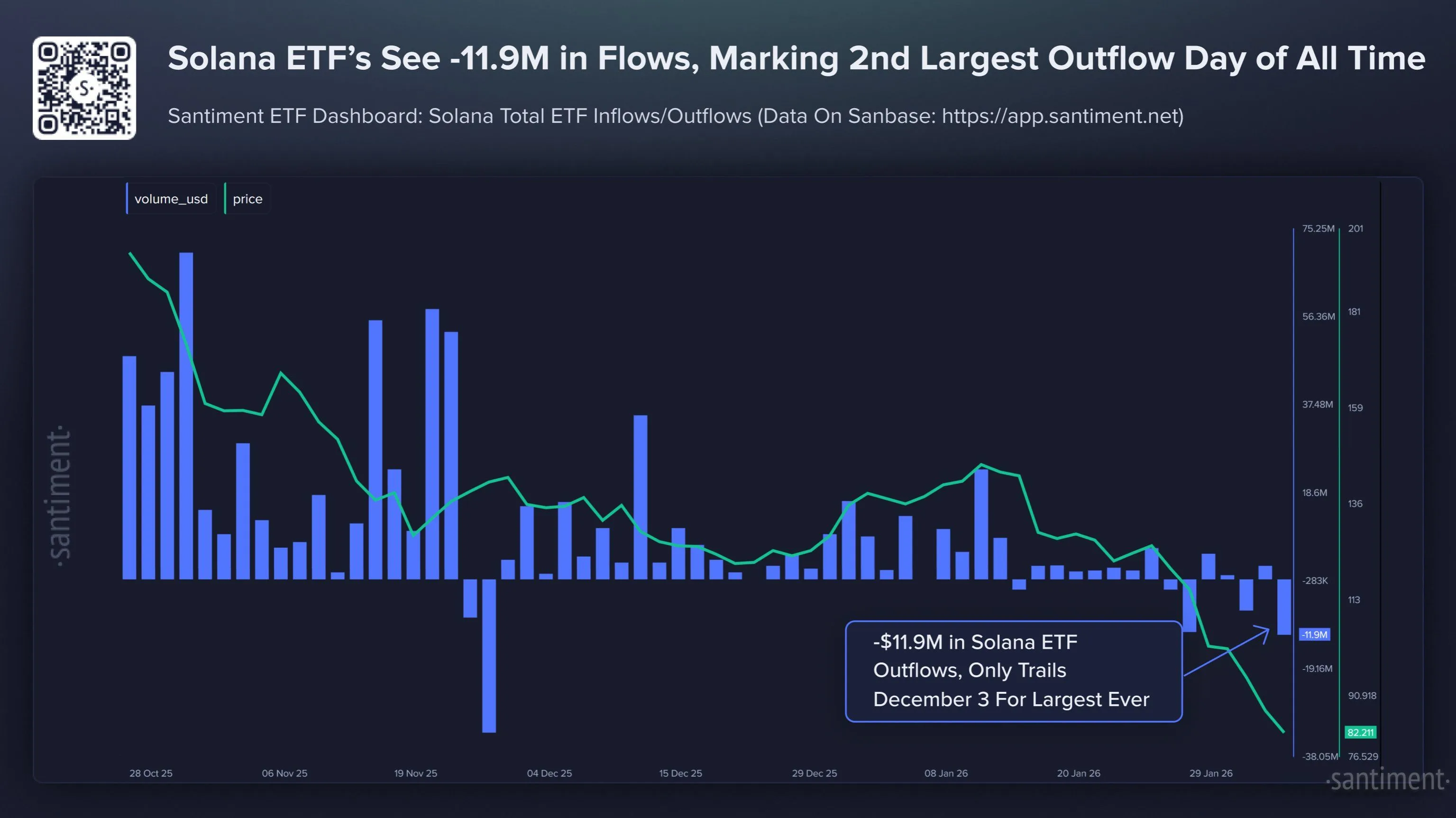

According to Ali Martinez, more than 1.07 million $SOL left centralized exchanges over the last 72 hours. Such withdrawals often reflect fear-driven self-custody rather than fresh accumulation. Besides that, Santiment data shows Solana-focused ETFs recorded $11.9 million in net outflows. This marked the second-largest capital exit on record.

Source: X

Significantly, Solana has lost roughly 62% of its market value over four months. Consequently, market behavior now resembles late-stage drawdowns seen in previous cycles. Moreover, heavy ETF outflows often appear near exhaustion phases, when sellers dominate flows regardless of price.

At the time of writing, Solana trades near $87 with muted daily price movement. However, weekly losses remain steep. Hence, short-term stability does not yet signal recovery.

Price Structure Break Signals $SOL Trend Weakness

Analysis from CryptoJobs3 points to a confirmed loss of monthly support between $98 and $100. This region previously acted as a strong demand zone. However, repeated closes below it indicate fading bullish control.

Additionally, price rebounds have grown weaker and continue to stall near former resistance. This behavior reflects a broader downtrend rather than temporary volatility. The next major support rests near $78, which aligns with a long-term weekly demand area.

If price breaks below $78, analysts expect selling pressure to accelerate. Consequently, downside targets extend toward $70, then $60. Deeper historical demand exists near the $48 to $45 range, where buyers previously stepped in.

$SOL Historical Fractals Point to a Possible Inflection

Another comparison draws attention to longer-term patterns. According to Galaxy, Solana shows a structure similar to late 2022. During that period, $SOL based near $8 after an extended decline. Today, $SOL trades between $85 and $90, resting on a long-term descending trendline.

Source: X

Significantly, weekly RSI now sits near 37, reflecting deep oversold conditions. A similar RSI compression preceded the 2022 reversal. Key supports remain at $80 and $65. A failure there risks a deeper sweep toward $55.

However, upside scenarios still exist. A reclaim of $120 would signal trendline recovery. That move could open paths toward $160 and eventually $220 to $260. Historically, such compression phases often precede sharp expansions.

u.today

u.today

ambcrypto.com

ambcrypto.com

beincrypto.com

beincrypto.com